Imagine this vision of 2016: Industrial output at NT$120 billion (US$3.6 billion), more than 240,000 jobs created, an annual production of 60,000 units, including 15,000 for export, with Taiwanese manufacturers becoming top 10 brands worldwide.

This is the blueprint the government has painted for the electric car industry six years from now, as the sector gains momentum globally amid growing environmental awareness.

Pundits say a few bumps on the road have to be cleared first to make this vision a reality.

“The automobile industry has more than 100 years of history. Taiwanese companies are considered a latecomer in the field,” said Kelly Chang (張嘉芬), marketing and communication manager at Luxgen Motor Co (納智捷汽車). “But Taiwan is now at the starting line, just like our competitors, because the electric car has just started booming.”

Taiwan stands a chance in the green vehicle sector, market watchers say, because it has the world’s leading technology supply chain — in areas from semiconductors and telecommunications to panels — and companies could use this advantage to devise intelligent solutions for electric car manufacturing, producing components or even whole cars.

On April 15, the government fleshed out its six-year plan to promote the electric car industry in two phases, by injecting NT$9.7 billion into the industry.

The government has chosen battery-powered electric vehicles (BEVs), over hybrid electric cars or plug-in hybrid electric vehicles (PHEVs), for reasons including Taiwan’s geography, as distances between cities are short, and the nation’s convenient transportation infrastructure.

Hybrids are vehicles that run on both gasoline engines and a battery, while PHEVs are hybrid vehicles with rechargeable batteries that can be by connecting a plug to an external power source.

BEVs produce only a quarter of the carbon dioxide emitted by gasoline cars, and a third of that emitted by hybrid cars, the Ministry of Economic Affairs (MOEA) says.

Under the government’s plan, the first three years comprise the first phase, during which it will exempt BEVs from commodity taxes and set up 10 trial zones, with each zone having 300 electric cars.

Infrastructure such as battery recharging stations would be completed within the demonstration zones to facilitate the trial runs.

The ministry said three recharging methods were possible: The first one would require consumers to install recharging equipment at home, with a charging time of about four to eight hours; the second would entail building speedy recharge stations next to gas stations, at highway pit stops and car parks, where 30 minutes would be enough to recharge the vehicle; the third would entail establishing common recharging stations, where recharging would require four to eight hours. Pinglin, Taipei County is expected to be the first demo zone, seeing electric cars run in the fourth quarter. Luxgen is expected to supply 30 BEVs to Taipei County for trial, said Hsu Kuo-hsing (�?�), president of Yulon Tobe Motor Co (裕隆酷比汽車).

“The 30 vehicles are slightly below our expectation,” said a source from the MOEA, adding that it would consider bringing in overseas brands to secure enough cars to make the demonstrations run smoothly.

The official said overseas BEVs could be brought into the zones to fill up the quota of 3,000 vehicles. As long as parts of the vehicles are locally produced to a certain extent, foreign makers could apply to join Taiwan’s trials.

Taiwan is also calling for government agencies and government-run enterprises to “take the lead” by adopting 185 electric cars.

The nation’s largest postal service provider, Chunghwa Post Co (中華郵政), is expected to have its first electric postal car running on the roads this month for courier service.

The car was jointly designed by the Industrial Technology Research Institute and the Taiwan Automotive Research Consortium.

“We were thinking of fueling the growth with the government purchasing 185 BEVs at first, but it seems now this is not viable,” the MOEA source said.

An electric car costs more than NT$1 million — about 30 percent more than the approved budget for government agencies to buy automobiles for work purposes, he said, adding that regulation amendments would be necessary to increase the budget.

For the initiative’s second phase, starting in 2014, the government plans to offer cash rebates for consumers buying electric cars, although how much the subsidy would be “depends on the outcome of the trial operations and the government’s financial status at the time,” director-general of the minstry’s Industrial Development Bureau Woody Duh (杜紫軍) said.

After the six-year initiative, the government hopes local automakers could join forces with their Chinese counterparts to market BEVs made in the Greater China region.

By 2030, the government aims to have local makers producing 1.2 million BEVs a year, with 200,000 for the local market and the rest for export.

