Portugal’s president said on Monday that fallout from the financial troubles of the founding family of Banco Espirito Santo SA (BES) could affect the wider economy, while the bank said it was appointing a special financial adviser to help boost its capital structure.

Portuguese President Anibal Cavaco Silva is the first high-profile politician to speak of a possible economic impact from the Espirito Santo crisis, after the family asked for creditor protection for one of its key holding companies on Friday last week.

Another of the family’s companies, Rioforte SA, last week failed to repay on time more than US$1 billion in debt owed to Portugal Telecom, which had a knock-on effect on the latter’s merger with Brazil’s Grupo Oi, forcing it to take a cut in its stake in the new entity.

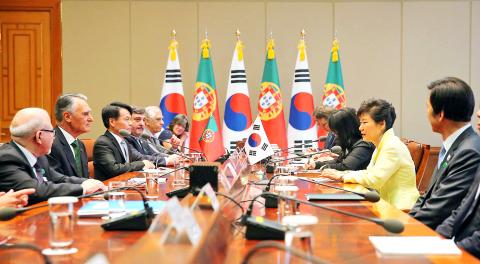

Photo: EPA

“If some citizens, some investors suffer significant losses [from the Espirito Santo group] they may delay investment decisions, or some of them may find themselves in very big difficulties,” Cavaco Silva said in comments during a visit to South Korea, which were aired on local television.

“We cannot ignore that there will be some impact on the real economy,” he said.

In Lisbon, Portuguese Economy Minister Antonio Pires de Lima said that a crisis engulfing the BES group could affect the country’s recovery, but insisted Portugal’s “upturn is stronger.”

“The crisis in the Espirito Santo group will not do us good, but the recovery is stronger and it is there to stay,” he told journalists on Monday.

The turmoil at Portugal’s largest lender comes at a delicate time for the country, which has just come out of a joint EU-IMF rescue program despite a surprise drop of 0.6 percent in its GDP in the first three months of the year.

Many analysts fear the knock-on effects of the crisis could further undermine Portugal’s faltering economy, one of the weakest in the eurozone. The economy is expected to grow by 1 percent this year, the first year of growth since 2011.

BES is under scrutiny following disclosures of financial irregularities at the Luxembourg-based Espirito Santo International SA (ESI), which filed for creditor protection on Friday. ESI indirectly owns 49 percent of the company that holds the Espirito Santos’ stake in BES.

BES was controlled and managed by the Espirito Santo family until just a few weeks ago, but they have since reduced their stake and left top jobs at the bank. Respected economist Vitor Bento is the new chief executive after Ricardo Espirito Santo Salgado, the family patriarch, resigned from the position.

Bento told clients in a message on Monday that he was “working hard to regain the confidence of markets, to generate sustainable benefits and to open a new chapter for the bank.”

The bank also said on Monday that it was finalizing the appointment of a special adviser who would help it to better structure its capital base.

Portugal’s central bank has said BES has enough capital to cope with any losses resulting from the fallout of the financial troubles of the family, whose companies owe the bank 1.2 billion euros (US$1.62 billion), and that it could tap private investors if there is a further need.

BES raised 1.045 billion euros in a capital increase last month, but subsequent details about its lending to Espirito Santo family companies and its troubled operations in Angola raised fresh questions about whether it needs more.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day