As ASEAN nations chase bilateral free trade agreements (FTAs) to cope with the China challenge, analysts warn the group stands to lose more than it gains if it fails to speed up internal liberalization.

FTAs will be more of a stumbling block than a building block for the Association of Southeast Asian Nations' own area free trade agreement (AFTA) if tariff walls among its 10 members are not sufficiently low, they say.

A flurry of FTAs will also result in a web of complex preferential tariff schemes which could burden the private sector and lead to trade diversion and investment distortion, analysts warned at a recent ASEAN business forum.

Singapore, the most affluent but trade-reliant ASEAN member, started the ball rolling by inking FTAs with the US, New Zealand, Japan and Australia. It says such deals can help restore investor confidence in the rest of Southeast Asia, and boost ASEAN's competitiveness against China.

The island-state said Friday it hoped to conclude FTA talks with Canada this year.

Other ASEAN members, including Thailand and the Philippines, have since joined the fray and are negotiating deals with economic heavyweights including the US and Japan.

Deunden Nikomborirak, research director with Thailand Development Research Institute, said cumbersome and slow multilateral negotiations were turning countries to FTAs but these were "second best alternatives."

The danger is they could divert trade from AFTA to big trading partners such as the US, Japan and the EU which end up becoming hubs, she said.

"If each ASEAN member country has a bilateral FTA with the US while maintaining high tariffs among themselves, then the US will mostly benefit as the preferred location for investment," she said. "To avoid this, ASEAN must ensure that tariff walls among themselves are sufficiently low."

Deunden said it would be tough for smaller economies to see net gains from FTAs since major industrialized countries often have a standard agreement, she said.

For instance, Japan and the US are using the FTA with Singapore as the blueprint for talks with Thailand but this is unfair as the economies differ and the Singapore FTA for example, does not include agriculture which is a key sector for Thailand, she said.

Hank Lim, research director at Singapore's Institute of International Affairs, said FTAs were "discriminatory in nature" and could complicate tariff rates and rules applied to the same products.

He noted that ASEAN, as a grouping, was also developing FTAs with a number of countries including the US, Japan, India, South Korea and was working with China to create the world's largest free trade zone within 10 years.

But in the absence of a common framework, there is a danger ASEAN will end up with a series of different frameworks that are inconsistent with each other and lead to negative implications, he said.

"One such undesirable effect is higher costs of doing business and discriminatory trade occurring because of the spaghetti bowl effect of regulations," he said in a paper presented at the forum.

"Another is that ASEAN does not become the hub and the framework is driven more by the non-ASEAN partner," he said.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

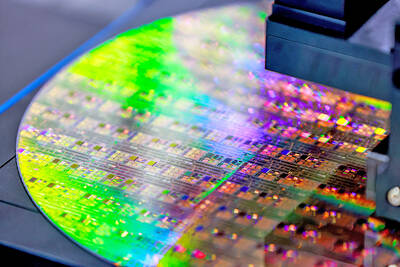

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

Pegatron Corp (和碩), a key assembler of Apple Inc’s iPhones, on Thursday reported a 12.3 percent year-on-year decline in revenue for last quarter to NT$257.86 billion (US$8.44 billion), but it expects revenue to improve in the second half on traditional holiday demand. The fourth quarter is usually the peak season for its communications products, a company official said on condition of anonymity. As Apple released its new iPhone 17 series early last month, sales in the communications segment rose sequentially last month, the official said. Shipments to Apple have been stable and in line with earlier expectations, they said. Pegatron shipped 2.4 million notebook