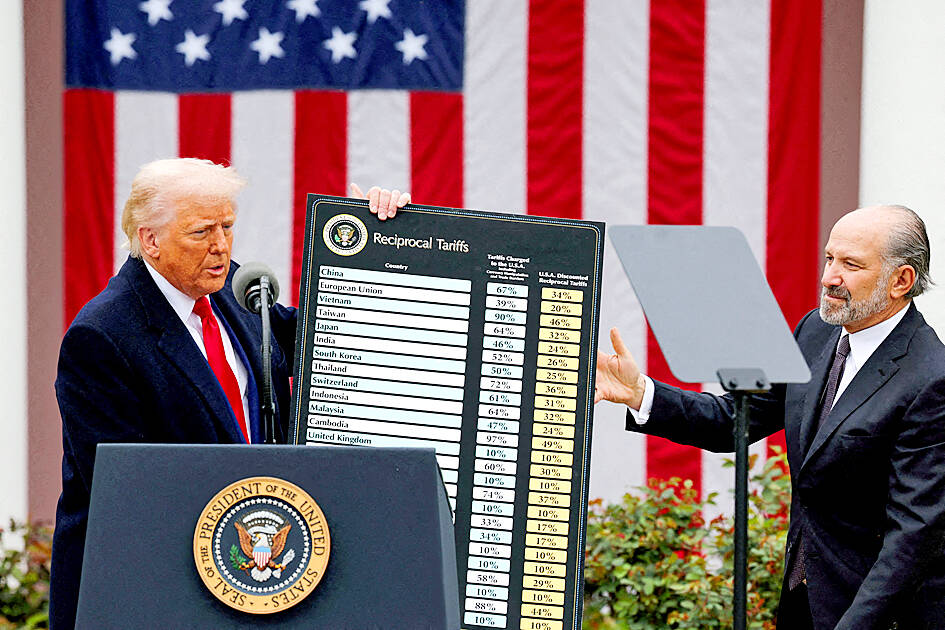

A federal appeals court offered US President Donald Trump a temporary reprieve from a ruling threatening to throw out the bulk of his sweeping tariff agenda, giving at least some hope to a White House now facing substantial new restrictions on its effort to rewrite the global trading order.

The administration celebrated the order from the US Court of Appeals for the Federal Circuit as validating its vow to aggressively challenge a ruling issued on Wednesday night by the Court of International Trade blocking sweeping parts of Trump’s tariffs over his use of the International Emergency Economic Powers Act (IEEPA).

White House officials also said that Trump has options to pursue similar tariffs through other authorities if appeals ultimately fall short, even as they planned to continue defending the legality of the IEEPA tariffs to the US Supreme Court.

Photo: Reuters

However, for a president eager to use trade policy to quickly reshape global commerce, other options would be more complicated and bind the threats he has able to wield in the negotiation process with other world leaders. Some alternative US tariff options are laborious to use and would take months to execute, while others are capped in scope and duration.

Trump hailed the appeals court ruling in a social media post on Thursday, while calling the original decision “so wrong and so political.” He claimed that seeking congressional approval for tariffs would hinder his trade agenda and “completely destroy Presidential Power.”

Despite the temporary stay, the possibility that the appeals court could ultimately back the original ruling and block Trump’s tariff policy hung heavy over the White House.

Separately, a second federal judge declared a number of Trump’s levies enacted using emergency powers unlawful, but limited his decision to the family-owned business that sued and delayed the order from taking effect for 14 days to allow the US Department of Justice time to appeal.

“America cannot function if President Trump — or any other president, for that matter — has their sensitive diplomatic or trade negotiations railroaded by activist judges,” White House press secretary Karoline Leavitt said. “Ultimately, the Supreme Court must put an end to this for the sake of our constitution and our country.”

The original court ruling would have provided the Trump administration just 10 days to unwind the levies, but the new order laid out a briefing schedule that runs until June 9 to decide on the request for a longer-term stay. If granted — or if a subsequent appeal to the Supreme Court was granted — the tariffs could remain in place for months.

For all of the confidence on Trump’s team, Wednesday’s initial court ruling marked one of the biggest setbacks of the president’s second term. Trump campaigned on using tariffs to combat what he calls other nation’s unfair treatment of the US, and the emergency law gave him the fastest avenue to deliver on his pledge.

The ruling would reduce the effective US tariff rate to below 6 percent from a high of almost 27 percent last month, according to Bloomberg Economics calculations, an astronomical level that risked stagflation for the US.

The legal fight also threatens to inject even more uncertainty into a world economy already rattled by Trump’s ever-changing posture on import taxes. It might sap Trump’s leverage as his team negotiates with numerous trading partners seeking tariff relief.

The trade court decision on Wednesday blocked tariffs on Mexico, Canada and China, as well as a flat import tax on almost every US trading partner.

Trump invoked the IEEPA on the grounds that fentanyl and trade deficits are each emergencies necessitating the broad use of executive power. The court ruled that he went too far.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) secured a record 70.2 percent share of the global foundry business in the second quarter, up from 67.6 percent the previous quarter, and continued widening its lead over second-placed Samsung Electronics Co, TrendForce Corp (集邦科技) said on Monday. TSMC posted US$30.24 billion in sales in the April-to-June period, up 18.5 percent from the previous quarter, driven by major smartphone customers entering their ramp-up cycle and robust demand for artificial intelligence chips, laptops and PCs, which boosted wafer shipments and average selling prices, TrendForce said in a report. Samsung’s sales also grew in the second quarter, up

LIMITED IMPACT: Investor confidence was likely sustained by its relatively small exposure to the Chinese market, as only less advanced chips are made in Nanjing Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) saw its stock price close steady yesterday in a sign that the loss of the validated end user (VEU) status for its Nanjing, China, fab should have a mild impact on the world’s biggest contract chipmaker financially and technologically. Media reports about the waiver loss sent TSMC down 1.29 percent during the early trading session yesterday, but the stock soon regained strength and ended at NT$1,160, unchanged from Tuesday. Investors’ confidence in TSMC was likely built on its relatively small exposure to the Chinese market, as Chinese customers contributed about 9 percent to TSMC’s revenue last

Taiwan and Japan will kick off a series of cross border listings of exchange-traded funds (ETFs) this month, a milestone for the internationalization of the local ETF market, the Taiwan Stock Exchange (TWSE) said Wednesday. In a statement, the TWSE said the cross border ETF listings between Taiwan and Japan are expected to boost the local capital market’s visibility internationally and serve as a key for Taiwan becoming an asset management hub in the region. An ETF, a pooled investment security that is traded like an individual stock, can be tracked from the price of a single stock to a large and

Despite global geopolitical uncertainties and macroeconomic volatility, DBS Bank Taiwan (星展台灣) yesterday reported that its first-half revenue rose 10 percent year-on-year to a record NT$16.5 billion (US$537.8 million), while net profit surged 65 percent to an unprecedented NT$4.4 billion. The nation’s largest foreign bank made the announcement on the second anniversary of its integration with Citibank Taiwan Ltd’s (花旗台灣) consumer banking business. “Taiwan is a key market for DBS. Over the years, we have consistently demonstrated our commitment to deepening our presence in Taiwan, not only via continued investment to support franchise growth, but also through a series of bolt-on acquisitions,” DBS