The eurozone economy grew more than expected at the end of last year, with fourth-quarter GDP rising 0.3 percent from the previous three months — maintaining the pace it set in the previous period — Eurostat said yesterday.

Analysts in a Bloomberg survey had foreseen an increase of 0.2 percent.

Germany, Italy and Spain all surpassed estimates, with the latter proving the standout performer once again through expansion of 0.8 percent.

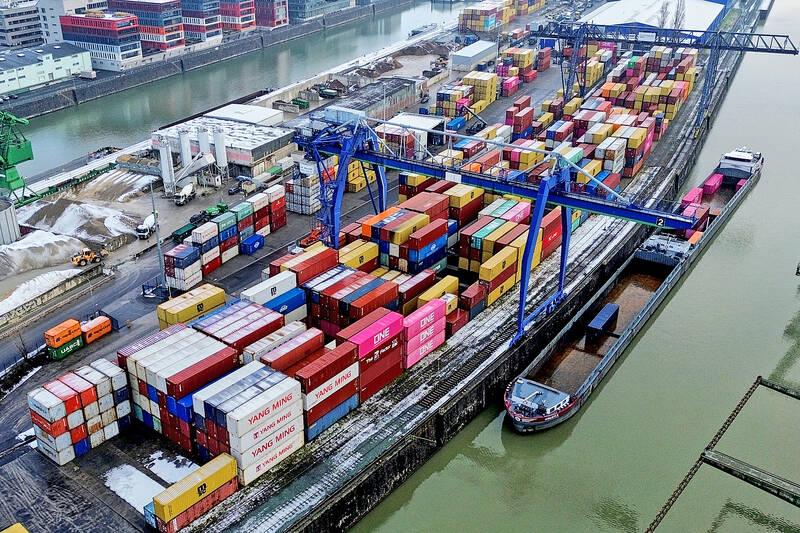

Photo: AP

Meanwhile France matched forecasts at 0.2 percent.

The currency bloc is holding up well after the US raised tariffs last year and should see growth of more than 1 percent this year as a spending splurge hauls Germany out of its long malaise.

The region can breathe easier over inflation, which is settling at about the European Central Bank’s (ECB) target, keeping interest rates steady at 2 percent.

Spain said that consumer prices this month rose 2.5 percent from a year earlier — down from 3 percent the previous month.

Regional data from Germany suggested that its national figure might slightly exceed the 2 percent estimate, according to Bloomberg Economics.

An ECB poll of eurozone consumers showed that inflation expectations over the next 12 months held steady at the end of last year.

The survey indicated a slightly more positive mood regarding the economy.

Indeed, other parts of the bloc also recorded growth: GDP was up by 0.5 percent in the Netherlands, 0.2 percent in Austria, 0.8 percent in Portugal and 1.7 percent in Lithuania.

An early indicator pointed to expansion of 0.6 percent in Finland, but Ireland slipped into a recession.

In Germany, household and government consumption drove growth of 0.3 percent from October to December last year.

German Chancellor Friedrich Merz’s outlays on infrastructure and defense should add to momentum as this year progresses — particularly if he can also deliver on promises to slash bureaucracy and boost competitiveness.

The German government predicted that GDP would rise 1 percent this year — progress after it only narrowly avoided a triple-dip recession last year.

Spain’s economy has outperformed its peers for several years, helped by a booming tourism industry and immigration.

Its latest growth success was fueled by household consumption, its statistics office said.

While Italy saw trade act as a drag on its economy, that was more than offset by domestic demand, resulting in expansion of 0.3 percent.

For France, the second half of last year was clouded by another government collapse, as well as rows over tax hikes and spending cuts that are needed to rein in a gaping budget deficit.

However, fourth-quarter investment rose by 0.2 percent, while consumer spending growth accelerated to 0.3 percent.

For last year, GDP rose 0.9 percent.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.