Internet retailer Amazon.com Inc is to be called back to the British parliament to clarify how its activities in the UK justify its low corporate income tax bill, two British lawmakers told reporters.

Amazon will follow search giant Google, which attended another grilling by the parliament’s Public Affairs Committee over its tax affairs on Thursday. A report earlier this month raised questions over Google’s earlier assertions that its UK-based staff do not sell to customers.

Over the past six years, Amazon has paid about US$9 million in income tax on over US$23 billion of sales to British clients, because it says it operates a single European business out of Luxembourg, rather than a multinational structure of independent subsidiaries in different countries, and should therefore pay tax in Luxembourg.

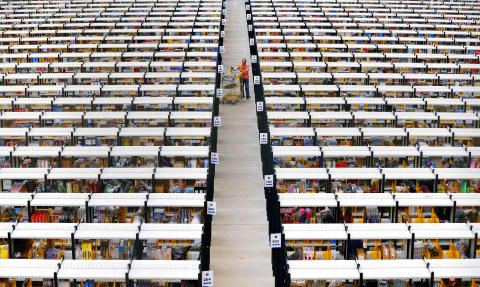

Photo: Reuters

However, Reuters has uncovered evidence from the company’s own statements, job advertisements, statements from three suppliers and five former employees, as well as the profiles of over 140 staff on networking Web site LinkedIn, which suggests the UK unit has a high degree of autonomy, with local managers deciding on many aspects of its business.

The information, collected during a three-month investigation, suggests that while Amazon depicts itself as a virtual business, its structure may not be so different from its bricks-and-mortar rivals.

“The basic business model wasn’t very different to a mail order company in the 1970s or 1980s,” said Mark Riley, a Business Development manager at Amazon.co.uk between 2005 and 2008.

Bryan Roberts, Retail Insights director for consultants Kantar Retail, said apart from the fact buyers seal deals over the Internet, Amazon’s UK unit Amazon.co.uk Ltd, which is based in an office block in Slough, near London, was essentially a UK retailer.

“Amazon.co.uk is a British business in that 99 percent of the people who are responsible for merchandising, buying, the online activity, fulfillment, are based in Slough,” said Roberts, an expert who advises many Amazon suppliers.

Amazon declined to answer any questions about its UK business.

On Thursday, the Guardian newspaper reported that it had found “extensive UK activities” for Amazon that suggested the UK tax authority could be tougher on taxing its British operations.

Companies, especially those which sell over the Internet, increasingly designate their British subsidiary as a supplier of support services to an affiliate in a low-tax jurisdiction, through which sales are then booked.

Firms including Expedia and Microsoft have used such arrangements to minimize tax bills, while also employing people in a wide range of roles in Britain, their accounts, employee profiles on their Web pages, job advertisements and the LinkedIn profiles of staff show.

Amazon and Microsoft say they follow tax law in every country where they operate. Expedia declined to comment.

The practice is based on international tax rules which allow companies to conduct “preparatory and auxiliary” activities in a country without creating a taxable presence there.

The UK tax authority, Her Majesty’s Revenue and Customs (HMRC), has never sought to define in court the limits of what an Internet company can do in Britain before it is deemed to have a taxable presence. Lawyers and academics say this has allowed a wide gray area to emerge.

In the case of Amazon at least, some tax experts said that in conducting a wide range of activity in the UK, it may be on the wrong side of the hitherto undefined boundary.

Yet Jacques Sasseville, head of the tax treaty unit at the Organisation for Economic Co-operation and Development, which advises rich nations on tax policy, said he was not sure if a boundary exists.

He said where sales were conducted online, it was almost impossible to prove a taxable presence in a jurisdiction, irrespective of how much activity is conducted in that country.

Member of Parliament Margaret Hodge said she wanted HMRC to look more closely at the company’s affairs, to see if Amazon was paying all the tax it should.

She also said she planned to call Amazon representatives back to testify to the committee which she chairs and clarify written evidence and witness testimony the firm gave in November last year, in which it downplayed its activities in Britain.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day

Thousands of parents in Singapore are furious after a Cordlife Group Ltd (康盛人生集團), a major operator of cord blood banks in Asia, irreparably damaged their children’s samples through improper handling, with some now pursuing legal action. The ongoing case, one of the worst to hit the largely untested industry, has renewed concerns over companies marketing themselves to anxious parents with mostly unproven assurances. This has implications across the region, given Cordlife’s operations in Hong Kong, Macau, Indonesia, the Philippines and India. The parents paid for years to have their infants’ cord blood stored, with the understanding that the stem cells they contained