Hon Hai Precision Industry Co (鴻海精密), which assembles Apple Inc’s iPhones, aims to grow revenue by 10 percent this year from last year’s NT$4.12 trillion (US$132.68 billion), on the back of the firm’s close relationships with its major client and optimism in smartphone industry, chairman Terry Gou (郭台銘) said yesterday.

“We have worked with our main client since it started rolling out its first-generation product... Our relationship with the client will only grow closer and closer,” Gou told shareholders at the firm’s annual general meeting in New Taipei City.

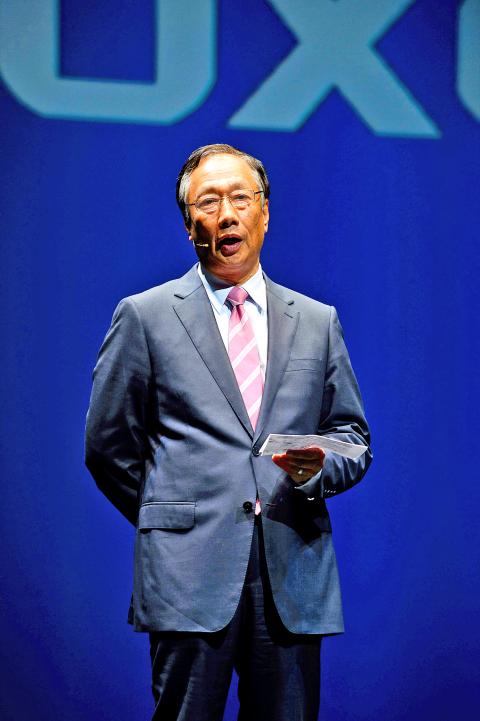

Gou’s remarks were in response to shareholders’ questions about Hon Hai’s strategies against rising competition in the market and the possibility of losing orders from Apple.

Photo: Bloomberg

“We are the main assembler for [Apple] and we expect to receive growing orders from it,” he said.

Gou said Hon Hai receives 100 percent of order allocation for Apple’s larger-sized display smartphone, while the client’s other assembler only receives “some” orders for smaller-sized screen handsets.

Hon Hai is ahead of the other assembler in terms of technologies and the relationship it has with Apple, Gou said, adding that the firm’s rival is only a “spare tire” to the client.

Photo: CNA

Gou’s remarks referred to Taiwanese manufacturer Pegatron Corp (和碩), which saw record-high annual revenues of NT$1.02 trillion last year, driven by increasing orders from Apple for its iPhone assembling business.

However, HSBC Holdings PLC said in a report on Wednesday that it foresees Hon Hai’s annual revenue growing only 6.88 percent — weaker than Gou’s aim — to NT$4.5 trillion this year.

Commenting on Hon Hai’s non-smartphone segments, Gou said investments in China, India and robotics businesses would become the firm’s growth drivers.

Hon Hai plans to allocate 10 percent of its employees in China to sell smartphones there in a bid to secure a share in the Chinese market, he said.

Hon Hai also plans to use 20 percent to 30 percent of its resources to invest in startups around the world, Gou said, adding that the firm would build startup incubator centers in Beijing, Hangzhou and Shenzhen to support new companies.

Hon Hai sees India as an emerging country that has business growth potential, Gou said, adding that the firm is in the process of investing in the e-commerce, clean energy and manufacturing sectors there.

With the company potentially providing financial aid to Japanese electronics maker Sharp Corp, Gou said Hon Hai is still waiting for a final decision.

“I am sure they [Sharp] will make the right decision. We will wait until Sharp’s management and the Japanese government feels comfortable with the investment,” he said.

“Japanese companies are our friends. We can support each other to compete against South Korean technology companies,” he said, adding that he is optimistic that Sharp will accept investment from a Taiwanese company rather than a South Korean company.

Hon Hai shares rose 1.43 percent to NT$99 in Taipei trading yesterday, outperforming the TAIEX, which gained 0.84 percent.

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,

Vincent Wei led fellow Singaporean farmers around an empty Malaysian plot, laying out plans for a greenhouse and rows of leafy vegetables. What he pitched was not just space for crops, but a lifeline for growers struggling to make ends meet in a city-state with high prices and little vacant land. The future agriculture hub is part of a joint special economic zone launched last year by the two neighbors, expected to cost US$123 million and produce 10,000 tonnes of fresh produce annually. It is attracting Singaporean farmers with promises of cheaper land, labor and energy just over the border.

A proposed billionaires’ tax in California has ignited a political uproar in Silicon Valley, with tech titans threatening to leave the state while California Governor Gavin Newsom of the Democratic Party maneuvers to defeat a levy that he fears would lead to an exodus of wealth. A technology mecca, California has more billionaires than any other US state — a few hundred, by some estimates. About half its personal income tax revenue, a financial backbone in the nearly US$350 billion budget, comes from the top 1 percent of earners. A large healthcare union is attempting to place a proposal before