Democrats grouse that US President George W. Bush has recklessly frittered away the surpluses of the 1990s. Foreign finance ministers plan to express their alarm about the US' Brobdingnagian budget deficit at a Group of 7 meeting in Boca Raton, Florida, this weekend. Even a growing number of Republicans argue that Bush needs to stop making excuses and cut government spending.

So what is the reaction from the bond market vigilantes, those disciplinarians who bid up interest rates whenever past deficits started looming? Yawn.

Since Bush released his budget proposal on Monday, forecasting a US$521 billion shortfall for the current fiscal year, the interest rate on 10-year Treasury notes has actually fallen slightly, closing on Friday at 4.08 percent. Since August, when the deficit estimate was US$475 billion, the rate has dropped from about 4.4 percent.

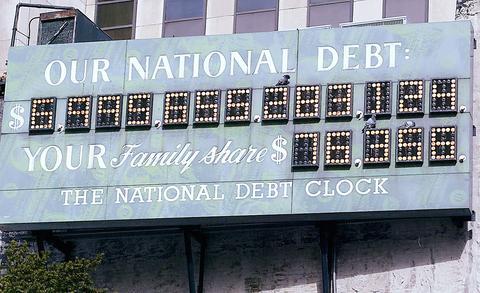

PHOTO: NY TIMES NEWS SERVICE

The bond market, it seems, has stopped worrying and learned to love the deficit. The question, of course, is whether everybody else can relax, too.

There are some basic economic reasons for low rates, like an influx of foreign capital and the unevenness of the US economy, that have little to do with the deficit. But there also appear to be psychological reasons. Many economists say the bond vigilantes' muted reaction is both a symbol and a cause of the misplaced calm about the deficits, at least outside the Washington hothouse.

Confidence

Most people old enough to vote or make investments can remember the 1980s, another time when the federal government spent more money than it had. Few people can think of any lasting harm those debts caused. So it may come as no surprise that only 2 percent of Americans named the deficit as the main issue they would like to hear candidates discuss in this year's presidential election, according to a recent New York Times/CBS News poll.

"Under Reagan in the '80s, I remember headlines day after day saying we were leveraging our children's future," said Lundy Wright, a managing director and top bond trader at Morgan Stanley.

"But in good times, we got back to surpluses. I think the lesson is, you can borrow when times aren't so good and cyclical factors will help get you out of it," Wright said.

N. Gregory Mankiw, the chairman of Bush's Council of Economic Advisers, added: "It's very clear the bond market still has a lot of confidence in the US economy. People basically trust the US to do the right thing. People do not expect the deficits to persist."

Perhaps they won't. The economy could indeed outgrow these deficits over the next decade. In fact, the Congressional Budget Office, a nonpartisan research arm of Congress, is forecasting that surpluses will return in 2014.

But many economists also say the rapid fiscal swings of the last 20 years have created a false sense of security about deficits. That serenity may have been reinforced by a series of accounting decisions in Bush's new budget that mask the deficit's true size, according to budget analysts.

Alarming

The absence of concern is all the more alarming now, given the enormous shortfalls in Social Security and Medicare that await in coming decades, economists say.

"If the '80s deficit had gone away on its own, that would be one thing," said Benjamin Friedman, a Harvard economics professor.

He noted that the long economic expansion of the 1980s did not bring down the national debt. Only after the first President Bush raised taxes, President Bill Clinton raised them further and the Republican Congress of the mid-90s reduced spending growth, did the deficit vanish.

"And the people who took those tough actions didn't necessarily get rewarded for them," Friedman said.

Before the first President Bush broke his "read my lips" vow and increased taxes, the Republicans won three consecutive presidential elections; they have not won the popular vote since. The controversial 1993 federal budget, meanwhile, contributed to the Democrats' loss of control of the House of Representatives, which they had held since 1955.

Those political costs do tend to stick in people's minds, and they have made a budget reckoning all but unthinkable during an election year. Barring truly spectacular and surprising economic growth in coming years, though, the reckoning is likely to come eventually, even if there is little hint of it in today's bond market.

"The numbers are so huge and the hole so deep and the politics so difficult," said Robert Rubin, a Treasury secretary in the Clinton administration.

"I think there is only one way you get out of this: both revenue increases and spending discipline," he said.

The bond market and its vigilantes demanded such measures once. If politicians did not obey, they quickly sold large piles of bonds, pushing interest rates higher and dampening economic growth.

They were acting in self-interest, out of a concern that the deficits would diminish the value of their holdings by flooding the marketplace with new government bonds. But the strategy pushed interest rates even higher, by further increasing the supply of bonds and forcing issuers to offer still higher rates.

