China’s campaign to tighten regulation across swathes of the nation’s industries is showing signs of abating, creating some relief among global investors. However, there remains a number of unresolved issues that could yet have wide-ranging repercussions on industries and financial markets alike.

The severity of the penalty for Didi Global Inc’s controversial US initial public offering (IPO), the result of a corruption probe into China’s massive financial industry and details of a planned expansion of property tax trials are just some of the potential concerns for investors.

China’s scrutiny over everything from technology to online tutors and real estate spurred a selloff that at one stage wiped more than US$1 trillion from the value of the nation’s stocks globally. The MSCI China Index is down 15 percent this year, trailing global shares by the most since 1998. Chinese President Xi Jinping (習近平) is seeking to remodel the economy, address inequality and reduce financial risk without destabilizing growth.

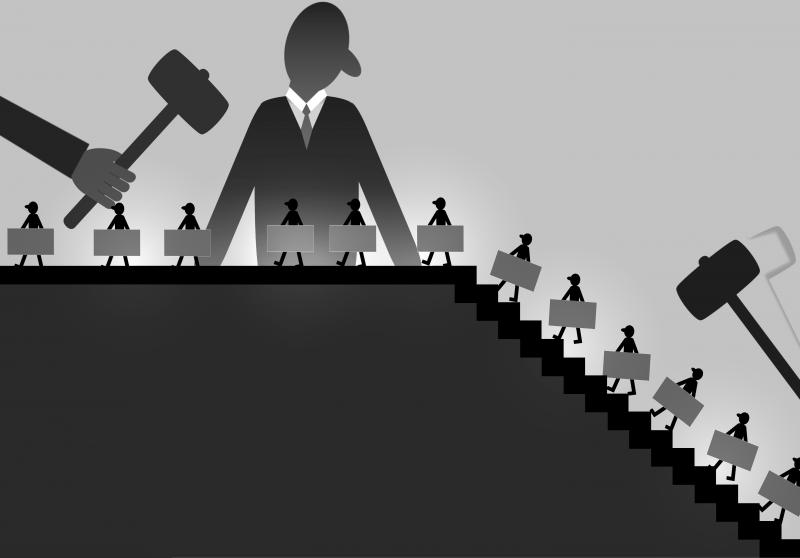

Illustration: Yusha

The following are some of the major focus areas for different industries as Xi’s crackdowns rumble on.

TECHNOLOGY

DIDI PROBE: Investors are awaiting the outcome of China’s regulatory investigations into ride-hailing giant Didi, logistics platform Full Truck Alliance Co and online recruitment firm Kanzhun Ltd following their US listings earlier this year. Regulators are weighing a range of potential punishments for Didi, including a fine and the introduction of a state-owned investor, Bloomberg reported in July. The Cyberspace Administration of China suggested that the three firms explore selling shares in Hong Kong, Dow Jones reported last month, adding that the probes could conclude this month.

ANT IPO: What is to happen with Ant’s IPO remains an open question, one year after Beijing quashed what would have been the world’s biggest debut. Bankers say they have stopped getting regular communication from the firm, and some are doubtful that it can return to market before 2023, Bloomberg News reported last month. On the brighter side, Ant founder Jack Ma (馬雲) recently traveled to Europe, Hong Kong media reports said, suggesting that relations with the government are improving.

BIG DATA: China has made it clear that the government plans to play a central role in controlling data and that private companies need to comply with Beijing’s priorities. Xi’s administration has debated a range of proposals, from nationalizing data under a government-controlled venture to setting guidelines for companies to manage their own data. The final decision is likely to have sweeping ramifications for almost all technology companies.

BREAK DOWN SILOS: Efforts by Chinese officials to break open closed ecosystems operated by its biggest companies are being closely watched. Authorities are considering asking companies from Tencent Holdings Ltd to ByteDance Ltd to let rivals access and display their content in search results, Bloomberg News reported last month. Such a move could further pull down online barriers and shake up Internet advertising.

MARKETS

OVERSEAS LISTINGS: Regulators in Beijing are still nailing down rule changes that would allow them to block Chinese companies from listing overseas, even if the unit selling shares is incorporated outside of China, using the variable interest entity (VIE) model. The move would close a loophole long used by technology giants to sidestep restrictions on foreign investment in sensitive sectors, although it is still unclear what this would mean for VIE firms already listed offshore, particularly in the US.

HONG KONG IPOs: Companies planning to go public in Hong Kong might be exempted from first seeking approval from China’s cybersecurity watchdog, Bloomberg News reported in July. If confirmed, it would make the listing process for Hong Kong less onerous than for the US. The uncertainty over Hong Kong’s treatment is weighing on the territory’s IPO market, which is going through a dry spell.

