US President Donald Trump on Monday granted Nvidia Corp permission to ship its H200 artificial intelligence (AI) chips to China in exchange for a 25 percent surcharge, a move that lets the world’s most valuable company potentially regain billions of dollars in lost business from a key global market.

The decision was announced by Trump in a post on his Truth Social network, capping weeks of deliberations with advisers about whether to allow H200 exports to China.

Trump said he informed Chinese President Xi Jinping (習近平) about the move and that Xi had responded favorably.

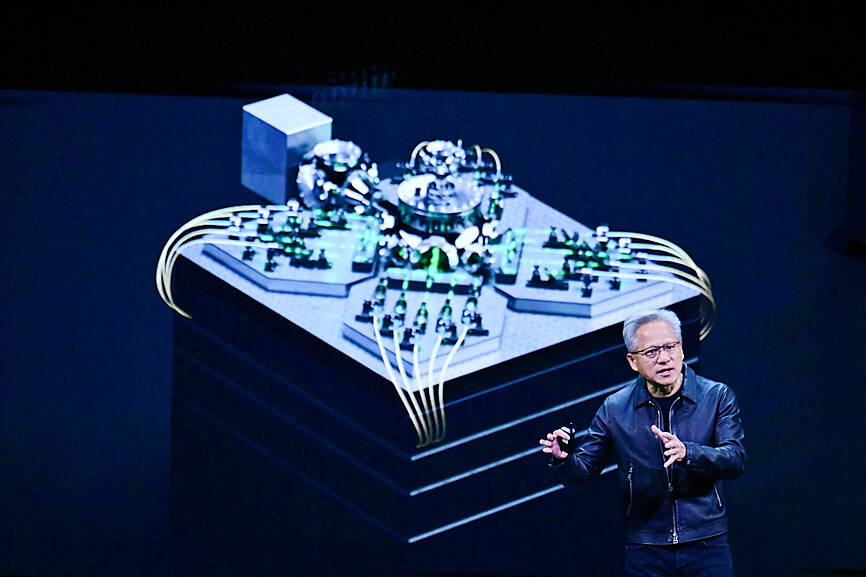

Photo: AFP

The US president added that shipments would only go to “approved customers,” and that chipmakers such as Intel Corp and Advanced Micro Devices Inc (AMD) would also be eligible.

Trump’s decision provoked an immediate backlash from Democratic US senators including Elizabeth Warren, who warned of a “colossal economic and national security failure” in providing Beijing the tools it needs to develop next-generation AI.

The H200 is, on paper at least, a generation ahead of anything offered by Chinese designers from Huawei Technologies Co (華為) to Cambricon Technologies Corp (寒武紀) and Moore Threads Technology Co (摩爾). China at present also requires more chips than local firms can supply.

“We will protect National Security, create American Jobs, and keep America’s lead in AI,” Trump said in his post.

“NVIDIA’s US Customers are already moving forward with their incredible, highly advanced Blackwell chips, and soon, Rubin, neither of which are part of this deal,” he said, referring to more advanced lines of Nvidia chips.

Nvidia chief executive officer Jensen Huang (黃仁勳) had met privately with Trump in Washington last week to discuss export controls, although neither the White House nor the company shared details on their conversation.

Payment to the US government would come as a 25 percent fee when the chips are shipped from manufacturing sites in Taiwan to the US for inspection by the US Department of Commerce’s Bureau of Industry and Security as part of a security review, a department official said, adding that the chips would then be shipped to customers in China.

In August, Nvidia won approval to sell its H20 chip to China while AMD was cleared for its MI308 processor — each designed to fall just below export restrictions. Under that arrangement, touted by Trump, the companies would have paid 15 percent of their China sales to the US government. The payments failed to materialize, because regulations that would make them legal were never enacted.

The H20 and H200 come from the same generation of Hopper processors, an aging lineup. Nvidia sells the more-advanced Blackwell generation in the US and is preparing to shift to an even speedier family of chips called Rubin.

Still, the H200 represents a significant step up from the H20.

The H200’s total processing performance is about 10 times the limit previously allowed for export to China, according to Georgetown University’s Center for Security and Emerging Technology.

Nvidia hailed the decision, saying it would “help to support high-paying jobs and manufacturing in America. Offering H200 to approved commercial customers, vetted by the Department of Commerce, strikes a thoughtful balance that is great for America.”

Nvidia and AMD shares both gained about 2 percent in late trading after Trump’s announcement. Intel, which is not expected to benefit from the changes in the near term, rose less than 1 percent.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)