The first Milan Fashion Week without Giorgio Armani marks the end of an era in Italian luxury, at a time when houses across the sector are already in transition.

After defending his independence throughout his life, the legendary designer, who died this month aged 91, has entrusted his heirs with the task of selling his group. He cited French companies L’Oreal and LVMH as potential buyers of his multimillion-euro empire, which spans from hotels to haute couture, as well as Franco-Italian eyewear giant EssilorLuxottica. Failing that, his will states the company should be listed on the stock market.

This year also saw the departure of Donatella Versace from the house she ran for three decades, shortly before it was acquired by Prada.

“These are the last years of the first generation of Italian designers. We’re in the middle of a major reshuffle,” the manager of a major Milanese house said this week on the margins of fashion week.

Roberto Cavalli, the king of sexy dresses and animal prints since the 1970s, also died last year.

However, his company had since 2019 belonged to an Emirati conglomerate — reflecting a wider trend.

In 2012, 76.8 percent of Italian fashion companies with annual revenues exceeding 50 million euros (US$58.5 million) were still managed by the founding family.

This fell to 57 percent in 2022, according to a survey by the Aub Observatory published last year.

FRENCH GIANTS

Over the past 30 years, many of Italy’s top fashion names have been snapped up by foreign groups, notably French giants Kering, which owns Gucci and Bottega Veneta, and LVMH, which counts Fendi and Loro Piana among its brands.

Shoe company Sergio Rossi is owned by China’s Lanvin Group, and Golden Goose by a London-based private equity fund.

Iconic names such as Dolce & Gabbana and Missoni remain independent, as does Brunello Cucinelli, but their size is limited.

The largest of them, Prada — with 76-year-old Miuccia Prada still at the helm — is eyeing combined revenues of about 6 billion euros after its deal with Versace.

This is far from the 84.7 billion euros in revenue expected by LVMH last year or the 17.2 billion euros of Kering.

Luca Solca, an expert in luxury at Bernstein, said that, despite a few attempts in the past, “Italy didn’t have an inspired businessman that could potentially aggregate a conglomerate.”

Armani was better than many at building a major brand, but in the end, he appeared to have decided there was nobody after him to run it, Solca said.

However, the luxury market is changing, and not just because of the hit from a slowdown in Chinese consumer spending.

Some see this as an opportunity for smaller Italian brands.

Bernardo Bertoldi, an economics professor at the University of Turin, said that LVMH and Kering capitalized on the rise of new, rich consumers in Asia and the Middle East, providing an accessible place for luxury goods.

“With a more evolved, more sophisticated consumer, they will stop shopping at the luxury supermarket and go looking for the best high-heeled shoe artisan,” he said.

Italian brands make much of their artisanal offerings, with Tod’s bringing in a dozen craftsmen and women for their catwalk show on Friday to show guests how handmade handbags and shoes are made.

In this world, Bertoldi says price is no issue.

SARTORIAL CODES

Amid an increasingly competitive market, many big brands have installed new creative leads who are debuting this season, from Gucci, Versace and Bottega Veneta, Chanel and Dior.

However, Ian Griffiths, lead designer at Max Mara, who has been with the family-owned Italian brand since 1987, questioned what this meant for a brand’s heritage — a key selling point.

“I really feel for those designers who get thrown into a house and have to prove themselves within a season or two, produce instant results,” the Briton said backstage after his Milan show, “because, you know, what happens to the heritage? I had 20 years to learn the Max Mara sartorial codes before I was let loose on any kind of decisionmaking.”

Milan Fashion Week wraps up tomorrow.

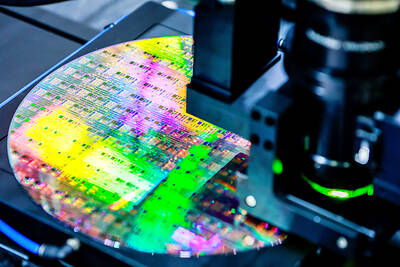

PULLING AHEAD: TSMC aims to start production at the Taichung fab in 2028 using its most advanced technology, while 1.6nm chips would be made in Kaohsiung next year Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is to start building a new 1.4-nanometer fab next quarter with an anticipated production value of up to NT$500 billion (US$16.49 billion), the Central Taiwan Science Park Bureau said yesterday. TSMC, the world’s biggest contract chipmaker, is working at full steam to push forward the construction of its new factories at home, rather than taking a slower approach as some media speculated, bureau Director-General Hsu Maw-shin (許茂新) said. “Everything is on schedule. TSMC plans to start construction in the fourth quarter. It is planning a detailed construction schedule and arranging contractors to build the fab,” Hsu

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reiterated that the company has not entered discussions with any company about potential investments or partnerships amid ongoing rumors of ailing Intel Corp seeking TSMC’s participation. In a statement, TSMC, the world’s largest contract chipmaker, dismissed a report by the Wall Street Journal, saying that Intel had approached TSMC soliciting investment in Intel’s manufacturing operations or a partnership. The company said it has never entered into talks with any company on establishing a joint venture or engaging in the licensing or transfer of technology. That stance was similar to previous statements made by TSMC chairman C.C.

Taiwan has imposed restrictions on the export of chips to South Africa over national security concerns, taking the unusual step of using its dominance of chip markets to pressure a country that is closely allied with China. Taiwan requires preapproval for the bulk of chips sold to the African nation, the International Trade Administration said in a statement. The decision emerged after Pretoria tried to downgrade Taipei’s representative office and force its move to Johannesburg from Pretoria, the Ministry of Foreign Affairs has said. The move reflects Taiwan’s economic clout and a growing frustration with getting sidelined by Beijing in the diplomatic community. Taiwan

Samsung Electronics Co shares jumped 4.47 percent yesterday after reports it has won approval from Nvidia Corp for the use of advanced high-bandwidth memory (HBM) chips, which marks a breakthrough for the South Korean technology leader. The stock closed at 83,500 won in Seoul, the highest since July 31 last year. Yesterday’s gain comes after local media, including the Korea Economic Daily, reported that Samsung’s 12-layer HBM3E product recently passed Nvidia’s qualification tests. That clears the components for use in the artificial intelligence (AI) accelerators essential to the training of AI models from ChatGPT to DeepSeek (深度求索), and finally allows Samsung