Citigroup Inc and US authorities were yesterday set to announce a US$7 billion agreement to end probes of the bank’s sales of mortgage-backed bonds, according to a person with direct knowledge of the matter.

The deal, signed over the weekend, requires the firm to pay US$4 billion to the US Justice Department, about US$300 million to state attorneys general and about US$200 million to the Federal Deposit Insurance Corp, and to provide US$2.5 billion in relief for consumers, the person said, asking not to be named because the talks are private. The settlement includes a statement of facts, outlining the allegations, the person said.

Citigroup, the third-biggest US bank, was among lenders including Bank of America Corp investigated by the US Justice Department for allegedly misrepresenting the quality of mortgage-backed bonds sold to investors as housing prices plummeted. JPMorgan Chase & Co, the biggest bank, agreed in November to pay US$13 billion to resolve similar federal and state probes. The government has sought about US$17 billion from Bank of America, a person familiar with those talks has said.

Mark Costiglio, a spokesman for New York-based Citigroup, declined to comment on the settlement.

Citigroup and government officials have been discussing a resolution since April, a person familiar with the matter said last month. Discussions broke down on June 9 after the bank’s settlement offers failed to satisfy prosecutors, the person said. Government officials had demanded more than US$10 billion to resolve the issue, while Citigroup raised its offer to less than US$4 billion, the person said.

Citigroup’s lawyers had argued that the should face a far smaller penalty than JPMorgan because Citigroup sold fewer mortgage bonds, the person with knowledge of the deal said.

The government rejected that position, citing what it considered Citigroup’s level of culpability based on e-mails, internal bank documents and the rates at which loans backing its bonds soured, the person said. Investigators also focused on how Citigroup employees “waived” loans that were supposed to be subject to certain criteria for inclusion in the securities, the person said.

As talks stalled in mid-June, the Justice Department told Citigroup it was planning a news conference to announce a lawsuit against the company, the person said. The arrest of a suspect in the attack on the US embassy in Libya prompted government prosecutors to temporarily postpone the announcement, concerned that the news from Benghazi would overshadow the Citigroup case, the person said. The bank and investigators reached a deal in the weeks that followed.

From 2005 through 2008, Citigroup sold about $91 billion of mortgage loans packaged into so-called private-label mortgage debt, which isn’t guaranteed or issued by government agencies, according to the bank’s annual securities filing.

RECYCLE: Taiwan would aid manufacturers in refining rare earths from discarded appliances, which would fit the nation’s circular economy goals, minister Kung said Taiwan would work with the US and Japan on a proposed cooperation initiative in response to Beijing’s newly announced rare earth export curbs, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday. China last week announced new restrictions requiring companies to obtain export licenses if their products contain more than 0.1 percent of Chinese-origin rare earths by value. US Secretary of the Treasury Scott Bessent on Wednesday responded by saying that Beijing was “unreliable” in its rare earths exports, adding that the US would “neither be commanded, nor controlled” by China, several media outlets reported. Japanese Minister of Finance Katsunobu Kato yesterday also

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September

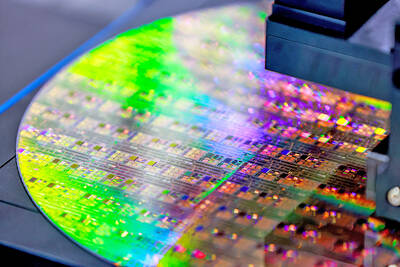

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional