Shipping companies that transport the world’s coal are in the crosshairs of some financial backers who are cleaning up their businesses in the absence of a truly global drive by nations to renounce the dirtiest fossil fuel.

In a sign of investors taking the initiative, six European firms collectively representing more than 5 percent of the estimated annual US$16 billion capital financing requirements of the dry bulk industry told Reuters that they were either reducing their exposure to vessels that transport coal or were considering doing so.

Such carriers — titanic vessels stretching up to 270m long and able to carry hundreds of thousands of tonnes of cargo — are the cheapest way to transport coal and other commodities like iron ore and grain in large quantities.

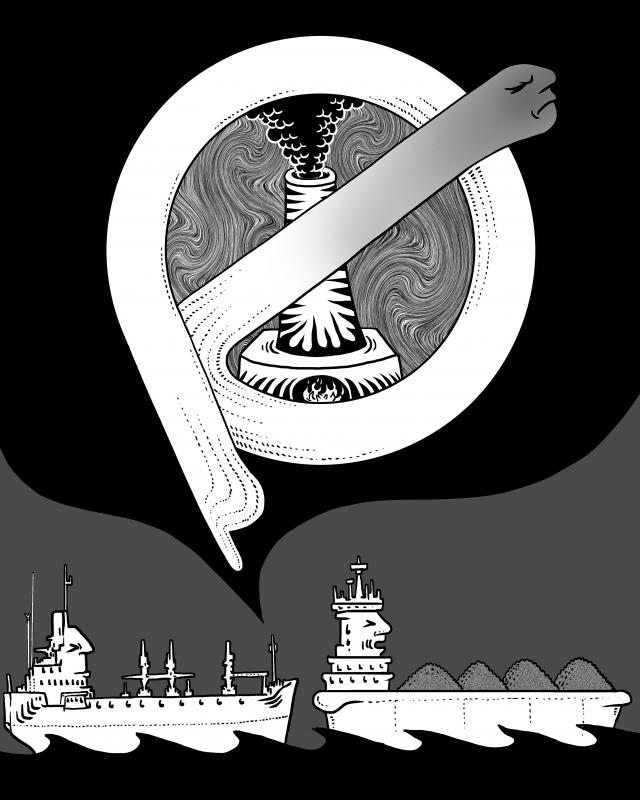

Illustration: Mountain People

Swiss Re told Reuters that from 2023 it would no longer cover the transport of thermal coal via reinsurance treaties, where it covers a portfolio of insurers’ policies. It exited the direct insurance of coal cargoes in 2018.

“There is much more pressure on the insurance companies in terms of ESG,” said Patrizia Kern-Ferretti, head of marine at Swiss Re Corporate Solutions, referring to the sustainable investment sphere.

“I hear from brokers they are having difficulty placing coal policies in the insurance market,” she added. “More and more companies are applying direct guidelines.”

Esben Saxbeck Larsen, senior portfolio manager at Denmark’s Danica Pension, said it favored greener shipping firms, as they provided the best risk/return characteristics. The fund has “close dialogue” with firms about their ESG strategies.

“If we are uncomfortable with such answers, we will not invest in the company,” he added, without elaborating on the specifics of the methodology.

Such pressures pose new challenges for the shipping industry, which hitherto largely has not been drawn into the center of the coal debate by policymakers and investors focused on production and consumption rather than transport of the fuel.

Andreas Sohmen-Pao, chairman of BW Group, which operates a diverse fleet including oil and gas tankers, offshore vessels and dry bulk carriers, said ESG pressures on investors and banks — capital providers to the industry — were growing.

“How that plays out in terms of outcome is a different question. Sometimes, people shun a sector and the returns only get better as supply moderates,” he added. “Everyone has to do what they think is right. Sometimes, you can have counter-intuitive effects.”

There is good money be made from delivering coal, which broadly accounts for about 30 percent of cargo volumes and has hit record prices amid a shortage of fuel, including natural gas, to provide the power needed by a global economy recovering from the COVID-19 pandemic.

Demand beckons for decades to come after major consumers, including China and India, failed to join a pact to phase out coal power at UN climate talks being held in Glasgow, Scotland, this month; while Europe and the US are retiring coal-fired plants, Asian nations are building almost 200 more.

Khalid Hashim, managing director of Precious Shipping, one of Thailand’s largest dry cargo ship owners, said investors should target the consumers and producers of coal.

“All we do is deliver it from the point of origin to the point of consumption, like a messenger delivering his message,” he added. “Coming after ship owners seems the easy cop-out route as we have no voice.”

CAPESIZE CARGOES

The six firms that spoke to Reuters about their coal concerns collectively own, finance, insure or reinsure more than US$1 billion of capital in the dry bulk industry, based on the estimated value of shipping assets.

Leading shipping financiers more broadly provide close to US$290 billion of lending to the industry annually, with capital requirements for the dry bulk segment accounting for about US$16 billion, according to analyst and Reuters estimates.

The investor pullback, part of a wider shift in the financial industry away from fossil fuels, threatens to drive up the cost of finance and insurance for some shipping firms in the dry bulk sector, which carries close to half of global seaborne cargo volumes.

