Apple Inc has brought in Tata Group to handle repairs for iPhones and MacBook devices in its fast-growing Indian market, signalling the Indian conglomerate’s deepening role in the US tech giant’s supply chain, two people familiar with the matter said.

As Apple looks beyond China for manufacturing, Tata has fast emerged as its key supplier and already assembles iPhones for local and foreign markets at three facilities in south India, with one of them also making some iPhone components.

In its latest partnership expansion, Tata is taking over the mandate from an Indian unit of Taiwan’s Wistron Corp (緯創), ICT Service Management Solutions (India) Pvt Ltd, and will carry out such after-sales repairs from its Karnataka iPhone assembly campus, both sources said.

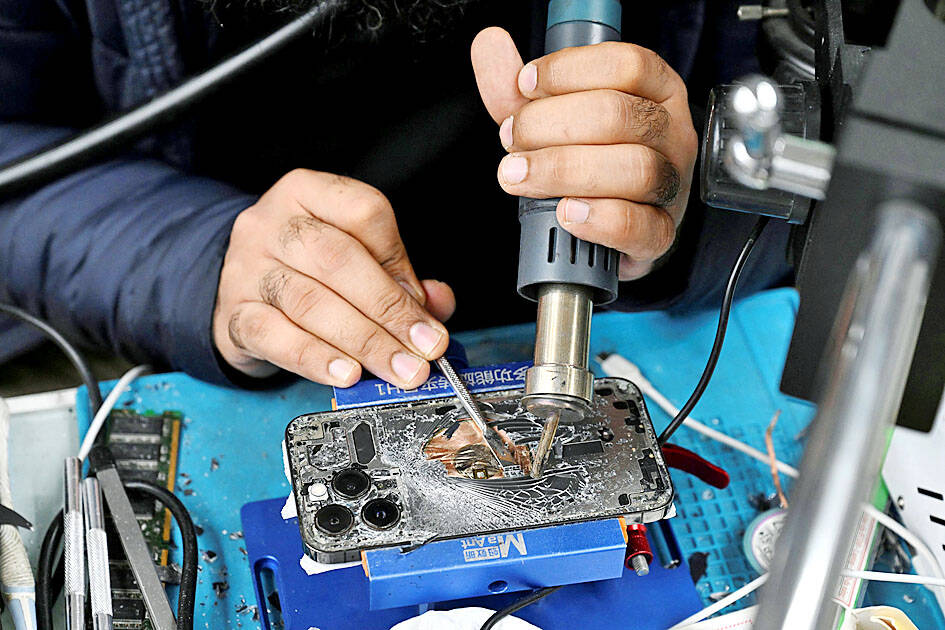

Photo: Jaimi Joy, Reuters

The market for repairs is only going to boom in India, the world’s second-biggest smartphone market, as iPhone sales skyrocket. Counterpoint Research estimates around 11 million iPhones were sold in India last year, giving Apple a 7 percent market share, compared to just 1 percent in 2020.

The latest contract award signals Apple’s growing confidence on Tata as it hopes to win more business from the world’s most valuable smartphone company.

“Tata’s deepening partnership with Apple could also pave the groundwork for Apple directly selling refurbished devices in India, like how it does in the United States currently,” Cybermedia Research vice president Prabhu Ram said.

While Apple’s official service centers across India can do basic repairs, they would now ship phones and laptops to Tata’s facility for more complex issues.

However, Wistron’s ICT will continue to service other clients excluding Apple, one of the sources said.

Amid an impending threat of US President Donald Trump’s tariffs on China, India is also emerging as a favored destination for iPhone exports. Apple CEO Tim Cook has said the bulk of iPhones sold in the US this quarter will be made at factories in India.

When Lika Megreladze was a child, life in her native western Georgian region of Guria revolved around tea. Her mother worked for decades as a scientist at the Soviet Union’s Institute of Tea and Subtropical Crops in the village of Anaseuli, Georgia, perfecting cultivation methods for a Georgian tea industry that supplied the bulk of the vast communist state’s brews. “When I was a child, this was only my mum’s workplace. Only later I realized that it was something big,” she said. Now, the institute lies abandoned. Yellowed papers are strewn around its decaying corridors, and a statue of Soviet founder Vladimir Lenin

UNIFYING OPPOSITION: Numerous companies have registered complaints over the potential levies, bringing together rival automakers in voicing their reservations US President Donald Trump is readying plans for industry-specific tariffs to kick in alongside his country-by-country duties in two weeks, ramping up his push to reshape the US’ standing in the global trading system by penalizing purchases from abroad. Administration officials could release details of Trump’s planned 50 percent duty on copper in the days before they are set to take effect on Friday next week, a person familiar with the matter said. That is the same date Trump’s “reciprocal” levies on products from more than 100 nations are slated to begin. Trump on Tuesday said that he is likely to impose tariffs

HELPING HAND: Approving the sale of H20s could give China the edge it needs to capture market share and become the global standard, a US representative said The US President Donald Trump administration’s decision allowing Nvidia Corp to resume shipments of its H20 artificial intelligence (AI) chips to China risks bolstering Beijing’s military capabilities and expanding its capacity to compete with the US, the head of the US House Select Committee on Strategic Competition Between the United States and the Chinese Communist Party said. “The H20, which is a cost-effective and powerful AI inference chip, far surpasses China’s indigenous capability and would therefore provide a substantial increase to China’s AI development,” committee chairman John Moolenaar, a Michigan Republican, said on Friday in a letter to US Secretary of

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) market value closed above US$1 trillion for the first time in Taipei last week, with a raised sales forecast driven by robust artificial intelligence (AI) demand. TSMC saw its Taiwanese shares climb to a record high on Friday, a near 50 percent rise from an April low. That has made it the first Asian stock worth more than US$1 trillion, since PetroChina Co (中國石油天然氣) briefly reached the milestone in 2007. As investors turned calm after their aggressive buying on Friday, amid optimism over the chipmaker’s business outlook, TSMC lost 0.43 percent to close at NT$1,150