Jimmy Wang’s (王峰銘) tiles can compete with the best brands of Europe, but that is of little use to the Taiwanese manufacturer, since the most lethal challenge he faces comes from China.

Wang beams with pride as he shows off his ceramic plant in the small coastal town of Guanyin (觀音) in Taoyuan County, an hour’s drive from Taipei, and its Italian-made equipment he bought for NT$500 million (US$15.2 million).

But when the 50-year-old president of Hiland Ceramic Co (昌達陶瓷) thinks about the threat from China, just 160km away, Wang lets out a sigh.

PHOTO: AFP

“I’m not afraid of competition. But I’m concerned about unfair competition,” he said.

Wang is among a growing number of small entrepreneurs in Taiwan fearing what will happen to their businesses once the Beijing-friendly government signs an economic cooperation framework agreement (ECFA) with China.

Critics fear that the ECFA, a scaled-down trade pact, will open the floodgates for a deluge of cheap Chinese imports, wiping out low-tech industries such as Wang’s.

China’s competitive labor is often cited as key, but there are other factors behind its export juggernaut.

One example: Taiwan’s tile makers are required to use natural gas, a relatively clean energy source, to meet strict environmental laws, but their Chinese rivals use coal, which is more polluting but six times cheaper.

There are around 50 ceramic plants in Taiwan and few are safe if the ECFA becomes a reality.

“At least half of the domestic ceramic plants may have to be shut down if China dumps cheap products here,” said Yu Teh-er (游德二), the chief secretary at the Taiwan Association of Ceramic Industry (台灣陶瓷公會).

Despite protests from the Democratic Progressive Party and some local industries, the administration under President Ma Ying-jeou (馬英九) insists the trade pact is necessary.

Ma, who on Thursday appointed a new premier and approved a new Cabinet, said he would return his focus to negotiating the trade pact after he deals with damages caused by Typhoon Morakot.

Without the pact, officials say, Taiwan will not be able to compete on fair terms in China — the country’s leading foreign market.

The 10-member ASEAN is scheduled to forge a free-trade agreement with China next year, while Taiwan’s two major competitors — Japan and South Korea — may sign a similar agreement with China in 2015.

If the free-trade agreements take effect as scheduled, companies from the 12 countries will be able to sell their products in China without paying tariffs, making action a necessity, Taiwan authorities argue.

“Without measures of our own, Taiwan would be in an extremely unfavorable position on the Chinese market,” a study from the Chung-Hua Institution for Economic Research (中華經濟研究院).

Customs figures show Taiwan’s exports to China, including Hong Kong, totaled US$92.6 billion last year, accounting for 38 percent of the country’s shipments.

Taiwan enjoyed a surplus of US$60 billion in the trade with its leading business partner.

Were it not for trade with China, Taiwan would have had a deficit of more than US$40 billion last year.

But apart from economic considerations, Taiwan’s ties with China also have a political aspect, since Beijing sees Taiwan as part of its territory awaiting unification, by force if necessary.

“The confrontation over sovereignty between Taiwan and China makes the ECFA highly political and controversial, even if it does not refer to sovereignty directly,” said Tung Chen-yuan (童振源), a cross-strait economy expert at National Chengchi University.

But for many businesspeople the most jarring aspect is neither the economic fears nor the political worries — but a feeling that the government does not really care about their plight.

“We have not been approached by responsible government officials to hear our concerns even though the government has said ECFA may be signed early next year,” Wang said.

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

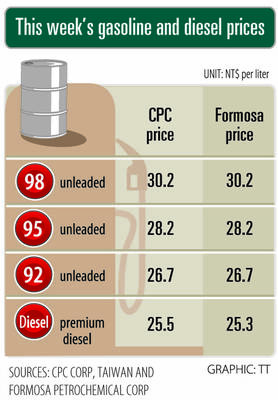

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01