Edward Yardeni, an economist who was working at Prudential-Bache Securities, is widely credited with inventing the term "bond vigilantes" back when the Reagan deficits were growing in the 1980s. Interest rates generally fell during the decade but spiked occasionally and remained far higher than they were in the '50s and '60s.

By the '90s, vigilantes like Stanley Druckenmiller, then of Soros Fund Management, and Louis Moore Bacon of Moore Capital Management reached the peak of their power.

As a White House adviser, Rubin, a former bond trader himself, helped persuade Clinton that cutting the deficit would sate the bond market. As news of his budget plans spread in 1993, the interest rate on the 10-year bond fell to a 22-year low.

Unafraid

James Carville, a political adviser to Clinton, joked at the time that he had once wanted to be reincarnated as the pope or a baseball player with a .400 batting average, but decided instead that he should return as the bond market and intimidate everybody.

No one seems afraid anymore.

"There's a much different attitude in the market now toward the deficit," said David Greenlaw, an economist at Morgan Stanley.

"There is no one clamoring for action," he said.

In part, other dynamics have kept interest rates low enough to steady the uneven economic recovery. Foreign money, much of it from Asian governments trying to prop up the dollar's value and keep their exports inexpensive, is flowing into the US. That has allowed bonds to find buyers, even at low rates. Then there is the still-weak US job market, which has forced the Federal Reserve to leave its benchmark short-term interest rate at the lowest level in almost 50 years, keeping a lid on long-term rates.

But optimism has been a big factor, too.

Over the last two decades, many people have become convinced that budget deficits are not a problem because the federal government will not let them become one.

"In theory, deficits can't last forever," said Woody Jay, a managing director for government securities at Lehman Brothers.

"I think the market probably believes some positive work will be done on the deficit," he said.

White House officials say they have started that work by holding the line on spending outside Social Security, Medicare, the military and domestic security. Bush has proposed the elimination of some school programs and cuts in some financing for police and fire departments, the Federal Aviation administration and the Internal Revenue Service.

"We're willing to make the tough choices to get the deficit down," Mankiw, of the economic advisers council, said.

"The interesting question is whether Congress will go along," he said.

Increasing demands

Even if Congress adds no new spending, however, the long-term deficit seems larger than the White House's official numbers suggest. The current proposal includes no spending for the military activities in Iraq beyond Sept. 30.

It excludes, among other items, a US$65 billion tax credit for uninsured people to buy catastrophic health insurance over the next decade. And it looks just five years ahead, ignoring most of the cost of making last year's tax cut permanent, as Bush advocated.

Today's deficits also prevent the government from socking away the so-called Social Security surplus for the day when the payroll tax will no longer cover the payments to retirees.

As the baby boomers begin turning 65 in 2011, they will make increasing demands on the federal budget.

Those fiscal time bombs make most economists confident that budget cuts or tax increases will eventually be necessary -- or the bond vigilantes will start to become restless again.

Any number of developments, from a healthy pickup in the economy to a newfound conviction that the deficits are not going away, could nudge up interest rates.

In fact, they could rise as soon as Monday if the Group of 7 ministers suggest this weekend that the dollar has fallen enough and Asian central banks then slow their purchases of US bonds.

"A lot of people are looking to the G-7 meeting for an indication," Wright, the Morgan Stanley bond trader, said.

The kids' problem

In the absence of such news, though, interest rates are unlikely to move sharply anytime soon. A deficit alone does not necessarily lead to higher interest rates, most economists say, but is merely one factor among many.

For now, it remains the kind of long-term issue that holds little sway with bond traders.

"The people who put money to risk really do it with a five-year time horizon," Wright said.

Stan Jonas, managing director at Fimat USA, a New York brokerage firm, added: "There's a lot of talk that the deficit is going to balloon in 2020. OK, I agree."

But, he said, "any bet I make about what's going to happen to the deficit in 20 years, I'm not going to be around to collect."

On top of that, the vigilantes may have personal reasons for viewing today's deficits differently from yesterday's.

"The bond vigilantes are getting older," Jonas said.

"They're the ones who benefit from the deficit. It's their kids' problem," he said.

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

Taiwanese exports to the US are to be subject to a 20 percent tariff starting on Thursday next week, according to an executive order signed by US President Donald Trump yesterday. The 20 percent levy was the same as the tariffs imposed on Vietnam, Sri Lanka and Bangladesh by Trump. It was higher than the tariffs imposed on Japan, South Korea and the EU (15 percent), as well as those on the Philippines (19 percent). A Taiwan official with knowledge of the matter said it is a "phased" tariff rate, and negotiations would continue. "Once negotiations conclude, Taiwan will obtain a better