This year will go down in the history books. Taiwan faces enormous turmoil and uncertainty in the coming months.

Which political parties are in a good position to handle big changes?

All of the main parties are beset with challenges. Taking stock, this column examined the Taiwan People’s Party (TPP) (“Huang Kuo-chang’s choking the life out of the TPP,” May 28, page 12), the Democratic Progressive Party (DPP) (“Challenges amid choppy waters for the DPP,” June 14, page 12) and the Chinese Nationalist Party (KMT) (“KMT struggles to seize opportunities as ‘interesting times’ loom,” June 20, page 11).

Photo: Liu Wan-lin, taipei Times

Times like these can produce unexpected political shifts and the emergence of leaders coming forth with new vigor, vision and strength. Whether or how such changes may occur will depend on what plays out.

It may be hard to predict, but the parties have different strengths and weaknesses depending on those challenges.

DOMESTIC POWER STRUGGLE

Photo: CNA

While storm clouds loom on the horizon for Taiwan economically, politically and technologically on the world stage, domestically the pan-blue KMT-TPP coalition and the ruling DPP are at each other’s throats, battling over the balance of power.

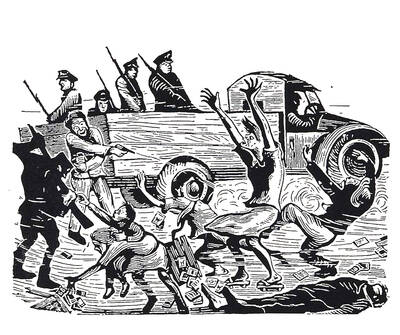

The KMT-TPP bloc has used their legislative majority to test the limits of the Constitution and existing laws to shift the balance away from the DPP-controlled executive and hobble the government’s ability to function.

In response, pro-DPP civic groups launched an unprecedented mass recall campaign against elected KMT lawmakers in an attempt to overturn last year’s elections and restore a DPP legislative majority.

Photo: Peter Lo, Taipei Times

Meanwhile, the KMT is facing a potentially brutal internal fight over the chair election scheduled for September, though calls are rising in the party to postpone it to concentrate on fighting the recalls.

Taiwan’s parties are in full tooth-and-nail election battle mode in what was not supposed to be an election year.

Those storm clouds could roll in, spitting thunder, right into the middle of this internal battle for power. They could profoundly alter the results of both the July 26 recall votes, and any subsequent early autumn by-elections following successful recalls.

How the parties respond to these external shocks could determine who controls the legislature several months from now. The result will determine how unified Taiwan’s government is until 2028.

AMERICAN TARIFFS

In early July, US President Donald Trump’s 90-day pause on imposing his “liberation day” tariffs will theoretically end.

Unlike other countries’ leaders, President William Lai (賴清德) can not personally appeal to Trump, and Washington has been prioritizing other, larger trading partners whose leaders Trump has met. Additionally, much of the staff that would have handled trade negotiations has been fired, leaving them short-staffed just as countries around the world are scrambling to try and make deals.

On Saturday, Minister of Economic Affairs Kuo Jyh-huei (郭智輝) all but admitted that Taiwan has made little progress, saying he hoped for more time to make Taiwan’s case.

If no headway is made and the Trump administration does not change its mind, Taiwan will be hit with a 32 percent tariff. That compares to 24 and 25 percent to be levied on Japan and South Korea, respectively.

A few years ago, Taiwan’s trade surplus was comparable to both those countries, but it has since boomed due to products like AI servers. This success could cause Taiwan to be hit much harder, giving the others a competitive advantage.

If tariffs are imposed in full, this will benefit the opposition, especially the KMT. It will be easy to channel people’s anger towards blaming the DPP for failing to reach an agreement with Washington, though it is doubtful any Taiwan government could have.

The DPP in recent years has tied itself closely to Washington.

KMT Chairman Eric Chu (朱立倫) will likely reiterate his stance that Taipei should “balance” relations between Washington and Beijing, but will be careful not to criticize the Americans too directly and will pin the blame entirely on the Lai administration.

This will not stop the America-skeptic and pro-China wings of the KMT from having a field day on social media. They will be bolstered by propaganda emanating from China. This will not have much impact on centrist voters, but Chu’s message may find some followers.

It may also benefit Taichung’s KMT mayor and presumptive presidential candidate Lu Shiow-yen (盧秀燕), who has more constructively expressed hopes on working with the government to alleviate economic fallout. Her message could be more widely popular.

CHINA’S ECONOMIC WOES

Already high tariffs on Chinese exports will soon start to hurt Taiwanese firms, whose tools and components are key elements of China’s export juggernaut.

China’s domestic consumption has recently been buoyed by subsidies, but once they run out, it is likely to return to the slumping trend of the last few years. China is too burdened with debt to extend the subsidies indefinitely.

