Congress wants to give the government a direct role in deciding how much executives on Wall Street are paid, after the biggest US banks accepted billions in taxpayer money and still managed to distribute US$1 million bonuses to thousands of employees.

The House was expected to pass legislation yesterday by Barney Frank, chairman of the House Financial Services Committee, that would ban “incentive-based” pay that could threaten the economy or viability of the institution.

The bill, which would give regulators nine months to hash out the details, would give the government unprecedented say in how private corporations reward brokers and traders.

Democrats said excessive salaries and bonuses risk harming the broader economy.

“The problem with executive compensation is essentially, from the systemic standpoint, that it gives perverse incentives,” said Frank, a Democrat.

Without penalties for bad bets, the system means “heads you win, tails you break even,” he said.

Aware of the bill’s populist appeal, Democratic leaders left the vote as one of their final acts before adjourning for their monthlong summer recess.

Republicans opposed the bill in committee because they said it would give the government too much control over executive pay. But the top Republican on the Financial Services Committee, Spencer Bachus, said he understands its attractiveness.

“Politically, it was very difficult for my members to stand up and fight this legislation,” Bachus said after the committee endorsed the bill in a 40-28 vote along party lines.

The House turns to the legislation one day after New York Attorney General Andrew Cuomo concluded in a report that the nation’s biggest banks, including Bank of America Corp, Merrill Lynch & Co, JPMorgan Chase & Co and Goldman Sachs Group Inc, awarded nearly US$4,800 million plus bonuses last year.

Citigroup, which is now one-third owned by the government as a result of the bailout, gave 738 of its employees bonuses of at least US$1 million, even after it lost US$18.7 billion during the year, Cuomo’s office said.

The New York-based bank received US$45 billion in government money and guarantees to protect it against hundreds of billions of dollars in potential losses from risky investments.

Bank of America, which also received US$45 billion in government money, paid US$3.3 billion in bonuses, with 172 employees receiving at least US$1 million and the top four recipients receiving a combined US$64 million. Merrill Lynch, which Bank of America acquired during the credit crisis, paid out US$3.6 billion, including a combined US$121 million to four top employees.

US President Barack Obama has proposed trying to discourage excessive corporate pay by giving shareholders a nonbinding vote on compensation packages and requiring that compensation committees not have financial relationships with the company and its executives.

Frank embraced the proposal in his legislation, but added the provision banning risky incentives. Firms with less than US$1 billion in assets would be exempt.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

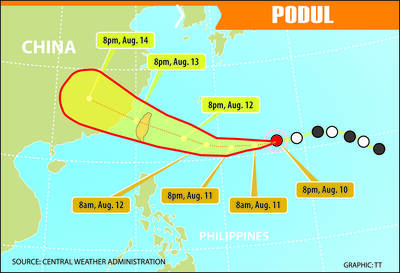

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

CHINA’s BULLYING: The former British prime minister said that he believes ‘Taiwan can and will’ protect its freedom and democracy, as its people are lovers of liberty Former British prime minister Boris Johnson yesterday said Western nations should have the courage to stand with and deepen their economic partnerships with Taiwan in the face of China’s intensified pressure. He made the remarks at the ninth Ketagalan Forum: 2025 Indo-Pacific Security Dialogue hosted by the Ministry of Foreign Affairs and the Prospect Foundation in Taipei. Johnson, who is visiting Taiwan for the first time, said he had seen Taiwan’s coastline on a screen on his indoor bicycle, but wanted to learn more about the nation, including its artificial intelligence (AI) development, the key technology of the 21st century. Calling himself an