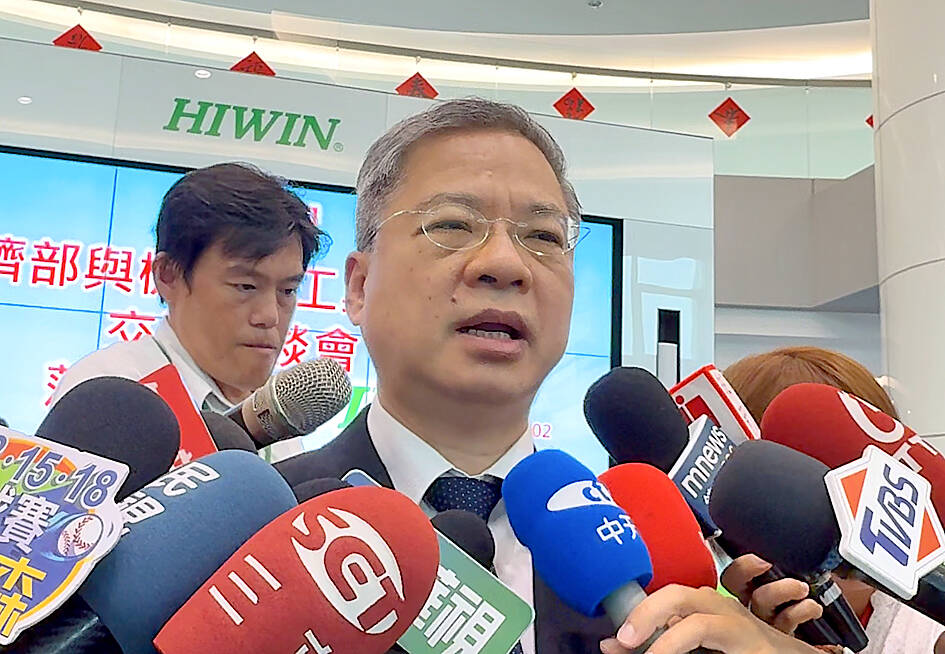

Minister of Economic Affairs Kung Ming-hsin (龔明鑫) yesterday said the government would stand by the machine tool and machinery industries, as they are the backbone of the domestic manufacturing industry, and vowed not to withdraw financial aid when needed.

The two industries are facing headwinds from the US’ decision last month to impose a 20 percent tariff on Taiwanese goods.

Without them, local manufacturing would be severely affected, Kung told reporters after meeting with industry representatives in Taichung.

Photo: Tsai Shu-yuan, Taipei Times

During the meeting, manufacturers voiced concern over exchange rate volatility, with the New Taiwan dollar trading at about NT$30.5 to the US dollar, Kung said.

They would like to see greater stability in the short term, as fluctuations complicate price quotations, he said.

As many small and medium-sized enterprises (SMEs) lack experience with foreign-exchange hedging, the ministry is offering assistance through hedging tools and financing programs via the Small and Medium Enterprise Credit Guarantee Fund of Taiwan (信保基金), he said.

The fund provided NT$143.38 billion (US$4.67 billion) in loan guarantees to SMEs and micro-enterprises last month, down 7.73 percent from NT$155.4 billion in July, a fund official told the Taipei Times by telephone.

In the first eight months of this year, total loan guarantees rose 5.85 percent to NT$1.13 trillion from NT$1.07 trillion a year earlier, the official said on condition of anonymity, adding that the fund would do its best to comply with the ministry’s policy.

If companies make regular interest payments, the guarantee fund would allow them to extend loans without reapplying, while the government would also provide financing and potentially lower interest rates to support overseas expansion, Kung said.

Companies investing in innovation — whether by replacing outdated equipment or upgrading research and development capacity — would likewise receive government backing, he said.

However, as the ministry is currently offering only urgent and limited aid through last year’s earmarked budget, Kung urged the legislature to swiftly approve a special budget to expand overseas support for companies.

He was referring to a NT$93 billion special budget under the Special Act for Strengthening Economic, Social and National Security Resilience in Response to International Circumstances (因應國際情勢強化經濟社會及民生國安韌性特別條例), designed to cushion the impact of US tariffs.

As overseas exhibitions and booths at international trade shows are costly and burdensome for SMEs, such support is especially critical, Kung said.

Machine tool and machinery makers attending the meeting yesterday included Hiwin Technologies Corp (上銀), Fair Friend Enterprise Co (友嘉實業), Tongtai Machine & Tool Co (東台精機), Victor Taichung Machinery Works Co (台中精機), Leadermac Machinery Co (勝源機械), Honor Seiki Co (榮田精機), Yinsh Precision Industrial Co (盈錫精密), Taiwan Takisawa Technology Co (台灣瀧澤), Quaser Machine Tools Inc (百德機械) and Ching Yuan Mechatronics Co (慶源機電).

To help address the challenges facing local businesses, Kung said he would spend the rest of the week meeting with industry and business associations, visiting companies and consulting legislators.

PERSISTENT RUMORS: Nvidia’s CEO said the firm is not in talks to sell AI chips to China, but he would welcome a change in US policy barring the activity Nvidia Corp CEO Jensen Huang (黃仁勳) said his company is not in discussions to sell its Blackwell artificial intelligence (AI) chips to Chinese firms, waving off speculation it is trying to engineer a return to the world’s largest semiconductor market. Huang, who arrived in Taiwan yesterday ahead of meetings with longtime partner Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), took the opportunity to clarify recent comments about the US-China AI race. The Nvidia head caused a stir in an interview this week with the Financial Times, in which he was quoted as saying “China will win” the AI race. Huang yesterday said

Nissan Motor Co has agreed to sell its global headquarters in Yokohama for ¥97 billion (US$630 million) to a group sponsored by Taiwanese autoparts maker Minth Group (敏實集團), as the struggling automaker seeks to shore up its financial position. The acquisition is led by a special purchase company managed by KJR Management Ltd, a Japanese real-estate unit of private equity giant KKR & Co, people familiar with the matter said. KJR said it would act as asset manager together with Mizuho Real Estate Management Co. Nissan is undergoing a broad cost-cutting campaign by eliminating jobs and shuttering plants as it grapples

The Chinese government has issued guidance requiring new data center projects that have received any state funds to only use domestically made artificial intelligence (AI) chips, two sources familiar with the matter told Reuters. In recent weeks, Chinese regulatory authorities have ordered such data centers that are less than 30 percent complete to remove all installed foreign chips, or cancel plans to purchase them, while projects in a more advanced stage would be decided on a case-by-case basis, the sources said. The move could represent one of China’s most aggressive steps yet to eliminate foreign technology from its critical infrastructure amid a

MORE WEIGHT: The national weighting was raised in one index while holding steady in two others, while several companies rose or fell in prominence MSCI Inc, a global index provider, has raised Taiwan’s weighting in one of its major indices and left the country’s weighting unchanged in two other indices after a regular index review. In a statement released on Thursday, MSCI said it has upgraded Taiwan’s weighting in the MSCI All-Country World Index by 0.02 percentage points to 2.25 percent, while maintaining the weighting in the MSCI Emerging Markets Index, the most closely watched by foreign institutional investors, at 20.46 percent. Additionally, the index provider has left Taiwan’s weighting in the MSCI All-Country Asia ex-Japan Index unchanged at 23.15 percent. The latest index adjustments are to