Asian stocks rose for a second week as optimism that government measures worldwide will ease the financial crisis offset cuts in earnings forecasts at Mizuho Financial Group Inc and Hitachi Ltd.

BHP Billiton Ltd and Kawasaki Kisen Kaisha Ltd led gains among mining and shipping companies after China cut some tariffs on raw material and component imports. Mitsubishi UFJ Financial Group Inc led banks lower as rival Mizuho, Japan’s second-largest lender, cut its earnings target. Hitachi, which makes electrical equipment, slumped 6.5 percent after forecasting the biggest loss by an Asian electronics maker.

“Fiscal and monetary stimulus policies have helped improve sentiment,” said Binay Chandgothia, who oversees about US$1.5 billion as chief investment officer at Principal Asset Management Co in Hong Kong. “These measures will benefit the economy, although there will be more earnings downgrades.”

The MSCI Asia-Pacific Index rose 0.4 percent to 83.42 in the past five days, adding to the previous week’s 3.5 percent increase. The gauge is down 6.9 percent this year amid mounting signs the global recession has hurt corporate profits.

Toyota Motor Corp, the world’s largest automaker, on Friday widened its loss prediction on slowing demand in the US and in Japan. Mitsubishi UFJ cut its full-year profit forecast after the stock market closed on Friday.

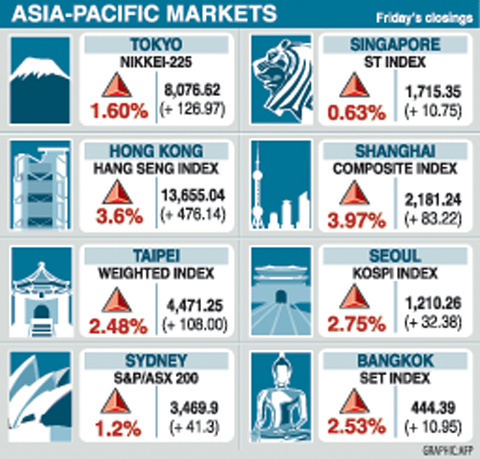

The Nikkei 225 Stock Average added 1 percent last week, while Hong Kong’s Hang Seng index climbed 2.8 percent. China’s Shanghai Composite Index surged 9.6 percent.

Stocks have fallen this year amid mounting signs the financial crisis, which has caused more than US$1 trillion in credit-related losses, is hurting corporate earnings. With banks tightening lending, bankruptcies among Japan’s listed companies reached an annual postwar record last year, according to Tokyo Shoko Research Ltd.

Governments around the world are stepping up efforts to ease the crisis that the IMF predicts will cause global growth to almost grind to a halt this year.

Indonesia’s central bank this week lowered its benchmark interest rate for a third straight month. China’s government started investing a second allocation of a 4 trillion yuan (US$580 billion) economic stimulus package, the official Xinhua News Agency reported.

China’s State Council, or Cabinet, also this week said that components and raw materials that “really needed to be imported” will be exempted from import duties.

Taiwanese share prices are expected to encounter strong technical resistance before the market moves above 4,500 points in the week ahead, dealers said on Friday.

The bourse is likely to drop at the beginning of the week before regaining momentum in the second half owing to adequate liquidity as more institutional investors return to rebuild positions, they said.

Bellwether electronic shares may lead the gains on their attractive valuations after a sell-off ahead of the Lunar New Year holiday last month.

But the financial sector is likely to underperform the broader market on bad loan fears amid the economic meltdown, they added.

The market is expected to fall to between 4,200 and 4,300 points on technical factors early on but is likely to overcome the resistance to jump to around 4,550 later, dealers said.

In the week to Friday, the weighted index rose 223.28 points or 5.26 percent to 4,471.25 after a 2.71 percent fall the week before the Lunar New Year holiday.

Average daily turnover stood at NT$59.76 billion (US$1.77 billion), compared with NT$43.41 billion at the close of the previous trading week.

“The technical resistance ahead of 4,500 points is stiff. It is time for the market to pull back to some extent after a strong showing this week,” Taiwan International Securities (金鼎證券) analyst Arch Shih (施博元) said.

But, as many investors remain empty-handed after unloading their holdings before the holiday, the market will be filled with liquidity.

“They [investors] are still hunting bargains. Any technical downturn will provide them with good buying opportunities,” Shih said.

With trading turnover expanding, Shih said he expects large cap stocks, in particular electronics, to continue to be the favorites of institutional investors.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better

FLOOD RECOVERY: “Post-Typhoon Danas reconstruction special act” is expected to be approved on Thursday, the premier said, adding the flood control in affected areas would be prioritized About 200cm of rainfall fell in parts of southern Taiwan from Monday last week to 9am yesterday, the Central Weather Administration (CWA) said. Kaohsiung’s Taoyuan District (桃源) saw total rainfall of 2,205mm, while Pingtung County’s Sandimen Township (三地門) had 2,060.5mm and Tainan’s Nanhua District (南化) 1,833mm, according to CWA data. Meanwhile, Alishan (阿里山) in Chiayi County saw 1,688mm of accumulated rain and Yunlin County’s Caoling (草嶺) had 1,025mm. The Pingtung County Government said that 831 local residents have been pre-emptively evacuated from mountainous areas. A total of 576 are staying with relatives in low-lying areas, while the other 255 are in shelters. CWA forecaster