Gold futures posted the longest slump since the middle of 2015 as momentum in the US labor market bolstered the prospect of multiple US interest-rate increases this year.

US employers last month added jobs at an above-average pace for a second month on outsized gains in construction and manufacturing while wage growth picked up, a government report showed on Friday.

Gold futures had a ninth straight decline, the longest stretch since July 2015, and a second straight weekly loss.

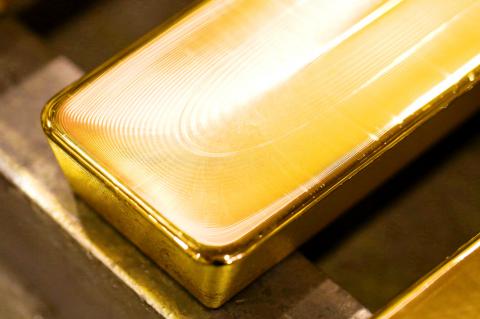

Photo: Bloomberg

Precious metals have been hammered by US Federal Reserve officials, including Fed Chair Janet Yellen, talking up the prospect of higher rates when they gather next week.

Higher rates reduce the appeal of owning gold because it does not pay interest.

The European Central Bank, meanwhile, has signaled it will not add to stimulus as growth picks up.

“All eyes will be on the Fed,” said Phil Streible, a senior market strategist at RJO Futures in Chicago. “If they give any indication they may want to be more aggressive, gold prices will remain under pressure.”

Gold for April delivery on Friday slipped 0.1 percent to settle at US$1,201.40 an ounce at 1:42pm on the Comex in New York. Prices are down 2 percent for the week.

Friday’s jobs report was the last major piece of economic data before the Fed meets next week, with markets pricing a rate increase as a near certainty.

While hiring was robust and wage gains strong, analysts are looking for clues on whether the pace is fast enough to spur the US central bank to accelerate its timeline for rate hikes from the current forecast of three.

“The immediate question now is the climate we may face after the rate hike comes to pass,” Barnabas Gan, an economist at Singapore-based Oversea-Chinese Banking Corp Ltd (華僑銀行), wrote in a note on Friday.

While market watchers will be left wondering when the next rate hike is coming, uncertainty over European elections and a lack of clarity over Trump’s policies might mean the fall in gold is short-lived, he said.

IRON RALLY STUMBLES

Iron ore’s rally is showing signs of cracking. After a drumbeat of warnings that the gains will not last, the commodity posted the biggest weekly slump in almost four months amid rising concern about the underlying strength of demand in China at a time of still-rising supplies.

Iron ore with 62 percent content in Qingdao — which hit US$94.86 a dry tonne on Feb. 21, the highest since August 2014 — this week lost 5 percent to US$86.72, according to Metal Bulletin Ltd.

Futures in Singapore and Dalian have entered corrections, down more than 10 percent from recent highs.

The surge “was premised on optimism about demand,” Capital Economics Ltd chief commodities economist Caroline Bain said in an e-mail. “As such, we think the recent decline reflects some doubts about China’s demand.”

Other metals:

Silver futures fell on the Comex, posting a second straight weekly decline.

Palladium futures dropped a fourth straight week on the New York Mercantile Exchange, the longest losing streak since October last year, while platinum futures fell a second week.

Copper for delivery in three months on Friday climbed 0.6 percent to US$5,721 a tonne on the LME by 10:06am in New York.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day