European leaders agreed on Friday to police thousands of eurozone banks beginning next year as they sought to create much-needed jobs in their austerity-battered economies.

By the close of a two-day summit, France and Germany had patched up differences over how to beat the debt crisis, with the new watchdog for 6,000 banks a key condition for allowing a dedicated rescue fund to re-float troubled lenders.

Leaders cited “significant progress” on a 120 billion euro (US$155 billion) package of measures to try to kickstart a climb out of recession as social and political unrest hits Spain as well as Greece.

However, the bank deal appeared to come too late for Spanish lenders, who need recapitalization to the tune of some 40 billion euros that Madrid had hoped would not be added to its public debt burden for fear of sparking new pressures on money markets.

German Chancellor Angela Merkel told reporters that direct recapitalization by the eurozone rescue fund could not be retroactive, that it “will only be possible for the future.”

Fellow hardliners the Netherlands and Finland adopted the same view when finance ministers from the three states met last month in Helsinki, seemingly reversing plans carefully laid down by the eurozone in June.

France is still pleading for the “Helsinki” trio to come round.

A top EU official speaking anonymously after the summit ended said Paris has concerns about spillover effects from Spain, and maintained Merkel’s remark came as “a surprise” as the 27 EU bloc leaders “did not settle this.”

This official said the Spanish bank bailout could benefit from some direct recapitalization later in the process, once the watchdog is up and running — supposed to be later next year.

Spanish Prime Minister Mariano Rajoy faces growing political problems with a general strike called for Nov. 14 and key elections in the autonomous Basque Country yesterday and independence-minded Catalonia next month.

Rajoy said the direct aspect of recapitalization was not an “urgent” issue for Spain, while talk of sovereign aid — expected to take the form of a credit line initially — also remains on the back-burner.

With market pressures considerably eased since the summer, the fresh commitment bird’s eye bank supervision led by the European Central Bank (ECB) is supposed to anchor a re-designed economic and monetary union.

Leaders are beginning to believe — after three years in full crisis mode — that the euro can be made more attractive to influential EU states still outside the currency bloc like Poland, one of the bloc’s strongest economies.

After an 11-hour session into the wee hours to reach the bank supervision deal, Merkel said it was about ensuring a “solid legal framework” as the ECB puts in place “hundreds” of staff.

The target date here is Jan. 1 next year, Merkel citing a need for “democratic legitimacy,” including a change to voting rights to assuage concerns in non-euro territories where eurozone banks operate, namely the global financial center of London.

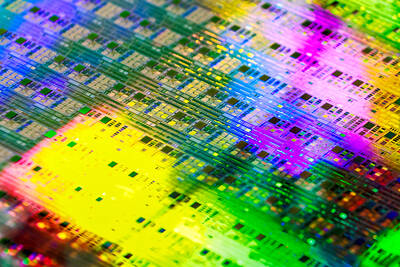

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs

The US on Friday penalized two Chinese firms that acquired US chipmaking equipment for China’s top chipmaker, Semiconductor Manufacturing International Corp (SMIC, 中芯國際), including them among 32 entities that were added to the US Department of Commerce’s restricted trade list, a US government posting showed. Twenty-three of the 32 are in China. GMC Semiconductor Technology (Wuxi) Co (吉姆西半導體科技) and Jicun Semiconductor Technology (Shanghai) Co (吉存半導體科技) were placed on the list, formally known as the Entity List, for acquiring equipment for SMIC Northern Integrated Circuit Manufacturing (Beijing) Corp (中芯北方積體電路) and Semiconductor Manufacturing International (Beijing) Corp (中芯北京), the US Federal Register posting said. The

READY TO HELP: Should TSMC require assistance, the government would fully cooperate in helping to speed up the establishment of the Chiayi plant, an official said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said its investment plans in Taiwan are “unchanged” amid speculation that the chipmaker might have suspended construction work on its second chip packaging plant in Chiayi County and plans to move equipment arranged for the plant to the US. The Chinese-language Economic Daily News reported earlier yesterday that TSMC had halted the construction of the chip packaging plant, which was scheduled to be completed next year and begin mass production in 2028. TSMC did not directly address whether construction of the plant had halted, but said its investment plans in Taiwan remain “unchanged.” The chipmaker started

MORTGAGE WORRIES: About 34% of respondents to a survey said they would approach multiple lenders to pay for a home, while 29.2% said they would ask family for help New housing projects in Taiwan’s six special municipalities, as well as Hsinchu city and county, are projected to total NT$710.65 billion (US$23.61 billion) in the upcoming fall sales season, a record 30 percent decrease from a year earlier, as tighter mortgage rules prompt developers to pull back, property listing platform 591.com (591新建案) said yesterday. The number of projects has also fallen to 312, a more than 20 percent decrease year-on-year, underscoring weakening sentiment and momentum amid lingering policy and financing headwinds. New Taipei City and Taoyuan bucked the downturn in project value, while Taipei, Hsinchu city and county, Taichung, Tainan and Kaohsiung