The US dollar this week rose to its strongest level against the euro in 11 years, as the Swiss National Bank’s (SNB) decision to scrap the franc’s cap steered investors into the world’s top reserve currency.

Meanwhile, the euro posted its biggest weekly loss versus the yen since July 2012, as Der Spiegel magazine reported that European Central Bank (ECB) President Mario Draghi briefed Germany officials on a sovereign bond-buying plan.

The greenback snapped a five-day skid against the yen after data showed US consumer confidence rose to the highest level since 2004.

Photo: AFP

The US dollar, which represents 63 percent of all known international reserves, surged 0.6 percent to US$1.1567 per euro at 5pm in New York on Friday and touched US$1.1460, the strongest level since November 2003. It gained 1.2 percent to ¥117.51.

The euro rose 0.6 percent to ¥135.95, narrowing its loss against the Japanese unit to 3.1 percent this week.

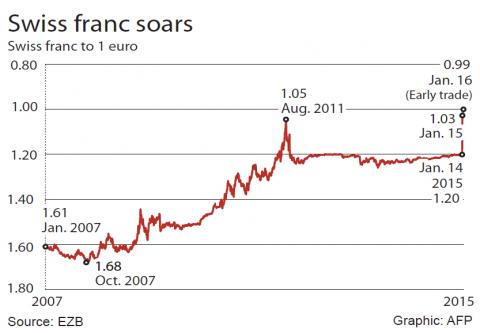

The franc dropped 1.9 percent to SF0.9941 per euro after surging to a record SF0.85172 and fell 2.3 percent to SF0.8587 per US dollar.

The Bloomberg Dollar Spot Index, which tracks the US currency against 10 major peers, climbed 0.2 percent to 1,139.27 to trim its first weekly loss in more than a month to less than 0.2 percent.

JPMorgan Chase & Co’s index of global currency volatility rose to as much as 11.68 — the most since June last year — up from last year’s low of 5.28 percent.

The SNB surprised markets on Thursday by abandoning its three-year-old cap of SF1.20 per euro on the franc. Policymakers also reduced the interest rate on sight deposits, deepening a cut announced less than a month ago.

“One of the reactions from the SNB decision was they knew the ECB will be embarking on monetary policy expansion,” Brian Daingerfield, a currency strategist at Royal Bank of Scotland Group PLC’s RBS Securities unit in Stamford, Connecticut, said by telephone.

The 19-nation currency posted a fifth weekly decline against the US dollar before the region’s policymakers meet on Thursday next week to discuss introducing new stimulus, including quantitative easing.

The plan that Draghi presented to German Chancellor Angela Merkel and Minister of Finance Wolfgang Schaeuble described quantitative easing plans under which central banks would buy bonds issued by their own country, Der Spiegel said in an article published yesterday, without saying where it got the information.

Greece would be excluded from the program because its bonds do not fulfill the necessary quality criteria, the magazine said. An ECB spokesman declined to comment.

In London, the pound posted its biggest weekly advance in almost two years against the euro as speculation the ECB will start government bond purchases stoked demand for the UK currency as a haven.

The SNB’s move also pushed sterling to its strongest level versus the 19-member common currency since February 2008.

The pound advanced 2.5 percent to £0.7617 per euro at 5pm in London on Friday, after touching £0.7596. Sterling declined 0.1 percent to US$1.5143.

ISSUES: Gogoro has been struggling with ballooning losses and was recently embroiled in alleged subsidy fraud, using Chinese-made components instead of locally made parts Gogoro Inc (睿能創意), the nation’s biggest electric scooter maker, yesterday said that its chairman and CEO Horace Luke (陸學森) has resigned amid chronic losses and probes into the company’s alleged involvement in subsidy fraud. The board of directors nominated Reuntex Group (潤泰集團) general counsel Tamon Tseng (曾夢達) as the company’s new chairman, Gogoro said in a statement. Ruentex is Gogoro’s biggest stakeholder. Gogoro Taiwan general manager Henry Chiang (姜家煒) is to serve as acting CEO during the interim period, the statement said. Luke’s departure came as a bombshell yesterday. As a company founder, he has played a key role in pushing for the

China has claimed a breakthrough in developing homegrown chipmaking equipment, an important step in overcoming US sanctions designed to thwart Beijing’s semiconductor goals. State-linked organizations are advised to use a new laser-based immersion lithography machine with a resolution of 65 nanometers or better, the Chinese Ministry of Industry and Information Technology (MIIT) said in an announcement this month. Although the note does not specify the supplier, the spec marks a significant step up from the previous most advanced indigenous equipment — developed by Shanghai Micro Electronics Equipment Group Co (SMEE, 上海微電子) — which stood at about 90 nanometers. MIIT’s claimed advances last

CROSS-STRAIT TENSIONS: The US company could switch orders from TSMC to alternative suppliers, but that would lower chip quality, CEO Jensen Huang said Nvidia Corp CEO Jensen Huang (黃仁勳), whose products have become the hottest commodity in the technology world, on Wednesday said that the scramble for a limited amount of supply has frustrated some customers and raised tensions. “The demand on it is so great, and everyone wants to be first and everyone wants to be most,” he told the audience at a Goldman Sachs Group Inc technology conference in San Francisco. “We probably have more emotional customers today. Deservedly so. It’s tense. We’re trying to do the best we can.” Huang’s company is experiencing strong demand for its latest generation of chips, called

GLOBAL ECONOMY: Policymakers have a choice of a small 25 basis-point cut or a bold cut of 50 basis points, which would help the labor market, but might reignite inflation The US Federal Reserve is gearing up to announce its first interest rate cut in more than four years on Wednesday, with policymakers expected to debate how big a move to make less than two months before the US presidential election. Senior officials at the US central bank including Fed Chairman Jerome Powell have in recent weeks indicated that a rate cut is coming this month, as inflation eases toward the bank’s long-term target of two percent, and the labor market continues to cool. The Fed, which has a dual mandate from the US Congress to act independently to ensure