London-based specialist asset manager Marine Capital, which owns and operates shipping assets on behalf of institutional investors, said it anticipated that funders would not support investments in the largest bulk carriers that typically carry coal, known as capesize vessels.

“When it comes to small bulk carriers below panamax size, the amount of coal they carry is relatively modest and our experiences suggest that certainly now institutions would take the view that the relationship with coal is, from their perspective, de minimis,” Marine Capital CEO Tony Foster said.

Tufton Investment Management, another prominent investor in shipping, said it had been increasingly limiting its exposure to coal carriage, especially thermal coal, since 2018 by favoring charterers less likely to carry the fuel.

“For example, we choose agricultural houses over miners and utilities,” chief investment officer Paulo Almeida said.

Separately, at least two major ports are making big shifts; Antwerp has turned its back on coal, for example, while Peel Ports is redeveloping its former Hunterston coal import terminal in Scotland to be able to handle offshore wind, dry docking for ships, aquaculture and the recycling of energy.

’APPLYING LIPSTICK’

Some bulk shipping players are looking to get ahead of the climate curve by refocusing their businesses away from fossil fuels. Others, who have seen patchy profits in the past few years, are loathe to the turn away from the returns on offer from coal.

Monaco-based Eneti is in the former camp, and it has shifted entirely out of dry bulk shipping this year into providing specialist vessels for the offshore wind sector.

“An important consideration when we exited the dry bulk sector was thermal coal,” managing director David Morant told Reuters, saying that trying to clean up coal transportation was “only applying lipstick.”

“As a publicly listed company, renewable energy through offshore wind is higher growth, environmentally responsible and attractive to our investor base,” he said.

Similarly Purus Marine, which has leading US investment company Entrust Global as its founding shareholder, says it is focused on more environmentally friendly ocean industries.

“Our business model is to own vessels and maritime infrastructure involved in offshore renewable energy, seafood, ferries and the climate-aligned sectors of industrial shipping,” CEO Julian Proctor said.

HIGHER SHIPPING PRICES

The impact of higher prices for shipping coal would be felt most in Asia, which consumes 80 percent of global coal supply and is more reliant than elsewhere on coal-fired power.

Even though emissions from burning coal are the single biggest contributor to climate change, the priority for many developing countries is to provide power to a rapidly growing population rather than converting to renewable plants.

An abrupt transition from coal would drive up logistics costs for producers and consumers, said Vuslat Bayoglu, managing director of South African investment firm Menar, which holds stakes in South African thermal coal, anthracite and manganese producers.

“The worst-case scenario is to see countries being plunged into darkness and manufacturing being hit hard, thus heralding a global economic crisis of sort,” he added. “This would be highly irresponsible, as many countries are crawling out of long periods of recession and COVID-induced decline.”

Additional reporting by Carolyn Cohn and Helen Reid

The gutting of Voice of America (VOA) and Radio Free Asia (RFA) by US President Donald Trump’s administration poses a serious threat to the global voice of freedom, particularly for those living under authoritarian regimes such as China. The US — hailed as the model of liberal democracy — has the moral responsibility to uphold the values it champions. In undermining these institutions, the US risks diminishing its “soft power,” a pivotal pillar of its global influence. VOA Tibetan and RFA Tibetan played an enormous role in promoting the strong image of the US in and outside Tibet. On VOA Tibetan,

By now, most of Taiwan has heard Taipei Mayor Chiang Wan-an’s (蔣萬安) threats to initiate a vote of no confidence against the Cabinet. His rationale is that the Democratic Progressive Party (DPP)-led government’s investigation into alleged signature forgery in the Chinese Nationalist Party’s (KMT) recall campaign constitutes “political persecution.” I sincerely hope he goes through with it. The opposition currently holds a majority in the Legislative Yuan, so the initiation of a no-confidence motion and its passage should be entirely within reach. If Chiang truly believes that the government is overreaching, abusing its power and targeting political opponents — then

On a quiet lane in Taipei’s central Daan District (大安), an otherwise unremarkable high-rise is marked by a police guard and a tawdry A4 printout from the Ministry of Foreign Affairs indicating an “embassy area.” Keen observers would see the emblem of the Holy See, one of Taiwan’s 12 so-called “diplomatic allies.” Unlike Taipei’s other embassies and quasi-consulates, no national flag flies there, nor is there a plaque indicating what country’s embassy this is. Visitors hoping to sign a condolence book for the late Pope Francis would instead have to visit the Italian Trade Office, adjacent to Taipei 101. The death of

As the highest elected official in the nation’s capital, Taipei Mayor Chiang Wan-an (蔣萬安) is the Chinese Nationalist Party’s (KMT) candidate-in-waiting for a presidential bid. With the exception of Taichung Mayor Lu Shiow-yen (盧秀燕), Chiang is the most likely KMT figure to take over the mantle of the party leadership. All the other usual suspects, from Legislative Speaker Han Kuo-yu (韓國瑜) to New Taipei City Mayor Hou You-yi (侯友宜) to KMT Chairman Eric Chu (朱立倫) have already been rejected at the ballot box. Given such high expectations, Chiang should be demonstrating resolve, calm-headedness and political wisdom in how he faces tough