Taiwan’s housing market is set to consolidate next year, with transaction volumes expected to hold near this year’s levels as tight mortgage conditions continue to weigh on demand, Evertrust Rehouse Co (永慶房屋) said on Wednesday, citing a quarterly survey.

Between 251,000 and 264,000 home sales are forecast for next year, implying anything from a 3 percent decline to a mild 2 percent increase from this year’s estimated 260,000 units, the company said.

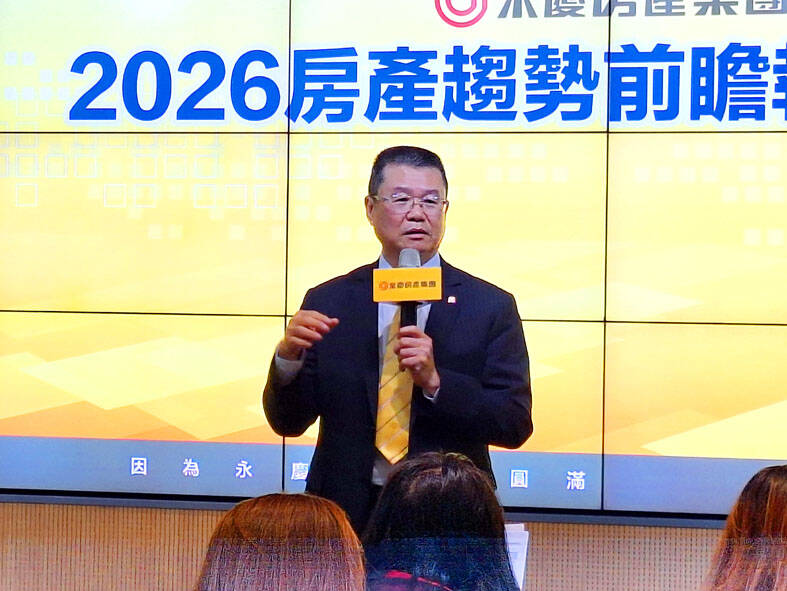

This year’s figures would represent a 27 percent slump, attributable to the central bank’s property loan curbs, Evertrust general manager Yeh Ling-chi (葉凌棋) told a news conference in Taipei.

Photo: CNA

“The worst from policy tightening is likely over and conditions are unlikely to deteriorate, barring major economic or policy shocks,” Yeh said.

Speculative buyers have mostly exited the market, leaving transactions increasingly driven by owner-occupiers, he said, as long as Taiwan’s economy remains broadly stable.

Yeh flagged four major uncertainties shaping the outlook: the health of a global artificial intelligence boom, Washington’s trade policy under US President Donald Trump, domestic housing policy directions, cross-strait relations and the pace of new housing supply.

Borrowing costs remain a key headwind.

Mortgage rates have climbed to about 2.3 percent, the highest since the 2008–2009 global financial crisis, eroding affordability for first-time buyers, Yeh said.

For years, Taiwanese homebuyers had grown accustomed to mortgage rates below 2 percent despite elevated home prices, he said, adding that interest rates have become the single most critical variable for the market.

Affordability pressures are set to intensify when a government interest-subsidy program expires in July next year.

The scheme, which provides subsidized interest rates on loans of up to NT$10 million (US$317,662) along with a five-year grace period, helped cushion households from rising borrowing costs, Evertrust said.

Authorities plan to roll out additional support measures in July next year, although Yeh cautioned against disclosing details too soon.

Early signals could encourage would-be buyers to sit on the sidelines, risking a freeze in transactions during the first half of the year, he said.

Nevertheless, housing sentiment has improved modestly.

The share of respondents expecting home prices to fall in the first quarter of next year dropped to 39 percent from 50 percent in the prior quarter, while those anticipating price gains rose to 26 percent, the survey showed.

About 35 percent of respondents expect prices to hold steady, Evertrust research manager Daniel Chen (陳賜傑) said.

The shift followed policymakers’ decision to exempt first-time homebuyers from property loan restrictions, even as they maintain overall credit controls, Chen said.

Additional relief might be emerging after the central bank on Thursday last week eased loan-reduction requirements for banks and required lenders to submit mortgage data on a monthly basis.

The move could help speed up loan approvals that had previously delayed or derailed transactions, Chen added.

Vincent Wei led fellow Singaporean farmers around an empty Malaysian plot, laying out plans for a greenhouse and rows of leafy vegetables. What he pitched was not just space for crops, but a lifeline for growers struggling to make ends meet in a city-state with high prices and little vacant land. The future agriculture hub is part of a joint special economic zone launched last year by the two neighbors, expected to cost US$123 million and produce 10,000 tonnes of fresh produce annually. It is attracting Singaporean farmers with promises of cheaper land, labor and energy just over the border.

US actor Matthew McConaughey has filed recordings of his image and voice with US patent authorities to protect them from unauthorized usage by artificial intelligence (AI) platforms, a representative said earlier this week. Several video clips and audio recordings were registered by the commercial arm of the Just Keep Livin’ Foundation, a non-profit created by the Oscar-winning actor and his wife, Camila, according to the US Patent and Trademark Office database. Many artists are increasingly concerned about the uncontrolled use of their image via generative AI since the rollout of ChatGPT and other AI-powered tools. Several US states have adopted

A proposed billionaires’ tax in California has ignited a political uproar in Silicon Valley, with tech titans threatening to leave the state while California Governor Gavin Newsom of the Democratic Party maneuvers to defeat a levy that he fears would lead to an exodus of wealth. A technology mecca, California has more billionaires than any other US state — a few hundred, by some estimates. About half its personal income tax revenue, a financial backbone in the nearly US$350 billion budget, comes from the top 1 percent of earners. A large healthcare union is attempting to place a proposal before

KEEPING UP: The acquisition of a cleanroom in Taiwan would enable Micron to increase production in a market where demand continues to outpace supply, a Micron official said Micron Technology Inc has signed a letter of intent to buy a fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corp (力積電) for US$1.8 billion to expand its production of memory chips. Micron would take control of the P5 site in Miaoli County’s Tongluo Township (銅鑼) and plans to ramp up DRAM production in phases after the transaction closes in the second quarter, the company said in a statement on Saturday. The acquisition includes an existing 12 inch fab cleanroom of 27,871m2 and would further position Micron to address growing global demand for memory solutions, the company said. Micron expects the transaction to