State-owned CPC Corp, Taiwan (CPC, 台灣中油) is considering investing in shale gas extraction and a petrochemical plant in the US, company chairman Derek Chen (陳金德) said yesterday.

Chen is scheduled to depart for the US on June 14 on a fact-finding visit.

Chen said that CPC and its affiliates would like to invest about US$10 billion in the US, with the aim of adopting more advanced technology to produce higher-quality ethylene at a lower cost.

He said the first step is next month’s visit to the US, when he will be accompanied by Minister Without Portfolio Ho Mei-yueh (何美玥), to explore the possibility of investing in natural gas in Louisiana.

One issue of concern is whether petrochemical products from a CPC downstream factory would have a strong market in the US, Chen said, noting that since US President Donald Trump took office in January, he has made US manufacturing a top priority.

If the project gets off the ground, Chen forecast a September start date.

However, he added that state-owned companies like CPC are subject to certain regulations that could slow overseas investment efforts and hamper quick adaptation to changing markets.

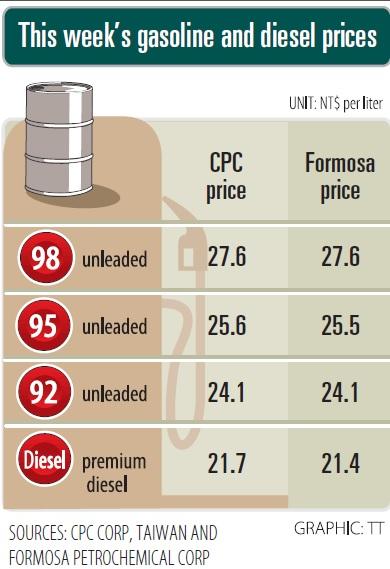

Separately, CPC yesterday said it is to raise its domestic gasoline and diesel prices by NT$0.2 per liter, starting today. It is to be the company’s second price hike in two weeks.

After the increase, prices at CPC gas stations nationwide are to be NT$21.7 per liter for super diesel, NT$24.1 per liter for 92-octane unleaded, NT$25.6 per liter for 95-octane unleaded and NT$27.6 per liter for 98-octane unleaded, the company said.

The prices reflect a rise last week in international crude oil prices after OPEC and non-OPEC producers on Thursday agreed to extend oil output cuts for another nine months until March next year.

A drop in US oil stocks for the seventh straight week also pushed crude prices higher, CPC said.

CPC calculates its weekly fuel prices based on a weighted oil price formula made up of 70 percent Dubai crude and 30 percent Brent crude.

After the increase in international crude prices, CPC’s average price of crude oil was calculated at US$52.44 per barrel this week, up from US$51.28 per barrel last week, it said.

Privately owned refiner Formosa Petrochemical Corp (台塑石化) on Saturday announced similar price increases for this week.

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.