When Volkswagen Group last month invested US$5 billion in US electric truck and sports utility vehicle (SUV) maker Rivian, the start-up’s shares soared on the cash infusion.

Volkswagen’s stock dropped 1.6 percent.

Some analysts praised the creation of a Volkswagen-Rivian joint venture to help the German giant with software.

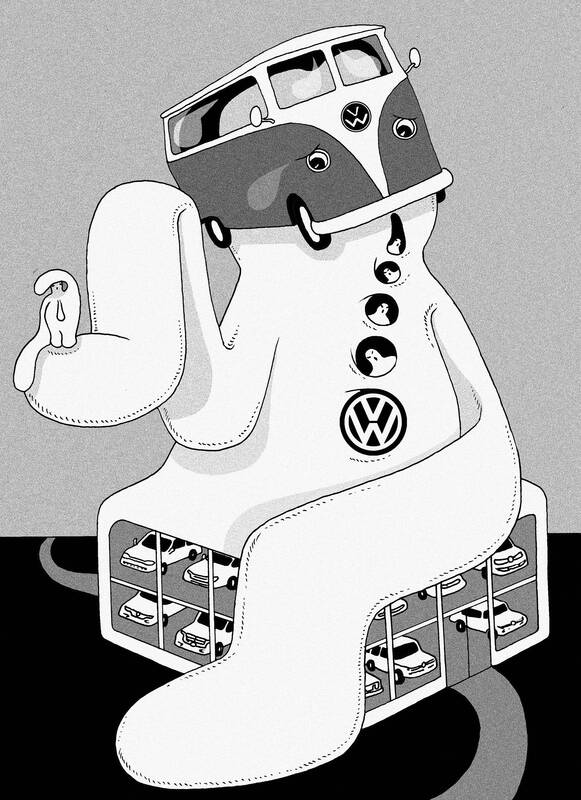

Illustration: Mountain People

However, the investment raised cost concerns and reinforced how Volkswagen’s problems in critical areas undermined its electric vehicle (EV) transition globally.

The world’s second-largest automaker faces a vexing landscape of challenges in Europe, the US and especially China, where domestic EV makers led by BYD are swiping its market share. It has lost more stock value than any major competitor over the past two years.

By 2030, Volkswagen plans to have more than 30 new electric or hybrid models in China and hopes to boost sales from about 3 million today to about 4 million, lifting its market share to 15 percent.

In the near term, the company expects to continue losing China market share and hopes to merely maintain its position in Europe, Volkswagen chief financial officer Arno Antlitz told Reuters.

Volkswagen’s troubles in China underscore bleak prospects for foreign automakers in the country, where homegrown EV makers are dominating the world’s fastest EV transition with high-tech, low-cost models. Volkswagen is particularly vulnerable, because China accounts for about one-third of its sales.

That leaves Volkswagen’s much-smaller US operation shouldering its biggest growth ambitions: The automaker plans to more than double its US market share to 10 percent by 2030.

About a dozen investors and analysts interviewed by Reuters expressed skepticism that the automaker has found the formula to achieve a sales boom.

Volkswagen lacks a distinctive US brand identity or breakthrough product plans in a crowded market that favors larger vehicles and has proven resistant to EVs, they said.

One upside: Volkswagen would not have to compete with Chinese EVs in the US, which in May levied 100 percent tariffs on them.

Volkswagen has launched initiatives to boost its competitiveness in China over the next two years, Antlitz told Reuters in February.

“Until then, we do not expect rising market share — rather the opposite,” he said.

The automaker expects to achieve cost parity with local competitors for compact cars by 2026, and aims to remain the largest international automaker in China and third-largest overall, a Volkswagen spokesperson said in a written response to questions last week.

“Profitability is our top priority,” the spokesperson said. “We will not grow at any price.”

Volkswagen’s China share dropped from 19 percent in 2019 to 14.5 percent last year. It has notched modest sales growth in the US, but would need to supercharge that to meet its market share target.

The Rivian tie-up is part of that US strategy, but would not result in any new models to boost sales. The 50-50 venture would instead develop software and other technology for both automakers.

Still, Volkswagen said it hopes products made with technology produced by the venture would attract new customers.

Rivian declined to comment on how it could influence Volkswagen’s sales.

Volkswagen said it is planning more than 30 battery-electric models for the US market, without providing details. What is known is that Volkswagen would launch two electric models, a pickup and an SUV, in late 2026 under the Scout nameplate, a historic US off-road brand, to be built at a new US$2 billion South Carolina factory with capacity for 200,000 units.

The plant could expand to double that size, Scout CEO Scott Keogh told Reuters, but declined to say what output he expected by 2030.

Continuing on the retro theme, Volkswagen would release an electric version of its iconic Microbus, called the ID. Buzz, later this year. It also plans new gas-powered SUVs and possibly new plug-in hybrids, Volkswagen US chief Pablo di Si said in an April interview with Reuters.

“I know we have aggressive targets,” Di Si said. “Our plans are very solid.”

Investors would need convincing. Volkswagen faces entrenched competitors in hybrids (Toyota and Ford) and SUVs (General Motors, Ford and Toyota). EV demand is waning globally, but especially in the US, where they accounted for 8 percent of all sales last year.

Jeffrey Scharf, a former Volkswagen investor who now owns Mercedes-Benz stock, called Volkswagen’s market share goal “hopelessly optimistic.”

