TAIEX drops on HTC concerns

The TAIEX trended lower yesterday, falling below the 8,800 point mark, led by smartphone maker HTC (宏達電) amid worries over the company’s newly announced deal to acquire graphics chipset designer S3 Graphics Co, dealers said.

Other high-tech heavyweights — semiconductor firms, in particular — were also under pressure as concerns lingered over weakening global demand for the third quarter of this year, they said.

The TAIEX closed down 51.02 points or 0.58 percent at 8,773.42, after moving between 8,757.47 and 8,795.88, on turnover of NT$106.87 billion (US$3.71 billion).

Oil shipments fell in June

Taiwan purchased less crude oil last month after a fire at Formosa Plastics Group (台塑集團) cut demand. Crude shipments declined 24 percent from a year earlier to 22.8 million barrels last month, the Ministry of Finance said yesterday.

Last month’s oil bill climbed 14 percent to US$2.58 billion, the ministry said in a statement.

The industrial group halted some plants at its Mailiao (麥寮) complex in Yunlin County after a fire on May 12.

Taiwan’s petroleum and coal-product output fell 13 percent in May from a year earlier, the Ministry of Economic Affairs said on June 23.

Long-term debt worth trillions

The national debt amounted to NT$207,000 per person at the end of last month, down NT$4,000 from the end of May, the finance ministry said yesterday.

As of June 30, Taiwan’s long-term debt was NT$4.6085 trillion, while its short-term debt stood at NT$178.8 billion, the ministry said.

Since December last year, the MOF has been publishing a Web-based “National Debt Clock” monthly, mainly to remind government agencies to monitor their spending and thus help lower the national debt.

Land developer to sell shares

Taiwan Land Development Corp (台灣土地開發) plans to sell 150 million new shares at NT$12.5 each to raise NT$1.88 billion, it said in a statement to the Taiwan Stock Exchange yesterday. The proceeds will be used to develop real estate projects and for investments, it said.

Powerchip reveals debt ratio

Powerchip Technology Corp (力晶科技), the nation’s second-biggest DRAM maker, said in a statement yesterday that its debt ratio was 75 percent as of the end of last month.

First bank eyes China deal

First Commercial Bank’s (第一銀行) board yesterday approved plans to sign a business cooperation agreement with China Construction Bank (中國建設銀行) to expand cross-strait banking services, according to a stock exchange filing issued by the lender’s parent, First Financial Holding Co (第一金控).

The bank said it would sign the pact with China Construction, one of China’s “Big Four,” after receiving the green light from the Financial Supervisory Commission, the filing showed.

China alters foreign cargo law

China will ban foreign companies, organizations and individuals from irregular-scheduled cargo sea transportation from Jan 1 next year, the Ministry of Transport said in a statement on its Web site on Wednesday.

NT slips against greenback

The New Taiwan dollar fell against the US currency yesterday, down NT$0.009 to close at NT$28.860. Dealers said the central bank intervened in late trade to reverse the losses posted by the US dollar.

Turnover totaled US$721 million during trading, up from US$606 million the previous session.

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the

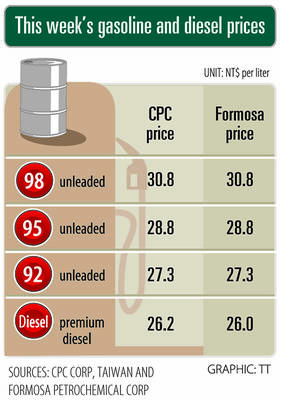

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

SinoPac Financial Holdings Co (永豐金控) is weighing whether to add a life insurance business to its portfolio, but would tread cautiously after completing three acquisitions in quick succession, president Stanley Chu (朱士廷) said yesterday. “We are carefully considering whether life insurance should play a role in SinoPac’s business map,” Chu told reporters ahead of an earnings conference. “Our priority is to ensure the success of the deals we have already made, even though we are tracking some possible targets.” Local media have reported that Mercuries Life Insurance Co (三商美邦人壽), which is seeking buyers amid financial strains, has invited three financial

CAUTION: Right now, artificial intelligence runs on faith, not productivity and eventually, the risk of a bubble will emerge,’ TIER economist Gordon Sun said Taiwanese manufacturers turned more optimistic last month, ending a five-month streak of declining sentiment as concerns over US tariffs, currency volatility and China’s overcapacity began to ease, the Taiwan Institute of Economic Research (TIER) said yesterday. The manufacturing business confidence index rose 1.17 points from June to 86.8, its first rebound since February. TIER economist Gordon Sun (孫明德) attributed the uptick to fading trade uncertainties, a steadier New Taiwan dollar and reduced competitive pressure from Chinese producers. Taiwan’s semiconductor industry is unlikely to face significant damage from Washington’s ongoing probe into semiconductors, given the US’ reliance on Taiwanese chips to power artificial