The production value of the local semiconductor industry is to grow 15.8 percent this year to NT$4.3 trillion (US$135.4 billion), following robust growth of 26.8 percent last year, the Market Intelligence & Consulting Institute (MIC, 產業情報研究所) projected yesterday.

The institute attributed the growth in output to Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) sharp production growth, which helped cushion the impact of an industrial slump due to shrinking demand for consumer electronics.

Taiwan’s growth this year would outpace the global semiconductor industry’s forecast annual expansion of 8.9 percent after an increase of 26.2 percent the previous year amid a drastic revision to projected shipments of notebook computers, smartphones and TVs, it said.

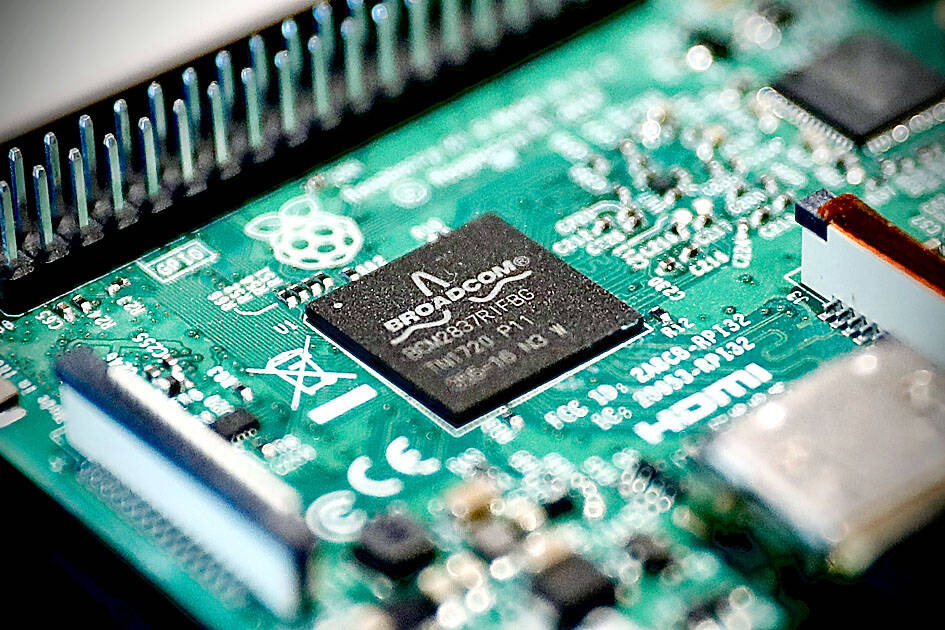

Photo: Ritchie B. Tongo, EPA-EFE

MIC cut its forecast for global notebook computer shipments this year by 10.76 percent to 199 million units.

Sagging demand for consumer electronics was deeply felt by local chip designers and manufacturers, MIC analyst Cynthia Yang (楊可歆) told an online forum.

Taiwan’s chip designers in the second quarter reported the first annual decline in production value in about two years — a 13.3 percent drop.

The best-case scenario for local chip designers is to report a flat production value this year compared with last year, as sluggish demand is compounding problems with high inventories, Yang said.

Memorychip makers would see a quarterly price decline of between 10 and 15 percent each quarter in the second half of this year due to oversupply, she said.

Increasing supply of NOR flash memory chips from China could undermine price quotes for this type of memory chips, she added.

However, local foundries, led by TSMC, would lend support to the nation’s chip manufacturing industry, with production value expanding 26.5 percent year-on-year last quarter and 20.7 percent this quarter, although the growth is weaker than last year due to dwindling demand for 8-inch wafers in light of weak consumer electronics sales, MIC said.

The long-lasting chip crunch has improved significantly this year, but the supply of microcontrollers for vehicles and power management chips for industrial devices remains tight, Yang said.

Commenting on the impact of an escalating US-China trade row, Yang said Washington is stepping up its curbs on semiconductor and equipment exports to China, while the US is forming partnerships with Taiwan, South Korea and Japan to enhance its chip supply resilience through the CHIPS and Science Act and Chip 4 alliance, she said.

Against this backdrop, China is accelerating its efforts to upgrade semiconductor technologies and boost self-sufficiency, Yang said.

Chinese firms are likely to catch up with Taiwanese foundries within three to five years in supplying mature semiconductor technologies, she said.

Separately, Minister of Economic Affairs Wang Mei-hua (王美花) said in an interview published yesterday in Japan’s Yomiuri Shimbun that semiconductor supplies would be disrupted if a contingency were to occur in the Taiwan Strait.

As Taiwanese makers account for a more than 60 percent share of the global foundry market, and Beijing relies on Taiwan for 36 percent of its semiconductor imports, any confrontation between the two sides would have a severe impact on China, Wang said.

Conflict with Taiwan could leave China with “massive economic disruption, catastrophic military losses, significant social unrest, and devastating sanctions,” a US think tank said in a report released on Monday. The German Marshall Fund released a report titled If China Attacks Taiwan: The Consequences for China of “Minor Conflict” and “Major War” Scenarios. The report details the “massive” economic, military, social and international costs to China in the event of a minor conflict or major war with Taiwan, estimating that the Chinese People’s Liberation Army (PLA) could sustain losses of more than half of its active-duty ground forces, including 100,000 troops. Understanding Chinese

The Ministry of Foreign Affairs (MOFA) yesterday said it is closely monitoring developments in Venezuela, and would continue to cooperate with democratic allies and work together for regional and global security, stability, and prosperity. The remarks came after the US on Saturday launched a series of airstrikes in Venezuela and kidnapped Venezuelan President Nicolas Maduro, who was later flown to New York along with his wife. The pair face US charges related to drug trafficking and alleged cooperation with gangs designated as terrorist organizations. Maduro has denied the allegations. The ministry said that it is closely monitoring the political and economic situation

UNRELENTING: China attempted cyberattacks on Taiwan’s critical infrastructure 2.63 million times per day last year, up from 1.23 million in 2023, the NSB said China’s cyberarmy has long engaged in cyberattacks against Taiwan’s critical infrastructure, employing diverse and evolving tactics, the National Security Bureau (NSB) said yesterday, adding that cyberattacks on critical energy infrastructure last year increased 10-fold compared with the previous year. The NSB yesterday released a report titled Analysis on China’s Cyber Threats to Taiwan’s Critical Infrastructure in 2025, outlining the number of cyberattacks, major tactics and hacker groups. Taiwan’s national intelligence community identified a large number of cybersecurity incidents last year, the bureau said in a statement. China’s cyberarmy last year launched an average of 2.63 million intrusion attempts per day targeting Taiwan’s critical

‘SLICING METHOD’: In the event of a blockade, the China Coast Guard would intercept Taiwanese ships while its navy would seek to deter foreign intervention China’s military drills around Taiwan this week signaled potential strategies to cut the nation off from energy supplies and foreign military assistance, a US think tank report said. The Chinese People’s Liberation Army (PLA) conducted what it called “Justice Mission 2025” exercises from Monday to Tuesday in five maritime zones and airspace around Taiwan, calling them a warning to “Taiwanese independence” forces. In a report released on Wednesday, the Institute for the Study of War said the exercises effectively simulated blocking shipping routes to major port cities, including Kaohsiung, Keelung and Hualien. Taiwan would be highly vulnerable under such a blockade, because it