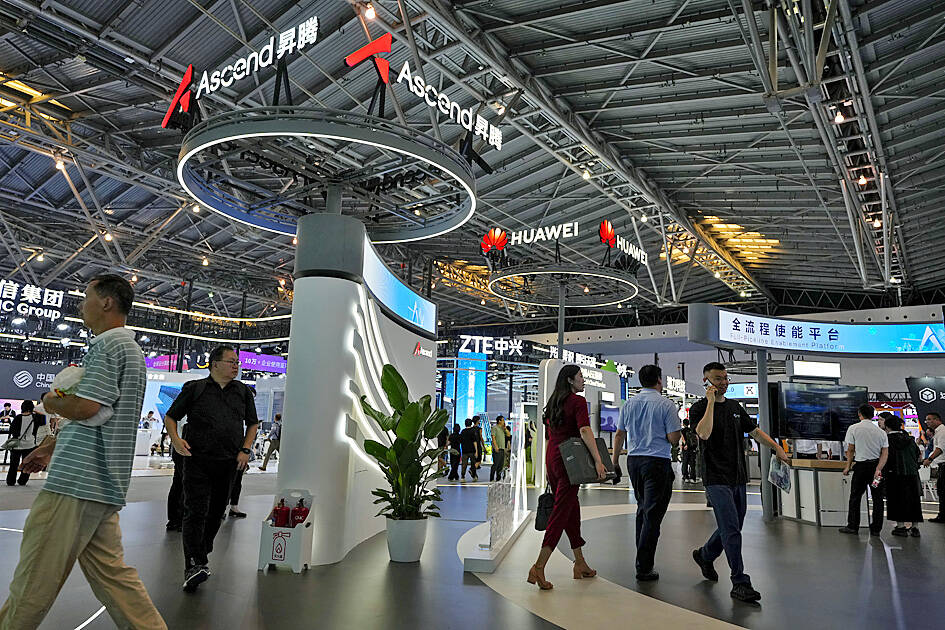

Malaysia declared it’ll build a first-of-its-kind artificial intelligence (AI) system powered by Huawei Technologies Co (華為) chips, only to distance itself from that statement a day later, underscoring the Asian nation’s delicate position in the US-Chinese AI race.

Malaysian Deputy Minister of Communications Teo Nie Ching (張念群) said in a speech on Monday that her country would be the first to activate an unspecified class of Huawei “Ascend GPU-powered AI servers at national scale.”

Malaysia would deploy 3,000 units of Huawei’s primary AI offering by next year, she said in prepared remarks reviewed by Bloomberg News. Chinese start-up DeepSeek (深度求索) would also make one of its AI models available to the Southeast Asian country, the official added.

Photo: Andy Wong, AP

The project, first reported by the local outlet Malaysia-China Insight, caught the attention of the White House, which is working to prevent Beijing from capturing foreign AI markets.

“As I’ve been warning, the full Chinese stack is here,” David Sacks, US President Donald Trump’s AI and crypto czar, wrote on X. The Trump administration was rescinding Biden-era global semiconductor curbs, which restricted chip sales to Malaysia, “just in time,” he said.

When reached for comment by Bloomberg News on Tuesday, Teo’s office said it’s retracting her remarks on Huawei without explanation. It’s unclear whether the project will proceed as planned.

A Huawei representative said that the company hasn’t sold Ascend chips in Malaysia and that the government hasn’t bought any.

The unusual about-face comes after the US Department of Commerce released — then tweaked — guidance warning overseas companies against using Huawei’s Ascend. The use of those chips “anywhere in the world” could violate US export controls, the agency originally said, before removing that globally focused language during a spat with Beijing.

Malaysia is in many ways the perfect test of the Trump administration’s new-fashioned AI diplomacy. The idea, championed in part by Sacks, is to proliferate American AI hardware across the world — with security guardrails — to ensure that companies building data centers in Southeast Asia or the Middle East don’t turn to Chinese alternatives. The US has limited time to entrench itself in those markets, Sacks argues, as Huawei makes progress in catching up with industry leader Nvidia Corp.

At the same time, the Trump administration has promised to crack down on illegal shipments of advanced Nvidia chips to China via third countries. Officials have identified Malaysia as a particular concern.

The Trump administration’s urgency stems in part from the growing prowess of Huawei, which has emerged as China’s national semiconductor champion since its breakthrough in processors for the Mate 60 Pro in 2023. The company has since expanded into adjacent arenas from electric vehicles to AI, where it’s begun making chips it hopes can compete with Nvidia.

Huawei’s Ascend lineup is thought to be so far largely confined to use in China by domestic firms that otherwise can’t legally access Nvidia’s cutting-edge products. The Ascend chips are still quite capable, though, particularly in running AI services, according to industry experts.

Trump officials this year pressured Malaysian authorities to crack down on semiconductor transshipment to China. The country is also in the cross hairs of a court case in Singapore, where three men have been charged with fraud for allegedly disguising the ultimate customer of AI servers that may contain high-end Nvidia chips barred from China. Malaysian officials are probing the issue.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) secured a record 70.2 percent share of the global foundry business in the second quarter, up from 67.6 percent the previous quarter, and continued widening its lead over second-placed Samsung Electronics Co, TrendForce Corp (集邦科技) said on Monday. TSMC posted US$30.24 billion in sales in the April-to-June period, up 18.5 percent from the previous quarter, driven by major smartphone customers entering their ramp-up cycle and robust demand for artificial intelligence chips, laptops and PCs, which boosted wafer shipments and average selling prices, TrendForce said in a report. Samsung’s sales also grew in the second quarter, up

LIMITED IMPACT: Investor confidence was likely sustained by its relatively small exposure to the Chinese market, as only less advanced chips are made in Nanjing Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) saw its stock price close steady yesterday in a sign that the loss of the validated end user (VEU) status for its Nanjing, China, fab should have a mild impact on the world’s biggest contract chipmaker financially and technologically. Media reports about the waiver loss sent TSMC down 1.29 percent during the early trading session yesterday, but the stock soon regained strength and ended at NT$1,160, unchanged from Tuesday. Investors’ confidence in TSMC was likely built on its relatively small exposure to the Chinese market, as Chinese customers contributed about 9 percent to TSMC’s revenue last

LOOPHOLES: The move is to end a break that was aiding foreign producers without any similar benefit for US manufacturers, the US Department of Commerce said US President Donald Trump’s administration would make it harder for Samsung Electronics Co and SK Hynix Inc to ship critical equipment to their chipmaking operations in China, dealing a potential blow to the companies’ production in the world’s largest semiconductor market. The US Department of Commerce in a notice published on Friday said that it was revoking waivers for Samsung and SK Hynix to use US technologies in their Chinese operations. The companies had been operating in China under regulations that allow them to import chipmaking equipment without applying for a new license each time. The move would revise what is known

UNCERTAINTY: A final ruling against the president’s tariffs would upend his trade deals and force the government to content with billions of dollars in refunds The legal fight over US President Donald Trump’s global tariffs is deepening after a federal appeals court ruled the levies were issued illegally under an emergency law, extending the chaos in global trade. A 7-4 decision by a panel of judges on Friday was a major setback for Trump, even as it gives both sides something to boast about. The majority upheld a May ruling by the Court of International Trade that the tariffs were illegal. However, the judges left the levies intact while the case proceeds, as Trump had requested, and suggested that any injunction could potentially be narrowed to apply