FINANCE

CORRUPTION INVESTIGATION: The top anti-graft body last month started a two-month inspection of 25 financial institutions including the central bank, the banking and insurance regulator, lenders and bad-debt managers. The probe plans to look at whether officials and banks were too close to private firms, including China Evergrande Group, Didi and Ant, the Wall Street Journal reported. The last major investigation into the industry was in late 2015 following a stock market crash, and resulted in the detention of bankers and brokerage executives, among others.

CROSS-BORDER BROKERS: The future of Chinese cross-border brokers is in doubt after a central bank official questioned the legitimacy of their operations, prompting declines in the shares of Futu Holdings Ltd and Fintech Holding Ltd. The companies have been operating in a gray area by allowing Chinese investors to evade capital controls and trade shares in markets such as Hong Kong and New York.

PROPERTY

REAL ESTATE TAX: Investors are keenly awaiting details of China’s plans to expand property-tax trials to more areas from Shanghai and Chongqing and to start taxing home owners. The plan, reported by Xinhua news agency late last month, did not say where the new trials are being applied. Hainan, which is being turned into a free trade hub, and Shenzhen are considered among the likely candidates.

While the five-year plan suggests a nationwide levy is unlikely to be rolled out anytime soon, concern over the potential consequences of the trials has weighed on property stocks. One index of developers fell for seven straight days after the news.

LUXURY GOODS

TAXES/COMMON PROSPERITY: Xi’s “common prosperity” campaign poses a potential risk to makers of luxury goods such as Burberry Group PLC and Cie Financiere Richemont SA if it leads to stronger efforts to clamp down on conspicuous consumption. China’s tax system still favors the rich, meaning one way to redistribute wealth would be through higher taxes. The country is also one of the only major economies that does not levy an inheritance tax. So far, there has been little public sign that tax reforms are in the offing. Chinese consumers are the No. 1 one driver of global sales of top-end goods.

MACAU CASINOS

CASINO REVIEW: Macau’s government is considering regulations to tighten restrictions on operators, including appointing government representatives to “supervise” companies. The proposed changes could be made in a revision of the casino law, which is likely to be passed before Macau issues new gambling licenses to operators. The current licenses expire in June next year. The sector could stay “nearly uninvestable” until there is clarity on the new licenses, JPMorgan analysts wrote in an Oct. 1 note.

HONG KONG

ANTI-SANCTIONS LAW: While Beijing is not reportedly imposing an anti-sanctions law on Hong Kong for now, it remains a concern hanging over the territory’s financial markets. The law is based on legislation passed in Beijing in June, which gives the Chinese government broad powers to seize assets from entities that implement US sanctions. In August, China’s top legislative body postponed a vote on imposing the law on the former British colony, with one local delegate saying it had been delayed pending further study.

A series of strong earthquakes in Hualien County not only caused severe damage in Taiwan, but also revealed that China’s power has permeated everywhere. A Taiwanese woman posted on the Internet that she found clips of the earthquake — which were recorded by the security camera in her home — on the Chinese social media platform Xiaohongshu. It is spine-chilling that the problem might be because the security camera was manufactured in China. China has widely collected information, infringed upon public privacy and raised information security threats through various social media platforms, as well as telecommunication and security equipment. Several former TikTok employees revealed

For the incoming Administration of President-elect William Lai (賴清德), successfully deterring a Chinese Communist Party (CCP) attack or invasion of democratic Taiwan over his four-year term would be a clear victory. But it could also be a curse, because during those four years the CCP’s People’s Liberation Army (PLA) will grow far stronger. As such, increased vigilance in Washington and Taipei will be needed to ensure that already multiplying CCP threat trends don’t overwhelm Taiwan, the United States, and their democratic allies. One CCP attempt to overwhelm was announced on April 19, 2024, namely that the PLA had erred in combining major missions

The Constitutional Court on Tuesday last week held a debate over the constitutionality of the death penalty. The issue of the retention or abolition of the death penalty often involves the conceptual aspects of social values and even religious philosophies. As it is written in The Federalist Papers by Alexander Hamilton, James Madison and John Jay, the government’s policy is often a choice between the lesser of two evils or the greater of two goods, and it is impossible to be perfect. Today’s controversy over the retention or abolition of the death penalty can be viewed in the same way. UNACCEPTABLE Viewing the

At the same time as more than 30 military aircraft were detected near Taiwan — one of the highest daily incursions this year — with some flying as close as 37 nautical miles (69kms) from the northern city of Keelung, China announced a limited and selected relaxation of restrictions on Taiwanese agricultural exports and tourism, upon receiving a Chinese Nationalist Party (KMT) delegation led by KMT legislative caucus whip Fu Kun-chi (傅崑萁). This demonstrates the two-faced gimmick of China’s “united front” strategy. Despite the strongest earthquake to hit the nation in 25 years striking Hualien on April 3, which caused