US stocks markets ended the pre-holiday week by booking solid gains on Friday, after five sessions that saw trade marked by a rare slowdown in bad news from Europe and further evidence of a US recovery.

The major indices began the week in the red amid lingering concerns that the European Central Bank would not step in to stop the eurozone rot.

However, they managed to eke out solid gains by Friday’s close.

While the Frankfurt-based central bank continued to shy away from backing indebted sovereigns, it did open lending windows for European banks, which helped ease panic.

“The signs are encouraging in Europe,” Hugh Johnson of Hugh Johnson Advisors said. “There are some signs, not overwhelming, that things are starting to stabilize in Europe.”

The Dow Jones Industrial Average finished up 3.6 percent to end the week at 12,294.00 points.

The NASDAQ was up 2.5 percent for the period and the S&P 500 added 3.7 percent for the week.

Stocks were helped by suggestions on Tuesday of a nascent turnaround in the US housing industry, with new home starts up 9.3 percent last month from a year earlier to the best level since April last year, when since-expired government tax credits were driving sales.

“The surge in sales ... suggests the sector is beginning to wake from its long sleep; expect sustained gains in sales and starts ahead,” Ian Shepherdson of High Frequency Economics said.

On Thursday, US stocks scored solid gains on encouraging jobs market data.

Weekly claims for US unemployment benefits fell to the lowest level since April 2008 last week, the US Department of Labor said.

Data from Germany also set a more positive tone.

Germany’s Ifo business sentiment index defied analysts’ expectations and rose to 107.2 points this month from 106.6 last month.

“There can be no talk of a crash as in 2008,” Ifo Institute president Hans-Werner Sinn said.

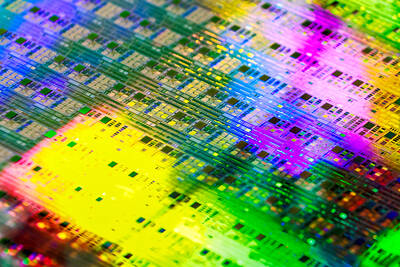

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

People walk past advertising for a Syensqo chip at the Semicon Taiwan exhibition in Taipei yesterday.

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs

The US on Friday penalized two Chinese firms that acquired US chipmaking equipment for China’s top chipmaker, Semiconductor Manufacturing International Corp (SMIC, 中芯國際), including them among 32 entities that were added to the US Department of Commerce’s restricted trade list, a US government posting showed. Twenty-three of the 32 are in China. GMC Semiconductor Technology (Wuxi) Co (吉姆西半導體科技) and Jicun Semiconductor Technology (Shanghai) Co (吉存半導體科技) were placed on the list, formally known as the Entity List, for acquiring equipment for SMIC Northern Integrated Circuit Manufacturing (Beijing) Corp (中芯北方積體電路) and Semiconductor Manufacturing International (Beijing) Corp (中芯北京), the US Federal Register posting said. The