China has roughly 30 percent of the world’s manufacturing capacity, according to estimates. On official data, domestic consumption could absorb maybe a little less than half of that, but in reality, it is likely less than a third.

China’s exports to the US have slumped, but they have had success in dumping those products onto other markets. That is unlikely to last, as even fellow BRICS nations are starting to block heavily subsidized Chinese import dumping.

Bigger markets like the EU, Japan, and South Korea are already eyeing raising barriers to protect key domestic industries, and it would not be surprising to see ASEAN countries following suit. Using third countries to get around trade barriers is also increasingly coming under scrutiny.

Some key state-promoted industries — such as electric vehicles — are extremely overextended and sinking in debt just as big markets overseas are closing their doors.

Expect a bloodbath.

This will hit Taiwanese exporters hard. If the US also hits Taiwan with 32 percent tariffs, the economy will be in for a rough ride.

Although the KMT will try to blame the DPP, it likely will not be very effective. The DPP will counter that the KMT has been the biggest proponent of more exposure to China, but this will likely not be very effective either, as they are the current ruling party and it is now their responsibility.

The DPP will likely lean in damage-mitigating spending. This would put the KMT in a bind; they could face criticism if they block those efforts in the legislature, but could be blamed by their base if they do not.

Potentially, the primary beneficiary could be the TPP, but much will depend on the timing. If the legislature is back in DPP hands or looks like it could be soon, the TPP could take a strategic pivot away from their KMT allies.

If not, the TPP would be risking that alliance, and may be more cautious.

The TPP is unburdened by historical baggage, and Chairman Huang Kuo-chang (黃國昌) could tout his efforts during the 2014 Sunflower Movement to block a KMT-led services pact with China. Whether he will do that or not is an open question, considering his current pan-blue stances.

TROUBLES IN ZHONGNANHAI

The biggest variable is the political situation in Beijing. High-level military purges, among other events, have revved up the rumor mill that Chinese leader Xi Jinping (習近平) may be losing power.

How this will play out is uncertain.

If the result is a more hostile China, this benefits the DPP. If it results in a more accommodating stance coming out of Beijing, that could open opportunities for the KMT.

How much of this will come to pass is totally uncertain, but depending on how it plays out, it could create possibilities for any or all of the parties.

Donovan’s Deep Dives is a regular column by Courtney Donovan Smith (石東文) who writes in-depth analysis on everything about Taiwan’s political scene and geopolitics. Donovan is also the central Taiwan correspondent at ICRT FM100 Radio News, co-publisher of Compass Magazine, co-founder Taiwan Report (report.tw) and former chair of the Taichung American Chamber of Commerce. Follow him on X: @donovan_smith.

Google unveiled an artificial intelligence tool Wednesday that its scientists said would help unravel the mysteries of the human genome — and could one day lead to new treatments for diseases. The deep learning model AlphaGenome was hailed by outside researchers as a “breakthrough” that would let scientists study and even simulate the roots of difficult-to-treat genetic diseases. While the first complete map of the human genome in 2003 “gave us the book of life, reading it remained a challenge,” Pushmeet Kohli, vice president of research at Google DeepMind, told journalists. “We have the text,” he said, which is a sequence of

On a harsh winter afternoon last month, 2,000 protesters marched and chanted slogans such as “CCP out” and “Korea for Koreans” in Seoul’s popular Gangnam District. Participants — mostly students — wore caps printed with the Chinese characters for “exterminate communism” (滅共) and held banners reading “Heaven will destroy the Chinese Communist Party” (天滅中共). During the march, Park Jun-young, the leader of the protest organizer “Free University,” a conservative youth movement, who was on a hunger strike, collapsed after delivering a speech in sub-zero temperatures and was later hospitalized. Several protesters shaved their heads at the end of the demonstration. A

In August of 1949 American journalist Darrell Berrigan toured occupied Formosa and on Aug. 13 published “Should We Grab Formosa?” in the Saturday Evening Post. Berrigan, cataloguing the numerous horrors of corruption and looting the occupying Republic of China (ROC) was inflicting on the locals, advocated outright annexation of Taiwan by the US. He contended the islanders would welcome that. Berrigan also observed that the islanders were planning another revolt, and wrote of their “island nationalism.” The US position on Taiwan was well known there, and islanders, he said, had told him of US official statements that Taiwan had not

We have reached the point where, on any given day, it has become shocking if nothing shocking is happening in the news. This is especially true of Taiwan, which is in the crosshairs of the Chinese Communist Party (CCP), uniquely vulnerable to events happening in the US and Japan and where domestic politics has turned toxic and self-destructive. There are big forces at play far beyond our ability to control them. Feelings of helplessness are no joke and can lead to serious health issues. It should come as no surprise that a Strategic Market Research report is predicting a Compound