Google Inc is making a big bet on augmented reality, leading a US$542 million investment in a shadowy startup called Magic Leap Inc, based in Dania Beach, Florida.

The investment, one of the largest ever made by Google, values Magic Leap at about US$2 billion, according to people briefed on the matter, but not authorized to discuss the deal publicly. Other investors in the round include Qualcomm Ventures, Legendary Entertainment, private equity firm KKR, Vulcan Capital, Kleiner Perkins Caufield & Byers, Andreessen Horowitz and Obvious Ventures.

Google’s role as the lead investor is significant. Just seven months ago, Facebook Inc stunned Silicon Valley with a US$2 billion acquisition of Oculus VR Inc, a virtual reality company. Facebook believes that Oculus can be a new sort of operating system as people continue to find new ways to interact with computers.

Google views Magic Leap in much the same way, according to people briefed on the company’s thinking. As people become more comfortable with wearable technology, technologies like Magic Leap — which superimposes animated digital imagery over what someone sees with the naked eye — is likely to become more commonplace.

Already, Google makes a similar technology on its own, Google Glass. Though nascent, Google Glass has attracted enthusiastic early adopters, who use the glasses — which have small computer displays embedded in the lenses — to do simple tasks like search the Internet, take photographs and send messages.

Magic Leap has broader ambitions. On its Web site, the little-known company outlines an ambitious vision for displaying rich interactive graphics alongside what people see naturally, using what it calls a “dynamic digitized lightfield signal.”

“Magic Leap is an eclectic group of visionaries, rocket scientists, wizards and gurus from the fields of film, robotics, visualization, software, computing and user experience,” the company says on its Web site.

As part of the deal, Sundar Pichai, Google’s senior vice president of Android, Chrome and Apps, will join the Magic Leap board.

“We are looking forward to Magic Leap’s next stage of growth, and to seeing how it will shape the future of visual computing,” Pichai said.

Qualcomm executive chairman Paul Jacobs and Google vice president of corporate development Don Harrison are to take observer roles on the board.

“We are excited and honored to have such an extraordinary group of investors to help us bring our vision and products to the world,” Magic Leap chief executive Rony Abovitz said.

“Magic Leap is going beyond the current perception of mobile computing, augmented reality and virtual reality. We are transcending all three and will revolutionize the way people communicate, purchase, learn, share and play,” Abovitz added.

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52

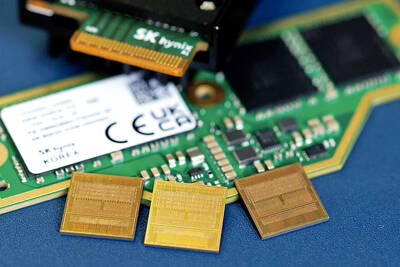

OPPORTUNITY: Supply of conventional DRAM chips tightened after the world’s major memory makers focused on manufacturing chips utilized in AI servers DRAM chipmaker Nanya Technology Corp (南亞科技) yesterday reported a spike in revenue for last month, as severe supply constraints prompted chip price hikes, almost doubling the company’s annual revenue last year from the previous year. Revenue soared 444.87 percent last month to NT$12.02 billion (US$381.4 million), from NT$2.21 billion a year earlier. That brought fourth-quarter revenue to NT$30.17 billion, from NT$6.58 billion for the same period in 2024. On a quarterly basis, revenue jumped 60.65 percent from NT$18.78 billion. Last year, revenue soared 95.09 percent to NT$66.59 billion from NT$32.13 billion in 2024, the company said. Supply of conventional DRAM