In support of government’s vision of transforming Taiwan into an “Asia Asset Management Center,” Standard Chartered Bank has combined its global expertise with local resources to lead the wealth management market.

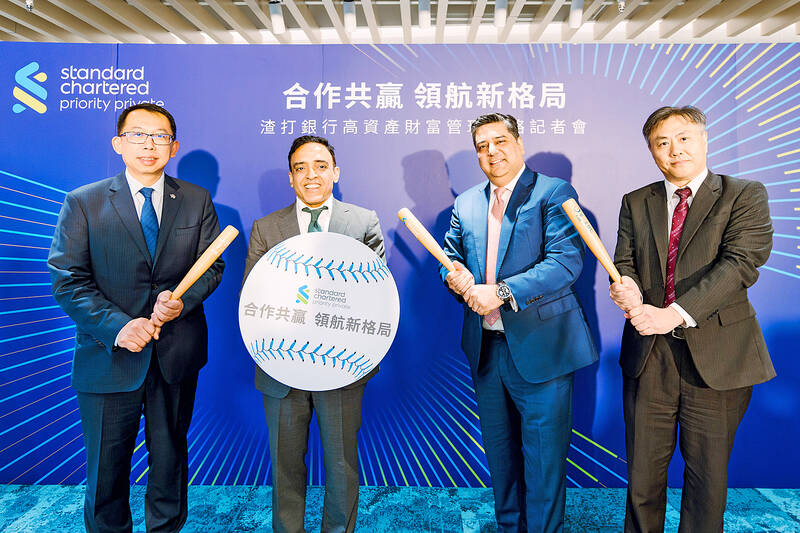

At a launch ceremony yesterday attended by Standard Chartered Bank’s global head of wealth solutions, deposits and mortgages Samir Subberwal, the bank in collaboration with its strategic partner Prudential Life Insurance and fund issuer First Securities Investment Trust launched its unique investment solutions to serve the needs of its high-net-worth clients in the Kaohsiung Asia Management Zone.

As a leading international bank, Standard Chartered integrates its global network with local market expertise, pioneering in launching many international innovative solutions in Taiwan. This not only helps accelerate value to our clients but also aligns with Financial Supervisory Commission’s (FSC) vision of the Asset Management Center in Taiwan. Going forwards, Standard Chartered Bank will continually strengthen the bank’s wealth management capabilities in collaboration with its partners to provide its clients with best-in-class services.

Photo courtesy of Standard Chartered Bank

During the speech made at the event, Samir Subberwal stated that this also demonstrates the high importance Standard Chartered places on Taiwan as a market. Subberwal said, “as a leading international wealth management institution, Standard Chartered leverages its distinctive international network spanning over 50 markets and 4 wealth hubs, combined with strong local influence, to create a diverse wealth management platform for high-net-worth clients. By integrating professional expertise and international experience, our wealth solutions are unique and innovative.”

Samir Subberwal emphasized that Standard Chartered is strategically positioning itself in Taiwan’s high-net-worth wealth management development picture. Standard Chartered has entered the local asset management zone in Kaohsiung in July and partnered with PCA Life Insurance as first international bank to launch Premium Financing solution in August, showcasing its collaboration with the global and local partners. The group has set its goal to achieve double-digit growth in wealth management business in five years, the potential of the Taiwan market is critical and highly promising.

Samrat Khosla, head of wealth management at Standard Chartered Bank Taiwan, stated that this year is the 40th anniversary of Standard Chartered in Taiwan. “Over these decades, we are privileged to grow and manage wealth of our affluent and high net worth clients. We have observed increasing expectations for global asset allocation, sophisticated wealth advisory and cross-border investment opportunities,” he stressed. Looking ahead, Standard Chartered remains committed to building its leadership by continuing to strengthen the bank’s capabilities and deepen its collaboration with its partners to deliver world-class wealth solutions to the clients.

In addition to the strong partnership with PCA Life Insurance, the bank also announced its collaboration with First Securities Investment Trust and Brookfield Oaktree Wealth Solutions to introduce the first Alternative Fund solution on an international banking trust platform for high-net-worth clients. By investing in non-traditional assets beyond stocks, bonds, and cash (such as private credit, private equity and real assets), the bank aims to reduce the overall volatility of high-net-worth clients’ investment portfolios, achieves goal of risk diversification, and returns enhancement and resistance to inflation.

Standard Chartered Bank Taiwan will continue to enrich its wealth management solutions with the introduction of Lombard Lending in the near future.

Mercuries Life Insurance Co (三商美邦人壽) shares surged to a seven-month high this week after local media reported that E.Sun Financial Holding Co (玉山金控) had outbid CTBC Financial Holding Co (中信金控) in the financially strained insurer’s ongoing sale process. Shares of the mid-sized life insurer climbed 5.8 percent this week to NT$6.72, extending a nearly 18 percent rally over the past month, as investors bet on the likelihood of an impending takeover. The final round of bidding closed on Thursday, marking a critical step in the 32-year-old insurer’s search for a buyer after years of struggling to meet capital adequacy requirements. Local media reports

US sports leagues rushed to get in on the multi-billion US dollar bonanza of legalized betting, but the arrest of an National Basketball Association (NBA) coach and player in two sprawling US federal investigations show the potential cost of partnering with the gambling industry. Portland Trail Blazers coach Chauncey Billups, a former Detroit Pistons star and an NBA Hall of Famer, was arrested for his alleged role in rigged illegal poker games that prosecutors say were tied to Mafia crime families. Miami Heat guard Terry Rozier was charged with manipulating his play for the benefit of bettors and former NBA player and

The DBS Foundation yesterday announced the launch of two flagship programs, “Silver Motion” and “Happier Caregiver, Healthier Seniors,” in partnership with CCILU Ltd, Hondao Senior Citizens’ Welfare Foundation and the Garden of Hope Foundation to help Taiwan face the challenges of a rapidly aging population. The foundation said it would invest S$4.91 million (US$3.8 million) over three years to foster inclusion and resilience in an aging society. “Aging may bring challenges, but it also brings opportunities. With many Asian markets rapidly becoming super-aged, the DBS Foundation is working with a regional ecosystem of like-minded partners across the private, public and people sectors

BREAKTHROUGH TECH: Powertech expects its fan-out PLP system to become mainstream, saying it can offer three-times greater production throughput Chip packaging service provider Powertech Technology Inc (力成科技) plans to more than double its capital expenditures next year to more than NT$40 billion (US$1.31 billion) as demand for its new panel-level packaging (PLP) technology, primarily used in chips for artificial intelligence (AI) applications, has greatly exceeded what it can supply. A significant portion of the budget, about US$1 billion, would be earmarked for fan-out PLP technology, Powertech told investors yesterday. Its heavy investment in fan-out PLP technology over the past 10 years is expected to bear fruit in 2027 after the technology enters volume production, it said, adding that the tech would