It is dangerous to engage in business in China now, and those considering engaging with it should pay close attention to the example Taiwanese businesspeople are setting.

Though way down from the heady days of Taiwanese investments in China two decades ago, a few hundred thousand Taiwanese continue to live, work and study there, but the numbers have been declining fast. As President William Lai (賴清德) pointed out approvingly to a visiting American Senate delegation, China accounted for 80 percent of the total overseas investment in 2011, but was reduced to just 11.4 percent last year.

That is a big drop. The entrepreneurs are savvy on China, and many have returned to Taiwan or moved to other countries, such as Vietnam, Thailand and Mexico.

Photo: AP

NOT SAFE

Any company that has three or more members of the Chinese Communist Party (CCP) are required to form a cell, which can interfere with its business.

The government also requires any and all company information to be handed over if asked. CCP cells and employees are essentially spies, so keeping intellectual property safe is difficult.

Photo: AFP

A common pattern is that once the Chinese have the intellectual property mastered and can compete, the original foreign company is frozen out or undercut by firms engaging in corruption. This is the same with imports from Taiwan: once they have a Taiwan-developed varietal of fruit or can successfully breed Taiwanese fish varieties, the Chinese will ban imports of those products under any pretext. For example, over 1,000 products were banned in the wake of Nancy Pelosi’s visit in August, 2022.

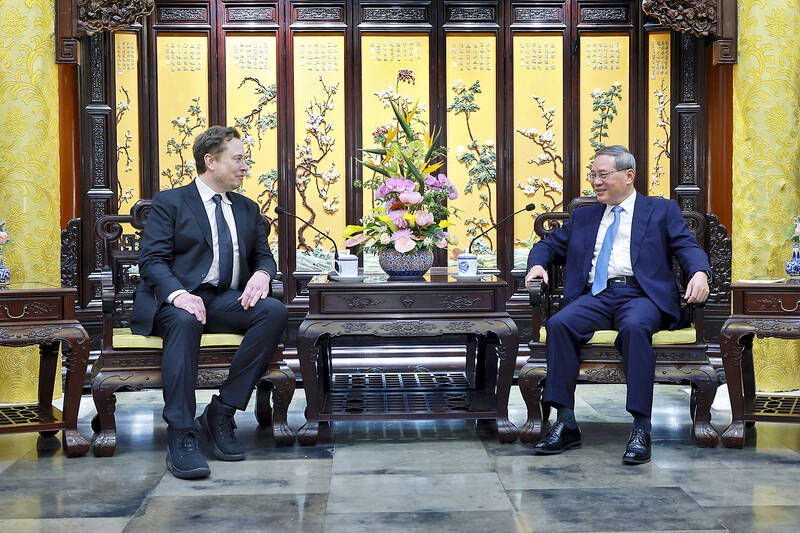

Though it appears that some processes and intellectual property rights are still maintained by Tesla in-house, they have handed over quite a bit of know-how to domestic suppliers, which combined with subsidies and support from the government has contributed to a booming Chinese electric vehicle industry. The CCP and the Shanghai municipal government knew what they were doing when they bent over backward to get Elon Musk to invest in a factory there.

Musk made a big mistake and there are already signs that the CCP and local officials are starting to make life difficult for Tesla. For example, there is an ever-widening list of places where Teslas are banned due to “security concerns,” starting logically with key government buildings and military bases, but expanding to highway operators, local authority agencies, convention centers and cultural centers.

Photo: Reuters

Musk flew to Beijing to beg to get Tesla’s Full Self-Driving (FSD) system, its autonomous driving software, approved. Though reportedly Tesla in China does maintain a high profit margin, its market share has shrunk dramatically, along with other foreign automakers, whose profits and market share have been collapsing.

While it does appear that Musk genuinely shares a lot of his ideology with the soon-to-return president Donald Trump, it makes one wonder if all the time they have been spending together is in part Musk hoping to avoid Trump’s promised 60 to 100 percent tariffs on Chinese goods. Meanwhile, incoming Secretary of State Marco Rubio is calling on Congress to revoke China’s “most favored trading nation” status.

RISKY ENVIRONMENT

Should those tariffs end up being imposed, that adds to the risk for foreign businesses. For manufacturers, China is in many ways the best place in the world to be.

For example, sample designs from suppliers that overseas might take weeks to arrive, in China that is often shortened to days or even hours. China has supply chains available to make almost anything in a relatively small geographic area, with excellent infrastructure and a huge domestic market, though the labor pool is no longer as plentiful and inexpensive as it used to be.

The tariffs should be of top concern to almost all foreign businesses operating in China. Trump also plans to deport millions of illegal immigrants, depriving the US of farm workers, construction workers, meat packers and dish washers among other crucial jobs so that much higher salaries will have to be paid, if they can find anyone at all.

Combined with the tariffs means the US faces high inflation, which will likely lead to higher interest rates. To get around the tariffs, both Chinese and foreign businesses will be running for the exits.

Additionally, wanting to take advantage of high interest rates could lead to massive capital outflows from China into the US dollar. To partially offset the tariffs, Beijing will face pressure to devalue the Chinese Yuan. Whether that is a small, managed devaluation or the market overwhelms Chinese attempts at currency controls and the currency goes into a freefall or a black market develops is hard to predict. This uncertainty comes with high risks.

