XYZprinting Inc (三緯), the second-largest producer of 3D printers in the world, yesterday launched its first 3D food printer. The device — able to print edible chocolate, cookies and pizza — brings 3D printing technology to kitchens.

XYZprinting — the 3D printer arm of the New Kinpo Group (新金寶集團) — said the 3D food printer is a milestone for the company as it combines manufacturing technology with the food industry.

The printer is the company’s first device to use ingredient capsules to produce edible items.

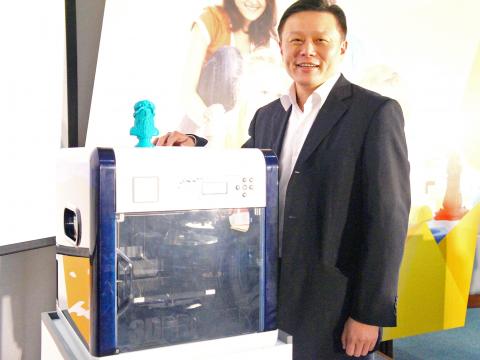

Photo: CNA

“We are working with different suppliers of food ingredients to go with the machine,” company chairman Simon Shen (沈軾榮) told a media briefing yesterday. “We believe that in the future 3D food printers might be used in space to print out food for astronauts, a topic NASA is researching at the moment.”

XYZprinting’s 3D food printer would be on the market by June next year, Shen said. The device would retail at an affordable price, compared with rivals’ expensive price tags of between US$3,000 and US$5,000 per unit, he said.

With new models to hit the market next year, the Greater Taipei-based company aims to more than triple its sales of 3D printers to between 120,000 and 150,000 units next year, from this year’s estimated 40,000 units, Shen said.

The one-year-old company also expects to make a profit next year after reaching the break-even point this quarter, Shen said. The gross margin for its 3D printers is higher than 10 percent, he added.

Research house Gartner Inc forecast that global 3D printer shipments next year would grow to 217,350 units, compared with 108,151 units recorded this year. Shipments would more than double every year over the next four years to reach more than 2.3 million units in 2018, Gartner said last month.

“Next year, we plan to introduce high-end 3D printers for business use [such as jewelry companies]. We are not only capable of making low-cost machines,” XYZprinting’s market development division senior manager Gary Shu (舒家誠) said.

Yesterday, XYZprinting also launched a 3D printer with a built-in scanner, which is the company’s first 3D-printing machine combining a printer and a scanner.

“The new 3D printer should provide 3D-modeling capability for the ordinary consumer,” Shen said.

The device, code-named da Vinci Aio, is available via online retailers, including Taiwan’s PChome Store Inc (商店街市集) and the US-based Amazon.com.

The 3D printer has a price tag of NT$26,990, which is much lower than the NT$76,560 asked for a similar model by AIO Robotics, according to XYZprinting.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.