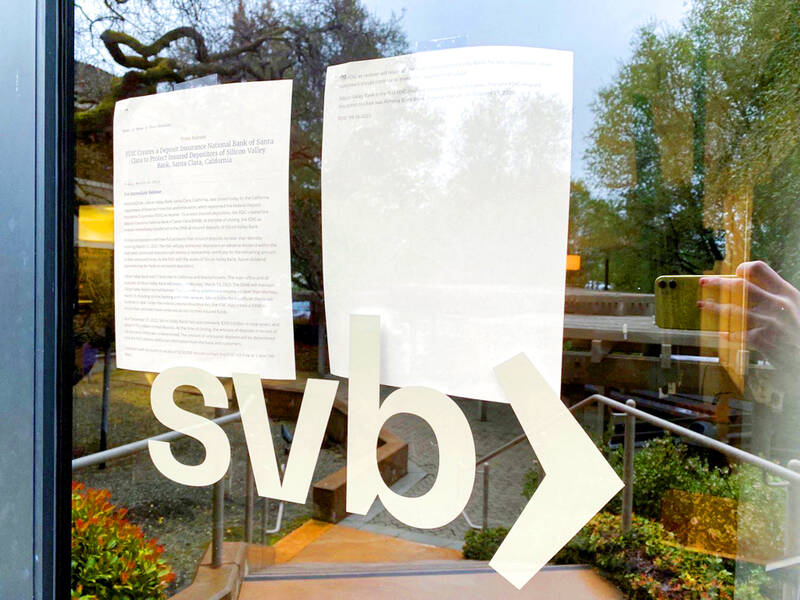

US regulators on Friday rushed to seize the assets of one of Silicon Valley’s top banks, marking the largest failure of a US financial institution since the height of the financial crisis almost 15 years ago.

Silicon Valley Bank (SVB), the nation’s 16th-largest bank, failed after depositors hurried to withdraw money this week amid anxiety over the bank’s health. It was the second-biggest bank failure in US history after the collapse of Washington Mutual in 2008.

The bank served mostly technology workers and venture capital-backed companies, including some of the industry’s best-known brands.

Photo: AFP

“This is an extinction-level event for start-ups,” said Garry Tan (陳嘉興), CEO of Y Combinator, a start-up incubator that launched Airbnb, DoorDash and Dropbox, and has referred hundreds of entrepreneurs to the bank.

“I literally have been hearing from hundreds of our founders asking for help on how they can get through this,” Tan said. “They are asking: ‘Do I have to furlough my workers?’”

There appeared to be little chance of the chaos spreading in the broader banking sector, as it did in the months leading up to the 2008 recession. The biggest banks — those most likely to cause an economic meltdown — have healthy balance sheets and plenty of capital.

Photo: Reuters

Nearly half of the US technology and healthcare companies that went public last year after receiving early funding from venture capital firms were Silicon Valley Bank customers, the bank’s Web site says.

Tan said that nearly one-third of Y Combinator’s start-ups would not be able to make payroll at some point in the next month if they cannot access their money.

Internet TV provider Roku was among casualties of the bank’s collapse.

It said in a regulatory filing on Friday that about 26 percent of its cash — US$487 million — was deposited at SVB, and the deposits were largely uninsured.

As part of the seizure, California bank regulators and the US Federal Deposit Insurance Corp (FDIC) transferred the bank’s assets to a newly created institution — the Deposit Insurance Bank of Santa Clara. The new bank is to start paying out insured deposits tomorrow.

The FDIC and California regulators plan to sell off the rest of the assets to make other depositors whole.

There was unease in the banking sector all week, with shares tumbling by double digits. Then news of SVB’s distress pushed shares of almost all financial institutions even lower on Friday.

The failure arrived with incredible speed.

Some industry analysts on Friday said the bank was still a good company and a wise investment, while SVB executives were trying to raise capital and find additional investors.

However, trading in the bank’s shares was halted before the stock market’s opening bell due to extreme volatility.

Shortly before noon, the FDIC moved to shutter the bank. Notably, the agency did not wait until the close of business, which is the typical approach. The FDIC could not immediately find a buyer for the bank’s assets, signaling how fast depositors cashed out.

The Ministry of the Interior (MOI) is to tighten rules for candidates running for public office, requiring them to declare that they do not hold a Chinese household registration or passport, and that they possess no other foreign citizenship. The requirement was set out in a draft amendment to the Enforcement Rules of the Public Officials Election and Recall Act (公職人員選舉罷免法 ) released by the ministry on Thursday. Under the proposal, candidates would need to make the declaration when submitting their registration forms, which would be published in the official election bulletin. The move follows the removal of several elected officials who were

FOUR DESIGNATED AREAS: Notices were issued for live-fire exercises in waters south and northwest of Penghu, northeast of Keelung and west of Kaohsiung, they said The military is planning three major annual exercises across the army, navy and air force this month, with the navy’s “Hai Chiang” (海強, “Sea Strong”) drills running from today through Thursday, the Ministry of National Defense said yesterday. The Hai Chiang exercise, which is to take place in waters surrounding Taiwan, would feature P-3C Orion maritime patrol aircraft and S-70C anti-submarine helicopters, the ministry said, adding that the drills aim to bolster the nation’s offshore defensive capabilities. China has intensified military and psychological pressure against Taiwan, repeatedly sending warplanes and vessels into areas near the nation’s air defense identification zone and across

SENATE RECOMMENDATION: The National Defense Authorization Act encourages the US secretary of defense to invite Taiwan’s navy to participate in the exercises in Hawaii The US Senate on Thursday last week passed the National Defense Authorization Act (NDAA) for Fiscal Year 2026, which strongly encourages the US secretary of defense to invite Taiwan’s naval forces to participate in the Rim of the Pacific (RIMPAC) exercise, as well as allocating military aid of US$1 billion for Taiwan. The bill, which authorizes appropriations for the military activities of the US Department of Defense, military construction and other purposes, passed with 77 votes in support and 20 against. While the NDAA authorizes about US$925 billion of defense spending, the Central News Agency yesterday reported that an aide of US

NATIONAL DAY: The ‘Taiwan Dome’ would form the centerpiece of new efforts to bolster air defense and be modeled after Israel’s ‘Iron Dome,’ sources said President William Lai (賴清德) yesterday pledged to strengthen the nation’s air defense capabilities and build a “T-Dome” system to create a safety net against growing military threats from China. “We will accelerate our building of the T-Dome, establish a rigorous air defense system in Taiwan with multi-layered defense, high-level detection and effective interception, and weave a safety net for Taiwan to protect the lives and property of citizens,” he said in his National Day address. In his keynote address marking the Republic of China’s (ROC) 114th anniversary, Lai said the lessons of World War II have taught nations worldwide “to ensure that