Don’t let the retro look of the mechanical men built by Swiss artisan Francois Junod deceive you — they fascinate tech fans from Silicon Valley to Asia and will no doubt gain broader popularity after the launch of Martin Scorsese’s film Hugo about a secret hidden in an automaton.

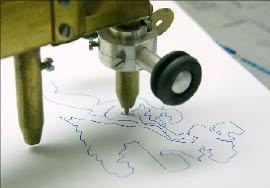

The latest of Junod’s time-consuming projects is an 80cm wind-up Leonardo da Vinci figure that will be able to do intricate drawings and write mirror-inverted texts in Latin.

“I have been working on the sculpture for 10 years and on the mechanism for six years. I do not have a buyer yet so I can take my time,” Junod said, surrounded by a mishmash of tools, machines and sketches in his workshop in the village of Sainte-Croix perched high up in the Swiss Jura mountains.

Photo: Reuters

His most complicated creation so far, an Alexander Pushkin animated by a complex mechanism enabling it to write down 1,458 different poems, was bought last year by a Silicon Valley entrepreneur for a price kept secret.

“Complex models can take years of work and cost up to 1.2 million Swiss francs [US$1.32 million],” Junod said, proudly showing historical automata that collectors from around the world ask him to restore.

“Before, I mainly worked for Japanese clients because automata really have a tradition there, but today, I have customers from all around the world,” said Junod, who counts the Sultan of Brunei and the late Michael Jackson among his clients.

Photo: Reuters

Interest in these sophisticated dolls, known as automata, is likely to get a fresh boost from Scorsese’s new 3D film Hugo.

Based on a best-selling children’s book by Brian Selznick, the film tells the tale of a young boy in a Paris railway station in the 1930s who struggles to uncover a secret hidden in his father’s automaton.

“The film is going to be a good advertisement for my business,” Junod said. “People who watch it may think nobody makes automata anymore.”

Photo: Reuters

Good-humored, enthusiastic Junod, who went through some rough times when he started making the self-operating machines in 1984, is one of the last craftsmen specialized in an art serving no other purpose than to surprise with its complexity.

“That’s what makes automata different from robots, which normally have a practical purpose. They are poetic,” he said.

Junod wants to give his Leonardo da Vinci a transparent back to make the mechanism visible.

“It’s part of the fascination with automata that people can understand how they work. These days, ever more objects are beyond our comprehension,” he said.

Junod’s automata are animated by a complex wind-up mechanism, not unlike the one in a mechanical watch, allowing them to accomplish a precise programmed series of gestures, which has often triggered comparisons with our modern computers.

The roots of these surprising machines reach back to ancient Greece, but they had their heyday in the 18th century when a general fascination with artificial humans helped watch and automaton maker Pierre Jaquet-Droz’s work win the favors of French King Louis XVI and his wife, Marie-Antoinette.

Jaquet-Droz’s three masterpieces — The Musician, The Writer and The Draughtsman — are on display in a Neuchatel museum and will be part of a large automata exhibition next year.

Junod has made several automata for high-end watch brand Jaquet Droz, now owned by Swatch Group, which wants to revive this heritage and a closer partnership is in the works.

“The idea is that I develop prototypes that Jaquet Droz then produces in small numbers,” he said.

“That is what I love: developing new machines, rather than reproducing,” he said, remembering how he once declined late Swatch Group founder Nicolas Hayek’s offer to work exclusively for the world’s largest watchmaker.

SEEKING CLARITY: Washington should not adopt measures that create uncertainties for ‘existing semiconductor investments,’ TSMC said referring to its US$165 billion in the US Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) told the US that any future tariffs on Taiwanese semiconductors could reduce demand for chips and derail its pledge to increase its investment in Arizona. “New import restrictions could jeopardize current US leadership in the competitive technology industry and create uncertainties for many committed semiconductor capital projects in the US, including TSMC Arizona’s significant investment plan in Phoenix,” the chipmaker wrote in a letter to the US Department of Commerce. TSMC issued the warning in response to a solicitation for comments by the department on a possible tariff on semiconductor imports by US President Donald Trump’s

The government has launched a three-pronged strategy to attract local and international talent, aiming to position Taiwan as a new global hub following Nvidia Corp’s announcement that it has chosen Taipei as the site of its Taiwan headquarters. Nvidia cofounder and CEO Jensen Huang (黃仁勳) on Monday last week announced during his keynote speech at the Computex trade show in Taipei that the Nvidia Constellation, the company’s planned Taiwan headquarters, would be located in the Beitou-Shilin Technology Park (北投士林科技園區) in Taipei. Huang’s decision to establish a base in Taiwan is “primarily due to Taiwan’s talent pool and its strength in the semiconductor

Industrial production expanded 22.31 percent annually last month to 107.51, as increases in demand for high-performance computing (HPC) and artificial intelligence (AI) applications drove demand for locally-made chips and components. The manufacturing production index climbed 23.68 percent year-on-year to 108.37, marking the 14th consecutive month of increase, the Ministry of Economic Affairs said. In the first four months of this year, industrial and manufacturing production indices expanded 14.31 percent and 15.22 percent year-on-year, ministry data showed. The growth momentum is to extend into this month, with the manufacturing production index expected to rise between 11 percent and 15.1 percent annually, Department of Statistics

An earnings report from semiconductor giant and artificial intelligence (AI) bellwether Nvidia Corp takes center stage for Wall Street this week, as stocks hit a speed bump of worries over US federal deficits driving up Treasury yields. US equities pulled back last week after a torrid rally, as investors turned their attention to tax and spending legislation poised to swell the US government’s US$36 trillion in debt. Long-dated US Treasury yields rose amid the fiscal worries, with the 30-year yield topping 5 percent and hitting its highest level since late 2023. Stocks were dealt another blow on Friday when US President Donald