Oil hit a fresh 18-month peak this week on mounting optimism about a US-led global economic recovery, while safe-haven gold sparkled amid heightened concerns about the Greek debt crisis.

“Oil prices are consolidating in their new trading range, having risen to their highest level in a year and a half,” Barclays Capital analysts said in a research note. “Copper prices have breached US$8,000 per tonne, while platinum group metals are close to two-year highs.”

They added: “The commodities complex is exhibiting price divergence, with oil and metals prices testing higher, contrasting starkly with the relative underperformance of agricultural markets.”

Global financial markets were rattled once again by stubborn worries that Greece will not be able to resolve its debt and public deficit problems without outside help.

OIL: Crude oil briefly punched above US$87 on Tuesday, as the market found support from a recent batch of encouraging economic news in the US, which is the world’s largest energy consumer.

New York’s main contract, light sweet crude for delivery in May, jumped to US$87.09 — the highest level since Oct. 9, 2008.

“People are getting more optimistic” about the demand prospects for the US, said Ellis Eckland, an independent analyst. “It looks like the shopping activity is picking up, even the job market is picking up a little bit — that’s very bullish for oil.”

By late on Friday on the New York Mercantile Exchange, Texas light sweet crude for delivery in May rose to US$85.45 compared with US$84.88 on Thursday of the previous week.

On London’s IntercontinentalExchange, Brent North Sea crude for May delivery rallied to US$85.23 from US$83.96 on Thursday of the previous week.

PRECIOUS METALS: Gold was boosted as traders sought a safe investment amid worries about Greece and low interest rates across the globe.

Gold rallied to US$1,160.03 on Friday, reaching the highest level since Jan. 11.

“Continued concerns over Greece’s financial situation, coupled with a lack of attractive investment alternatives due to continuously low interest rate levels both in the US and the eurozone, should keep interest in gold high and should support the gold price,” Commerzbank analysts said.

By late on Friday on the London Bullion Market, gold rose to US$1,152.50 an ounce from US$1,123.50 on Thursday of the previous week.

Silver leapt to US$18.34 an ounce from US$17.69.

On the London Platinum and Palladium Market, platinum soared to US$1,717 an ounce from US$1,660.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

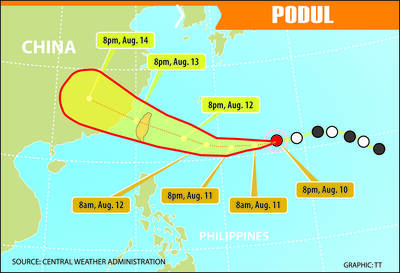

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

Tropical Storm Podul strengthened into a typhoon at 8pm yesterday, the Central Weather Administration (CWA) said, with a sea warning to be issued late last night or early this morning. As of 8pm, the typhoon was 1,020km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, moving west at 23kph. The storm carried maximum sustained winds of 119kph and gusts reaching 155kph, the CWA said. Based on the tropical storm’s trajectory, a land warning could be issued any time from midday today, it added. CWA forecaster Chang Chun-yao (張竣堯) said Podul is a fast-moving storm that is forecast to bring its heaviest rainfall and strongest