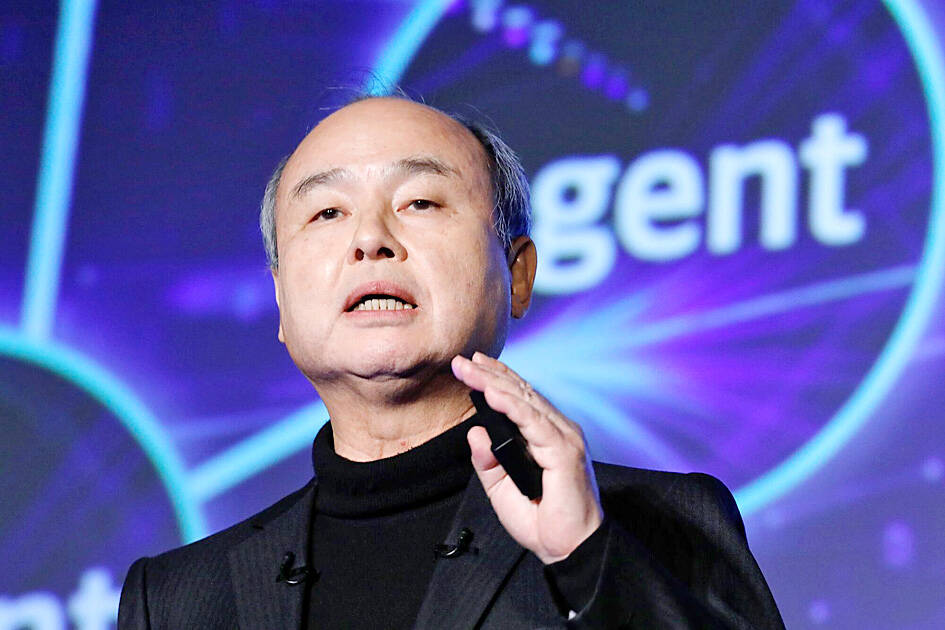

Softbank Group Corp founder Masayoshi Son has proposed setting up a US-Japan sovereign wealth fund aimed at making large investments in technology and infrastructure, the Financial Times reported, citing three unidentified people close to the situation.

Son has discussed the plan with US Secretary of the Treasury Scott Bessent, although it has not been formally proposed, the report said.

The joint fund would likely need about US$300 billion in initial capital, with significant leverage, to be effective, one person told the Financial Times.

Photo: Bloomberg

The fund would be jointly owned and run by the US Department of the Treasury and the Japanese Ministry of Finance, with each holding a significant stake, the report said.

The fund could also be opened to limited partner investors, potentially offering retail investors in Japan and the US a chance to participate.

Bessent has been looking for revenue streams for the US Treasury that do not involve raising taxes, and the fund could potentially provide a solution, a person briefed on the situation told the newspaper.

However, Bessent on Friday said US President Donald Trump paused plans to create a sovereign wealth fund as the president prioritizes paying down the national debt.

“I think the president has decided it’s on pause while we work on everything else that we’re doing now,” Bessent said in an interview on Bloomberg Television’s Wall Street Week with David Westin. “He said the other day that we’ll probably spend more time paying down debt. He is laser-focused on paying down debt.”

Trump in February ordered a plan to create one of the biggest such funds in the world, suggesting it could be backed by monetizing government assets and used for strategic investments including critical minerals projects or stakes in companies such as TikTok.

Bessent at the time said that the fund could be up and running in 12 months.

However, the ambition has slid down the list of priorities after running into legal, financial and political realities. Instead, the administration is pivoting to a potentially simpler and limited investment vehicle using existing agencies that would not need congressional approval.

Bessent and US Secretary of Commerce Howard Lutnick, who Trump tasked with coming up with the proposal within 90 days, submitted their ideas earlier this month, but White House officials were not satisfied and a final plan was not presented to Trump for approval, people familiar with the situation said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.