Collaborative robots and intelligent machinery might have wowed the crowds at this year’s Hannover Fair, but experts see German industry as having some way to go toward incorporating them on factory floors in what could become the fourth industrial revolution.

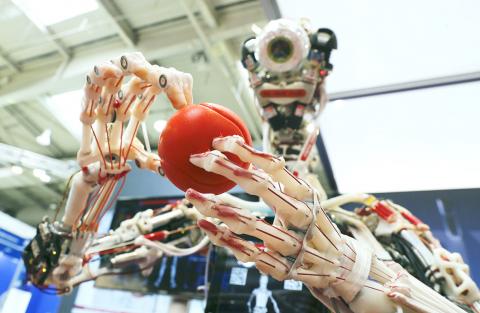

The undoubted star of the world’s largest industrial trade fair, which closed its doors in the northern German city on Friday, was YuMi, a collaborative, dual-armed robot made by Swiss-based automation technology group ABB Ltd.

ABB said it developed YuMi primarily for the consumer electronics industry and it is capable of handling items ranging from the delicate and precise parts of a wristwatch to the components used in mobile phones, tablets and desktop PCs.

Photo: Reuters

However, it is expected to be rolled out to other market sectors as well, the company said.

YuMi and human coworkers can work side-by-side on shared tasks without protective fencing or cages, the company added. German Chancellor Angela Merkel tested its safety features when she visited the stand by placing her finger inside the gripper on YuMi’s right arm, causing it to stop.

At another stand, German firm Beckhoff Automation GmbH & Co KG showed off an automated assembly line, which it said is able to seamlessly adapt itself to handle different parts according to their shape, size and color, while human coworkers are equipped with a special smartwatch to monitor the process and can intervene if necessary.

Industry views the merging of production and online technology as the way forward for manufacturing, where “smart” factories use information and communications technologies to digitize their processes, boosting quality and efficiency while cutting costs.

Digitization is being heralded as the fourth industrial revolution — hence Merkel’s “Industry 4.0” initiative — following the invention of the steam engine, mass production and automation.

With nothing less than Germany’s mighty industrial prowess at stake, German politicians and business leaders are keen to wave the Industry 4.0 flag.

Berlin has even launched a new working group of businesses, unions and researchers to look into ways of moving digitization forward, which is to present its ideas and findings later this year.

However, German companies still have a long way to go, experts said.

A recent survey by the BITKOM trade group for information technology, telecommunications and new media found that, four out of 10 companies in key industrial sectors use Industry 4.0 applications.

The automobile sector is leading the pack, with 53 percent of companies using such applications, followed by electrical engineering, the chemicals sector and mechanical engineering.

“Digitization of German factories is in full swing, but still has a long way to go,” BITKOM board member Winfried Holz said. “In view of the fierce international competition, say from China and the US, companies must invest massively in the digitization of their processes and products if Germany wants to hold on to its leading position in the manufacturing sector.”

However, German companies still have some catching up to do.

The BITKOM survey found that about one in four companies have no Industry 4.0 strategy, even if they insist it is on their radar in the future.

However, up to 14 percent of companies said digitization is not an issue for them at all.

Over all, 80 percent of companies said they felt that industry was too reticent about digitization, with 72 percent saying they were put off by the investment costs and 56 percent by the complexity of the issue, the survey showed. Another 56 percent said they saw a lack of specialist personnel as a problem.

If digitization “is to lead the way for the next 10 to 15 years, we only partially know exactly how to implement it,” said Wolfgang Dorst, who heads BITKOM’s own Industry 4.0 department.

While many large companies have sufficient financial and human resources to digitize production, frequently it is the small and medium-sized companies who are not so well off financially that have the creative ideas, Dorst said.

Bernhard Juchheim, the head of Jumo, a family-run company that specializes in industrial sensor and automation technology, told reporters that his company would start building its own smart factory in Fulda, Germany, next year.

Critics fear digitization could render human workers obsolete in the manufacturing process.

However, the process will actually create new jobs, the Boston Consulting Group’s Michael Ruessmann said.

He wrote a study that found that 390,000 new jobs and an additional 30 billion euros (US$32.4 billion) in GDP could be created in Germany over the next 10 years as companies switch to intelligent factories.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to