Yulon Group (裕隆集團), Taiwan’s largest automaker conglomerate, with affiliates such as China Motors Co (中華汽車), Yulon Tobe and Luxgen, has started producing engines for electric cars.

Luxgen has spent NT$5 billion developing BEVs, with NT$1.5 billion spent developing the electric battery alone, company president Hu Kai-chang (胡開昌) said.

While most BEVs from overseas makers are “show cars,” Hu said Luxgen’s models “are ready for mass production any time now.”

Luxgen’s BEVs are seven-seater sports utility vehicles or multi-purpose vehicles, which differentiates them from the Nissan Leaf, a four-seater, and the Tesla Roadster, a two-seater, he said.

Hsu has a strategy he says would boost demand for BEVs.

The company has an M’ Car series, a revamped version of the Panda car manufactured by its partner, Chinese automaker Geely Automobile Holdings Ltd (吉利汽車).

“We plan to sell a battery-powered M’ Car in the future, giving consumers the option of leasing the battery instead of buying it,” Hsu said, adding that electric batteries contribute a large portion to BEVs’ price tags.

That business model would allow the electric M’ Car to be sold near the range of its gas-powered peers — about NT$400,000. Drivers would pay only a few thousand NT dollars a month to lease the battery, less than the cost of the gasoline they are buying now, he said.

“This is the incentive to persuade more people to buy the green vehicle,” Hsu said.

While the electric car is the current talk of the industry, the MOEA said there are many hurdles to be overcome.

“The initial stage is usually the most difficult for a new initiative,” Duh said.

“The government is playing a very critical role in the beginning, after which we would leverage the strength of our industry partners to make the scheme a successful one and bring Taiwan-made cars to the world,” he said.

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

Two Chinese chipmakers are attracting strong retail investor demand, buoyed by industry peer Moore Threads Technology Co’s (摩爾線程) stellar debut. The retail portion of MetaX Integrated Circuits (Shanghai) Co’s (上海沐曦) upcoming initial public offering (IPO) was 2,986 times oversubscribed on Friday, according to a filing. Meanwhile, Beijing Onmicro Electronics Co (北京昂瑞微), which makes radio frequency chips, was 2,899 times oversubscribed on Friday, its filing showed. The bids coincided with Moore Threads’ trading debut, which surged 425 percent on Friday after raising 8 billion yuan (US$1.13 billion) on bets that the company could emerge as a viable local competitor to Nvidia

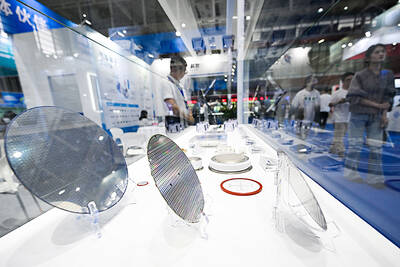

BARRIERS: Gudeng’s chairman said it was unlikely that the US could replicate Taiwan’s science parks in Arizona, given its strict immigration policies and cultural differences Gudeng Precision Industrial Co (家登), which supplies wafer pods to the world’s major semiconductor firms, yesterday said it is in no rush to set up production in the US due to high costs. The company supplies its customers through a warehouse in Arizona jointly operated by TSS Holdings Ltd (德鑫控股), a joint holding of Gudeng and 17 Taiwanese firms in the semiconductor supply chain, including specialty plastic compounds producer Nytex Composites Co (耐特) and automated material handling system supplier Symtek Automation Asia Co (迅得). While the company has long been exploring the feasibility of setting up production in the US to address

OPTION: Uber said it could provide higher pay for batch trips, if incentives for batching is not removed entirely, as the latter would force it to pass on the costs to consumers Uber Technologies Inc yesterday warned that proposed restrictions on batching orders and minimum wages could prompt a NT$20 delivery fee increase in Taiwan, as lower efficiency would drive up costs. Uber CEO Dara Khosrowshahi made the remarks yesterday during his visit to Taiwan. He is on a multileg trip to the region, which includes stops in South Korea and Japan. His visit coincided the release last month of the Ministry of Labor’s draft bill on the delivery sector, which aims to safeguard delivery workers’ rights and improve their welfare. The ministry set the minimum pay for local food delivery drivers at