To help make China a self-reliant “technology superpower,” the ruling Chinese Communist Party is pushing the world’s biggest e-commerce company to take on the tricky, expensive business of designing its own processor chips — a business unlike anything Alibaba Group (阿里巴巴) has done before.

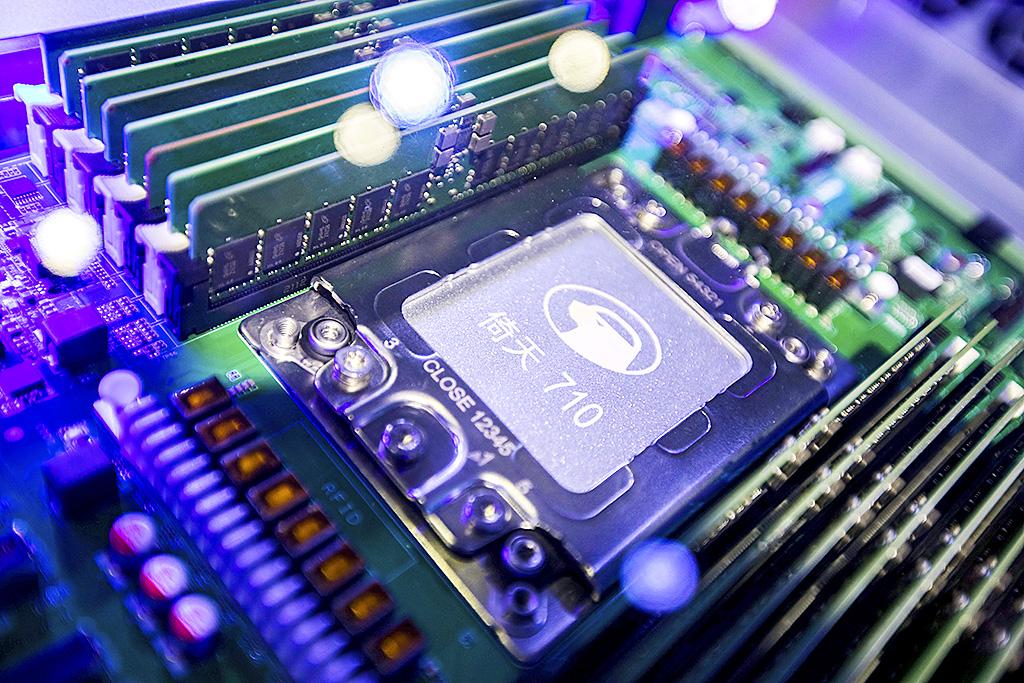

Its 3-year-old chip unit, T-Head, unveiled its third processor in October, the Yitian 710 for Alibaba’s cloud computing business. Alibaba says for now, it has no plans to sell the chip to outsiders.

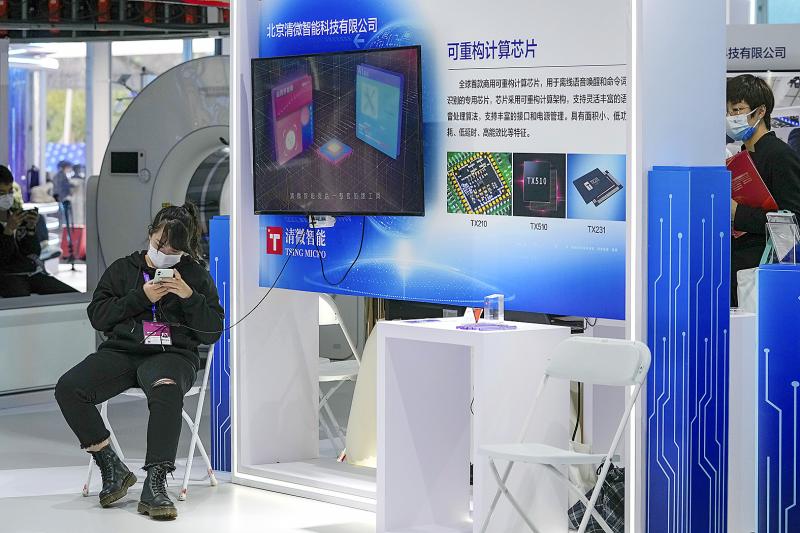

Other rookie chip developers including Tencent (騰訊), a games and social media giant, and smartphone brand Xiaomi (小米) are pledging billions of dollars in line with official plans to create computing, clean energy and other technology that can build China’s wealth and global influence.

