Prices of gasoline products at domestic fuel stations are this week to drop NT$0.2 per liter, while diesel prices are to remain unchanged from last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday.

The price adjustments came even as international crude oil prices fluctuated in a narrow range last week, with the average prices higher than the previous week, amid a mixed bag of positive and negative factors, the companies said.

The factors included Saudi Arabia announcing price hikes for crude oil sold to Asia, Yemen’s Houthi rebels attacking cargo ships in Red Sea, the US Energy Information Administration lowering US crude oil production growth this year and markets worrying that the new round of US tariffs could hit the global economy, the companies added.

Front-month Brent crude oil futures — the international oil benchmark — last week gained 3.02 percent to settle at US$70.36 per barrel on the Intercontinental Exchange, while West Texas Intermediate crude oil futures — the US oil gauge — rose 2.16 percent to US$68.45 per barrel on the New York Mercantile Exchange.

CPC and Formosa adjusted gasoline prices downward after taking into account global oil market trends, the exchange rate for the New Taiwan dollar and intense competition in the domestic market, the companies said.

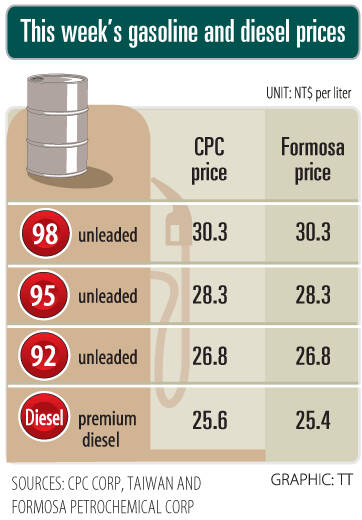

Effective today, gasoline prices at CPC and Formosa stations are to fall to NT$26.8, NT$28.3 and NT$30.3 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to stay at NT$25.6 per liter at CPC stations and NT$25.4 at Formosa pumps, they said.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Nvidia Corp’s GB300 platform is expected to account for 70 to 80 percent of global artificial intelligence (AI) server rack shipments this year, while adoption of its next-generation Vera Rubin 200 platform is to gradually gain momentum after the third quarter of the year, TrendForce Corp (集邦科技) said. Servers based on Nvidia’s GB300 chips entered mass production last quarter and they are expected to become the mainstay models for Taiwanese server manufacturers this year, Trendforce analyst Frank Kung (龔明德) said in an interview. This year is expected to be a breakout year for AI servers based on a variety of chips, as

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)