The output value of Taiwan’s semiconductor sector is expected to rise more than 19 percent this year due to stronger performances in the integrated circuit (IC) manufacturing and design segments, the Industrial Technology Research Institute (ITRI, 工研院) said last week.

The output of the local semiconductor industry is expected to reach NT$6.33 trillion (US$209.8 billion) this year, up 19.1 percent from a year earlier, the government-supported institute said in its latest IEK Current Quarterly Model report.

The estimate was more optimistic than a previous ITRI forecast in February, which projected a 16.2 percent increase to NT$6.17 trillion.

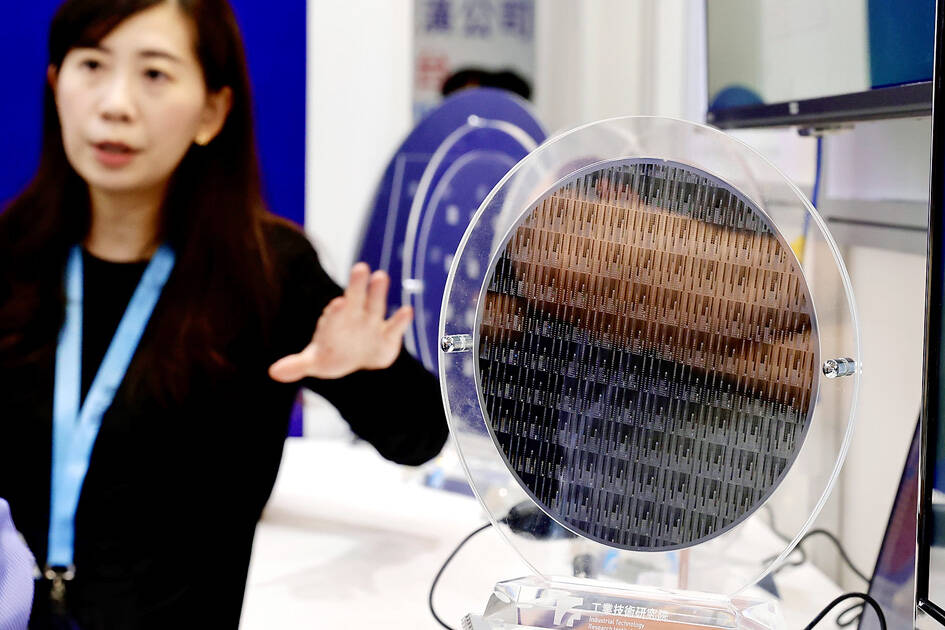

Photo: EPA-EFE

By segment, the output of local IC manufacturing is expected to rise 23.1 percent from a year earlier to NT$4.2 trillion, beating an earlier forecast of a 19.4 percent increase, the ITRI said.

The output value of the IC design segment is expected to grow 13.9 percent to NT$1.44 trillion, beating the previous estimate of an 11.3 percent rise, the institute said.

The IC packaging segment is expected to generate NT$461.5 billion in output, up 9 percent from a year earlier, while the IC testing segment is expected to post output of NT$212.2 billion, up 6 percent from a year earlier, it added.

Contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, has forecast its sales would grow by 24 percent to 26 percent this year in US dollar terms, due to strong demand for high-end processes in artificial intelligence applications.

That is expected to drive up the growth of Taiwan’s IC manufacturing and IC design businesses, analysts said.

In the first quarter, the production value of Taiwan’s semiconductor industry totaled NT$1.48 trillion, falling 0.4 percent from a quarter earlier, but soaring 27.6 percent from a year earlier.

Many customers of Taiwan’s IC industry rushed to place large orders ahead of schedule in the first quarter to avoid US President Donald Trump’s chaotic tariff policy, boosting production in the traditionally slow quarter, the ITRI said.

Looking ahead to the second quarter, the output of Taiwan’s IC industry is expected to hit NT$1.53 trillion, up 20.6 percent from a year earlier and up 2.9 percent from a quarter earlier, the institute said.

Real estate agent and property developer JSL Construction & Development Co (愛山林) led the average compensation rankings among companies listed on the Taiwan Stock Exchange (TWSE) last year, while contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) finished 14th. JSL Construction paid its employees total average compensation of NT$4.78 million (US$159,701), down 13.5 percent from a year earlier, but still ahead of the most profitable listed tech giants, including TSMC, TWSE data showed. Last year, the average compensation (which includes salary, overtime, bonuses and allowances) paid by TSMC rose 21.6 percent to reach about NT$3.33 million, lifting its ranking by 10 notches

Popular vape brands such as Geek Bar might get more expensive in the US — if you can find them at all. Shipments of vapes from China to the US ground to a near halt last month from a year ago, official data showed, hit by US President Donald Trump’s tariffs and a crackdown on unauthorized e-cigarettes in the world’s biggest market for smoking alternatives. That includes Geek Bar, a brand of flavored vapes that is not authorized to sell in the US, but which had been widely available due to porous import controls. One retailer, who asked not to be named, because

SEASONAL WEAKNESS: The combined revenue of the top 10 foundries fell 5.4%, but rush orders and China’s subsidies partially offset slowing demand Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) further solidified its dominance in the global wafer foundry business in the first quarter of this year, remaining far ahead of its closest rival, Samsung Electronics Co, TrendForce Corp (集邦科技) said yesterday. TSMC posted US$25.52 billion in sales in the January-to-March period, down 5 percent from the previous quarter, but its market share rose from 67.1 percent the previous quarter to 67.6 percent, TrendForce said in a report. While smartphone-related wafer shipments declined in the first quarter due to seasonal factors, solid demand for artificial intelligence (AI) and high-performance computing (HPC) devices and urgent TV-related orders

STILL LOADED: Last year’s richest person, Quanta Computer Inc chairman Barry Lam, dropped to second place despite an 8 percent increase in his wealth to US$12.6 billion Staff writer, with CNA Daniel Tsai (蔡明忠) and Richard Tsai (蔡明興), the brothers who run Fubon Group (富邦集團), topped the Forbes list of Taiwan’s 50 richest people this year, released on Wednesday in New York. The magazine said that a stronger New Taiwan dollar pushed the combined wealth of Taiwan’s 50 richest people up 13 percent, from US$174 billion to US$197 billion, with 36 of the people on the list seeing their wealth increase. That came as Taiwan’s economy grew 4.6 percent last year, its fastest pace in three years, driven by the strong performance of the semiconductor industry, the magazine said. The Tsai