Photo: AP

Processor chips play an increasingly critical role in products from smartphones and cars to medical devices and home appliances. Shortages due to the coronavirus pandemic are disrupting global manufacturing and adding to worries about supplies.

Chips are a top priority in the Communist Party’s marathon campaign to end China’s reliance on technology from the US, Japan and other suppliers Beijing sees as potential economic and strategic rivals. If it succeeds, business and political leaders warn that might slow down innovation, disrupt global trade and make the world poorer.

“Self-reliance is the foundation for the Chinese nation,” President Xi Jinping (習近平) said in a speech released in March. He called for China to become a “technology superpower” to safeguard “national economic security.”

Photo: AP

“We must strive to become the world’s main center of science and the high ground of innovation,” Xi said.

COSTLY DISAPPOINTMENT?

Beijing might be chasing a costly disappointment. Even with huge official investments, businesspeople and analysts say chipmakers and other companies will struggle to compete if they detach from global suppliers of advanced components and technology — a goal no other country is pursuing.

Photo: AP

“It’s hard to imagine any one country rebuilding all of that and having the best technology,” said Peter Hanbury, who follows the industry for Bain & Co.

Beijing’s campaign is adding to tension with Washington and Europe, which see China as a strategic competitor and complain it steals technology. They limit access to tools needed to improve its industries.

If the world were to decouple, or split into markets with incompatible standards and products, US or European-made parts might not work in Chinese computers or cars. Smartphone makers who have a single dominant global operating system and two network standards might need to make unique versions for different markets. That could slow down development.

Photo: AP

Washington and Beijing need to “avoid that the world becomes separated,” UN Secretary-General Antonio Guterres said in September.

China’s factories assemble the world’s smartphones and tablet computers but need components from the US, Europe, Japan, Taiwan and South Korea. Chips are China’s biggest import, ahead of crude oil, at more than US$300 billion last year.

Official urgency over that grew after Huawei Technologies Ltd.(華為), China’s first global tech brand, lost access to US chips and other technology in 2018 under sanctions imposed by the White House.

Photo: AP

That crippled the telecom equipment maker’s ambition to be a leader in next-generation smartphones. American officials say Huawei is a security risk and might aid Chinese spying, an accusation the company denies.

A DECADE BEHIND

Huawei and some Chinese rivals are close to matching Intel Corp., Qualcomm Inc., South Korea’s Samsung Electronics and Britain’s Arm Ltd. at being able to design “bleeding edge” logic chips for smartphones, according to industry analysts.

But when it comes to making them, foundries such as state-owned SMIC (中芯) in Shanghai are up to a decade behind industry leaders including TSMC (台積電), or Taiwan Semiconductor Manufacturing Corp., which produces chips for Apple Inc. and other global brands.

Even companies such as Alibaba that can design chips likely will need Taiwanese or other foreign foundries to make them. Alibaba’s Yitian 710 requires precision no Chinese foundry can achieve. The company declined to say which foreign producer it will use.

“My country still faces a big gap in chip technology,” said industry analyst Liu Chuntian of Zero Power Intelligence Group.

China accounts for 23 percent of global chip production capacity but only 7.6 percent of sales.

Packing millions of transistors onto a fingernail-size sliver of silicon requires some 1,500 steps, microscopic precision and arcane technologies owned by a handful of US, European, Japanese and other suppliers.

They include KLA Corp. in California for super-precise measurement and Japan’s TEL for machines to apply coatings a few molecules thick. Many are covered by restrictions on “dual use” technologies that can be used in weapons.

China “lags significantly” in tools, materials and production technology, the Semiconductor Industry Association said in a report this year.

Washington and Europe, citing security worries, block access to the most advanced tools Chinese chipmakers need to match global leaders in precision and efficiency.

Without those, China is falling farther behind, said Bain’s Hanbury.

“The TSMC horse is sprinting away and the Chinese horse is stopped,” he said. “They can’t move forward.”