Additionally, it is already a painful process to get profits out of China. Beijing, not known for good economic planning and grasping at short-term fixes over systemic overhaul, might tighten their grip on capital outflows even more.

CASH GRABS

Because official statistics are not trustworthy it is hard to determine how bad China’s economy is, much less predicting where it will go. Some think its economy is shrinking, while others suggest that it is still growing in an unhealthy manner, mostly on the back of government infrastructure projects like money-losing high speed rail lines to nowhere.

Propped up by government subsidies exponentially higher than in other industrial nations, parts of the export sector are growing. However, the real estate market — which forms an estimated 70 to 80 percent of household wealth — has collapsed.

That has hit local governments hard, which made a lot of their income from real estate or selling long-term leases to land. Local governments were already in debt due to corruption, and the CCP ordering them to stimulate the local economy, which for legal reasons they did through workaround local government financing vehicles (LGFV).

One tactic local governments are using is to hike fees and fines. A week ago images showing two cities in Guangdong Province appearing like ghost towns were circulating online as everyone was fearful of announced fire and health and safety inspections.

Some of the notices explaining why their business was shuttered were even humorous, with one posting “afraid of ghosts.” One online post explained the situation succinctly: “If you close, you only lose a few hundred yuan, whereas you could lose tens of thousands if you open”

It gets worse. Localities are using law enforcement in other jurisdictions and threatening small and medium-sized enterprises (SMEs) with fines to raise money in a controversial practice called “cross-provincial legal enforcement,” or more colloquially “remote fishing.” They are essentially demanding ransom money from these companies, and in some cases it has involved literal kidnapping.

There are widespread reports of local governments not paying suppliers or even staff. Demands for repayment of past bonuses is occurring in some places, as well as demanding back taxes from local businesses going back in some cases into the 1990s.

AT YOUR PERIL

It is also physically risky to be in China now. In recent years there has been a sharp uptick in anti-espionage campaigns that is spreading widespread paranoia and xenophobia against outsiders.

Famously, offers of rewards for up to half a million Yuan are offered to turn people in. Reports of distrust, outright hostility and even violence against outsiders are up sharply, all things that were rare when I lived there.

In June, Beijing announced 22 guidelines imposing criminal punishments on die-hard “Taiwanese independence” separatists, including the death penalty. Such crimes include promoting “two Chinas,” “one China, one Taiwan” or “Taiwanese independence.”

Arbitrary arrests against foreigners, or refusing to let them exit the country, is also on the rise. In August, figures compiled by the Taiwan Association for Human Rights and several other non-government groups were released showing that 857 Taiwan nationals have been “forcibly disappeared or arbitrarily arrested” in China.

Many countries, including Taiwan, have raised their risk alert for merely visiting China. It is not worth the risk.

Go somewhere else.

Donovan’s Deep Dives is a regular column by Courtney Donovan Smith (石東文) who writes in-depth analysis on everything about Taiwan’s political scene and geopolitics. Donovan is also the central Taiwan correspondent at ICRT FM100 Radio News, co-publisher of Compass Magazine, co-founder Taiwan Report (report.tw) and former chair of the Taichung American Chamber of Commerce. Follow him on X: @donovan_smith.

The 2018 nine-in-one local elections were a wild ride that no one saw coming. Entering that year, the Chinese Nationalist Party (KMT) was demoralized and in disarray — and fearing an existential crisis. By the end of the year, the party was riding high and swept most of the country in a landslide, including toppling the Democratic Progressive Party (DPP) in their Kaohsiung stronghold. Could something like that happen again on the DPP side in this year’s nine-in-one elections? The short answer is not exactly; the conditions were very specific. However, it does illustrate how swiftly every assumption early in an

Francis William White, an Englishman who late in the 1860s served as Commissioner of the Imperial Customs Service in Tainan, published the tale of a jaunt he took one winter in 1868: A visit to the interior of south Formosa (1870). White’s journey took him into the mountains, where he mused on the difficult terrain and the ease with which his little group could be ambushed in the crags and dense vegetation. At one point he stays at the house of a local near a stream on the border of indigenous territory: “Their matchlocks, which were kept in excellent order,

Jan. 19 to Jan. 25 In 1933, an all-star team of musicians and lyricists began shaping a new sound. The person who brought them together was Chen Chun-yu (陳君玉), head of Columbia Records’ arts department. Tasked with creating Taiwanese “pop music,” they released hit after hit that year, with Chen contributing lyrics to several of the songs himself. Many figures from that group, including composer Teng Yu-hsien (鄧雨賢), vocalist Chun-chun (純純, Sun-sun in Taiwanese) and lyricist Lee Lin-chiu (李臨秋) remain well-known today, particularly for the famous classic Longing for the Spring Breeze (望春風). Chen, however, is not a name

There is no question that Tyrannosaurus rex got big. In fact, this fearsome dinosaur may have been Earth’s most massive land predator of all time. But the question of how quickly T. rex achieved its maximum size has been a matter of debate. A new study examining bone tissue microstructure in the leg bones of 17 fossil specimens concludes that Tyrannosaurus took about 40 years to reach its maximum size of roughly 8 tons, some 15 years more than previously estimated. As part of the study, the researchers identified previously unknown growth marks in these bones that could be seen only