Foreign companies pulled more money from China last quarter, a sign that some investors are still pessimistic even as Beijing rolls out stimulus measures aimed at stabilizing growth.

China’s direct investment liabilities in its balance of payments dropped US$8.1 billion in the third quarter, data released by the Chinese State Administration of Foreign Exchange showed on Friday. The gauge, which measures foreign direct investment (FDI) in China, was down almost US$13 billion for the first nine months of the year.

Foreign investment into China has slumped in the past three years after hitting a record in 2021, a casualty of geopolitical tensions, pessimism about the world’s second-largest economy and stronger competition from Chinese domestic firms in industries such as cars. Should the decline continue for the rest of the year, it would be the first annual net outflow in FDI since at least 1990, when comparable data begins.

Photo: Reuters

Companies that have pulled back some China operations this year include automakers Nissan Motor Co and Volkswagen AG, along with others such as Konica Minolta Inc.

Nippon Steel Corp in July said it was exiting a joint venture in China, while International Business Machines Corp said it is shutting down a hardware research team in the country, a decision affecting about 1,000 employees.

The prospect of an expanded trade war and deteriorating relations with Beijing during US president-elect Donald Trump’s second term might further weigh on investment.

“Geopolitical tension” is the topmost concern for members of the American Chamber of Commerce in Shanghai, group chair Allan Gabor said.

“It makes it difficult to plan big investments, but on the contrary, we see a lot of members making small and medium-sized investments,” Gabor said in an interview with Bloomberg TV last week during the China International Import Expo. “It’s a much more surgical investment environment.”

Still, government efforts in late September to stimulate the economy have already benefited one group of foreign investors, with the value of stocks held by foreigners jumping more than 26 percent from August,

China’s central bank data showed. The Chinese benchmark stock index gained almost 21 percent in September after the start of a coordinated stimulus effort, although it has since given up some of those gains.

By contrast, outbound investment from China has been rising sharply. In the third quarter, Chinese firms increased their overseas assets by about US$34 billion, Chinese State Administration of Foreign Exchange data showed.

Outflows so far this year reached US$143 billion, the third-highest total on record for the period. That is likely to continue and expand as more countries put tariffs on Chinese exports.

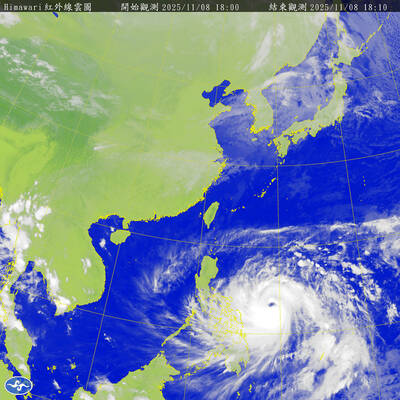

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

Taiwan’s exports soared to an all-time high of US$61.8 billion last month, surging 49.7 percent from a year earlier, as the global frenzy for artificial intelligence (AI) applications and new consumer electronics powered shipments of high-tech goods, the Ministry of Finance said yesterday. It was the first time exports had exceeded the US$60 billion mark, fueled by the global boom in AI development that has significantly boosted Taiwanese companies across the international supply chain, Department of Statistics Director-General Beatrice Tsai (蔡美娜) told a media briefing. “There is a consensus among major AI players that the upcycle is still in its early stage,”

‘SECRETS’: While saying China would not attack during his presidency, Donald Trump declined to say how Washington would respond if Beijing were to take military action US President Donald Trump said that China would not take military action against Taiwan while he is president, as the Chinese leaders “know the consequences.” Trump made the statement during an interview on CBS’ 60 Minutes program that aired on Sunday, a few days after his meeting with Chinese President Xi Jinping (習近平) in South Korea. “He [Xi] has openly said, and his people have openly said at meetings, ‘we would never do anything while President Trump is president,’ because they know the consequences,” Trump said in the interview. However, he repeatedly declined to say exactly how Washington would respond in

Japanese Prime Minister Sanae Takaichi said yesterday that China using armed force against Taiwan could constitute a "survival-threatening situation" for Japan, allowing the country to mobilize the Japanese armed forces under its security laws. Takaichi made the remarks during a parliamentary session yesterday while responding to a question about whether a "Taiwan contingency" involving a Chinese naval blockade would qualify as a "survival-threatening situation" for Japan, according to a report by Japan’s Asahi Shimbun. "If warships are used and other armed actions are involved, I believe this could constitute a survival- threatening