Washington stepped up pressure on Huawei last year by barring global foundries from using American technology to produce its chips. US vendors can sell chips to the company, but not for next-generation “5G” smartphones.

For its part, the EU said it will review foreign investments after complaints China was eroding Europe’s technology lead by purchasing important assets such as German robot maker Kuka.

NO DETACHING

Alibaba’s Yitian 710 is based on architecture from Britain’s Arm, highlighting China’s enduring need for foreign know-how. Alibaba said it still will work closely with longtime foreign suppliers Intel, Arm, Nvidia Corp. and Advanced Micro Devices, Inc.

T-Head’s first chip, the Hanguang 800, was announced in 2019 for artificial intelligence. Its second, the XuanTie 910, is for self-driving cars and other functions.

Last month, Tencent Holding, which operates the WeChat messaging service, announced its first three chips for artificial intelligence, cloud computing and video.

Beijing says it will spend US$150 billion from 2014 through 2030 to develop its chip industry, but even that is a fraction of what global leaders invest. TSMC plans to spend US$100 billion in the next three years on research and manufacturing.

China is trying to buy experience by hiring engineers from TSMC and other Taiwanese producers. Taiwan, which Beijing claims as part of its territory and has threatened to attack, has responded by imposing curbs on job advertising.

Beijing encourages smartphone and other manufacturers to use suppliers within China, even if they cost more, but officials deny China wants to detach from global industries.

“We will never go back in history by seeking to decouple,” Xi said in a speech by video link last month during a meeting of Asia-Pacific leaders in Malaysia.

The latest conflict is over photolithography, which uses ultraviolet light to etch circuits into silicon on a scale measured in nanometers, or billionths of a meter.

The leader is ASML in the Netherlands, which makes machines that can etch transistors just 5 nanometers apart. That would pack 2 million into a space 1cm wide.

China’s SMIC is about one-third as precise at 14 nanometers. Taiwan’s TSMC is preparing to increase its precision to 2 nanometers.

SMIC wants to upgrade by purchasing ASML’s latest machine, but the Dutch government has yet to agree.

“We will wait for their decision,” said an ASML spokeswoman, Monica Mols, in an E-mail.

Dissident artist Ai Weiwei’s (艾未未) famous return to the People’s Republic of China (PRC) has been overshadowed by the astonishing news of the latest arrests of senior military figures for “corruption,” but it is an interesting piece of news in its own right, though more for what Ai does not understand than for what he does. Ai simply lacks the reflective understanding that the loneliness and isolation he imagines are “European” are simply the joys of life as an expat. That goes both ways: “I love Taiwan!” say many still wet-behind-the-ears expats here, not realizing what they love is being an

Google unveiled an artificial intelligence tool Wednesday that its scientists said would help unravel the mysteries of the human genome — and could one day lead to new treatments for diseases. The deep learning model AlphaGenome was hailed by outside researchers as a “breakthrough” that would let scientists study and even simulate the roots of difficult-to-treat genetic diseases. While the first complete map of the human genome in 2003 “gave us the book of life, reading it remained a challenge,” Pushmeet Kohli, vice president of research at Google DeepMind, told journalists. “We have the text,” he said, which is a sequence of

Every now and then, even hardcore hikers like to sleep in, leave the heavy gear at home and just enjoy a relaxed half-day stroll in the mountains: no cold, no steep uphills, no pressure to walk a certain distance in a day. In the winter, the mild climate and lower elevations of the forests in Taiwan’s far south offer a number of easy escapes like this. A prime example is the river above Mudan Reservoir (牡丹水庫): with shallow water, gentle current, abundant wildlife and a complete lack of tourists, this walk is accessible to nearly everyone but still feels quite remote.

It’s a bold filmmaking choice to have a countdown clock on the screen for most of your movie. In the best-case scenario for a movie like Mercy, in which a Los Angeles detective has to prove his innocence to an artificial intelligence judge within said time limit, it heightens the tension. Who hasn’t gotten sweaty palms in, say, a Mission: Impossible movie when the bomb is ticking down and Tom Cruise still hasn’t cleared the building? Why not just extend it for the duration? Perhaps in a better movie it might have worked. Sadly in Mercy, it’s an ever-present reminder of just