The Ministry of Finance is expected to raise income tax deductions by the end of this year to ease the tax burden on income earners next year, as consumer prices have grown beyond the trigger point since previous adjustments.

Taiwanese file their income taxes in May each year for income earned the previous calendar year.

Assorted tax deductions are linked to the consumer price index, which has risen more than 3 percent over the past three years.

Photo: CNA

That increase qualifies for upward revisions to the allowances by the government so people would feel less of the pinch, KPMG Taiwan said.

The inflationary gauge last month picked up 2.63 percent from a year earlier, the highest in eight-and-a-half years, and might gain further momentum on the back of steep increases in global oil and raw material prices, the Directorate-General of Budget, Accounting and Statistics said last week.

Income tax laws obligate the Ministry of Finance to make adjustments based on the average 12-month consumer price index data ending this month, the accounting firm said.

As of last month, the consumer price index had advanced 4.04 percent to 103.72, from the last revision at 99.69 in 2017, KPMG Taiwan said.

The chances of an upward adjustment are high, if not utterly necessary, the company said, adding that a consumer price index increase of 4 percent would mean an extra deduction of NT$4,000 (US$142.62) from taxable income.

The release of this month’s consumer price index data early next month should shed final light on the matter, KPMG Taiwan said.

Rising inflation also means the government has to allow more leeway for standard tax deductions, salary tax deductions and special deductions for people with disabilities, the firm said.

The last time the government revised deductions was in 2018 and the consumer price index has since grown 3.2 percent to 100.49, it said, suggesting that standard tax deductions should climb by NT$4,000 to NT$124,000, while salary tax deductions and special tax deductions for people with disabilities should be NT$206,000, an addition of NT$6,000.

The new formula would push up taxable income thresholds for different brackets, KPMG Taiwan said.

Furthermore, the government has to make greater concessions on inheritance and gift taxes, as the consumer price index has risen 10.9 percent since the last adjustment in 2009 at 93.49, the company said.

That means the inheritance tax allowance should rise from NT$12 million to NT$13.32 million, while gift tax deduction should grow from NT$2.2 million to NT$2.44 million a year to reflect inflation, it said.

The ministry said it has to wait for this month’s consumer price index data to confirm the need for adjustments and would disclose related figures in December at the latest.

The Central Election Commission has amended election and recall regulations to require elected office candidates to provide proof that they have no Chinese citizenship, a Cabinet report said. The commission on Oct. 29 last year revised the Measures for the Permission of Family-based Residence, Long-term Residence and Settlement of People from the Mainland Area in the Taiwan Area (大陸地區人民在台灣地區依親居留長期居留或定居許可辦法), the Executive Yuan said in a report it submitted to the legislature for review. The revision requires Chinese citizens applying for permanent residency to submit notarial documents showing that they have lost their Chinese household record and have renounced — or have never

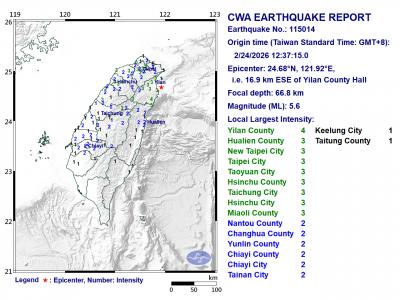

A magnitude 5.6 earthquake struck off the coast of Yilan County at 12:37pm today, with clear shaking felt across much of northern Taiwan. There were no immediate reports of damage. The epicenter of the quake was 16.9km east-southeast of Yilan County Hall offshore at a depth of 66.8km, Central Weather Administration (CWA) data showed. The maximum intensity registered at a 4 in Yilan County’s Nanao Township (南澳) on Taiwan’s seven-tier scale. Other parts of Yilan, as well as certain areas of Hualien County, Taipei, New Taipei City, Taoyuan, Hsinchu County, Taichung and Miaoli County, recorded intensities of 3. Residents of Yilan County and Taipei received

Taiwan has secured another breakthrough in fruit exports, with jujubes, dragon fruit and lychees approved for shipment to the EU, the Ministry of Agriculture said yesterday. The Animal and Plant Health Inspection Agency on Thursday received formal notification of the approval from the EU, the ministry said, adding that the decision was expected to expand Taiwanese fruit producers’ access to high-end European markets. Taiwan exported 126 tonnes of lychees last year, valued at US$1.48 million, with Japan accounting for 102 tonnes. Other export destinations included New Zealand, Hong Kong, the US and Australia, ministry data showed. Jujube exports totaled 103 tonnes, valued at

BIG SPENDERS: Foreign investors bought the most Taiwan equities since 2005, signaling confidence that an AI boom would continue to benefit chipmakers Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) market capitalization swelled to US$2 trillion for the first time following a 4.25 percent rally in its American depositary receipts (ADR) overnight, putting the world’s biggest contract chipmaker sixth on the list of the world’s biggest companies by market capitalization, just behind Amazon.com Inc. The site CompaniesMarketcap.com ranked TSMC ahead of Saudi Aramco and Meta Platforms Inc. The Taiwanese company’s ADRs on Tuesday surged to US$385.75 on the New York Stock Exchange, as strong demand for artificial intelligence (AI) applications led to chip supply constraints and boost revenue growth to record-breaking levels. Each TSMC ADR represents