“If they had something like full self-driving or some other unique feature before anyone else did, I’d see it,” he said. “But they don’t have a recognizable niche anymore.”

‘WISHFUL THINKING’

Volkswagen’s predicament reflects an industry shake-up stemming from the breakneck pace of EV development in China, where domestic brands have tapped government subsidies and the nation’s superior battery supply chains.

EVs and hybrids represent about 40 percent of China’s new car sales, the China Passenger Car Association said.

Foreign brands’ China market share has fallen from 62 percent in 2019 to 44 percent in the first four months of this year.

Volkswagen has fared better than some: General Motor’s China sales slumped by more than half this year so far.

Volkswagen is spending heavily to stop the bleeding. It announced in April a US$2.7 billion investment in an EV design and production hub in Anhui Province. That followed a US$700 million investment in Chinese EV maker Xpeng in December last year to develop EV platforms and software, along with two EV models by 2026.

For now, the automaker must accept a diminished role in China’s EV market, six industry analysts told Reuters.

Volkswagen also faces challenges in hitting its US market share target.

Volkswagen needs to make products that spark the kind of enthusiasm as its historic successes — from the Beetle to the Microbus to the Golf, investors and analysts said.

Volkswagen’s current SUV lineup, including the full-sized Atlas, is tailored to US tastes, but the company’s badge is not quite premium, nor economy, said Roger Norberg, director of equity research at Thrivent Financial, a Volkswagen investor.

He called the automaker’s market share target “wishful thinking.”

Keogh said Scout would deliver larger vehicles that appeal to US buyers seeking a car with a US feel.

“To make growth happen, you have to go into these new segments,” Keogh said.

Still, investors highlighted that all-electric trucks and SUVs have attracted relatively few sales despite high-profile offerings from Ford, General Motors, Tesla and Rivian.

Both the Scouts are to start at US$50,000 to US$60,000, Keogh said.

Volkswagen declined to comment on the pricing of the ID. Buzz.

New SUVs would be “critical in terms of volume, share and profit,” Di Si said, but did not provide product details or clarity on where the company sees room for a new volume seller.

Volkswagen already offers small, medium and large SUVs. Its larger Atlas has boosted the automaker’s SUV sales in the US, which rose 23 percent in the second quarter.

Volkswagen is still wavering on plug-in hybrids. Executives once lauded hybrids as a bridge to fully electric cars, but shifted to prioritize EVs after Volkswagen’s 2015 diesel-emissions scandal.

Now, automakers that stuck with hybrids, including Toyota and Ford, are seeing their sales jump.

“Investing money in hybrid versions of selected models would be better spent than in Scout,” said Moritz Kronenberger, portfolio manager at Volkswagen shareholder Union Investment. “I have yet to find anyone who yells ‘hooray’ about the plans for Scout.”

A response to my article (“Invite ‘will-bes,’ not has-beens,” Aug. 12, page 8) mischaracterizes my arguments, as well as a speech by former British prime minister Boris Johnson at the Ketagalan Forum in Taipei early last month. Tseng Yueh-ying (曾月英) in the response (“A misreading of Johnson’s speech,” Aug. 24, page 8) does not dispute that Johnson referred repeatedly to Taiwan as “a segment of the Chinese population,” but asserts that the phrase challenged Beijing by questioning whether parts of “the Chinese population” could be “differently Chinese.” This is essentially a confirmation of Beijing’s “one country, two systems” formulation, which says that

Media said that several pan-blue figures — among them former Chinese Nationalist Party (KMT) chairwoman Hung Hsiu-chu (洪秀柱), former KMT legislator Lee De-wei (李德維), former KMT Central Committee member Vincent Hsu (徐正文), New Party Chairman Wu Cheng-tien (吳成典), former New Party legislator Chou chuan (周荃) and New Party Deputy Secretary-General You Chih-pin (游智彬) — yesterday attended the Chinese Communist Party’s (CCP) military parade commemorating the 80th anniversary of the end of World War II. China’s Xinhua news agency reported that foreign leaders were present alongside Chinese President Xi Jinping (習近平), such as Russian President Vladimir Putin, North Korean leader Kim

Taiwan stands at the epicenter of a seismic shift that will determine the Indo-Pacific’s future security architecture. Whether deterrence prevails or collapses will reverberate far beyond the Taiwan Strait, fundamentally reshaping global power dynamics. The stakes could not be higher. Today, Taipei confronts an unprecedented convergence of threats from an increasingly muscular China that has intensified its multidimensional pressure campaign. Beijing’s strategy is comprehensive: military intimidation, diplomatic isolation, economic coercion, and sophisticated influence operations designed to fracture Taiwan’s democratic society from within. This challenge is magnified by Taiwan’s internal political divisions, which extend to fundamental questions about the island’s identity and future

Taiwan People’s Party (TPP) Chairman Huang Kuo-chang (黃國昌) is expected to be summoned by the Taipei City Police Department after a rally in Taipei on Saturday last week resulted in injuries to eight police officers. The Ministry of the Interior on Sunday said that police had collected evidence of obstruction of public officials and coercion by an estimated 1,000 “disorderly” demonstrators. The rally — led by Huang to mark one year since a raid by Taipei prosecutors on then-TPP chairman and former Taipei mayor Ko Wen-je (柯文哲) — might have contravened the Assembly and Parade Act (集會遊行法), as the organizers had