The US President Donald Trump's administration is working on changes to a previous administration's rule that would limit global access to artificial intelligence (AI) chips, including possibly doing away with its splitting the world into tiers that help determine how many advanced semiconductors a country can obtain, three sources familiar with the matter said.

The sources said the plans were still under discussion and warned they could change. But if enacted, removing the tiers could open the door to using US chips as an even more powerful negotiating tool in trade talks. The regulation, which was issued in January, is aimed at dividing up access to the most advanced AI chips and controlling certain model weights in order to keep the most sophisticated computing power in the United States and among its allies, and away from China and other countries of concern.

The Framework for Artificial Intelligence Diffusion, as the rule is called, was issued by the US Department of Commerce in January, a week before the end of the administration of former US president Joe Biden. Companies must comply with its restrictions starting on May 15.

Photo: Ann Wang, Reuters

Currently, the rule has the world divided into three tiers. Seventeen countries and Taiwan in the first tier can receive unlimited chips. Some 120 other countries are in the second tier, which leaves them subject to caps on how many AI chips they can get. And countries of concern like China, Russia, Iran and North Korea in the third tier are blocked from the chips.

But Trump administration officials are weighing discarding the tiered approach to access in the rule and replacing it with a global licensing regime with government-to-government agreements, the sources said.

"There are some voices pushing for elimination of the tiers," Wilbur Ross, who served as Commerce secretary during the first Trump administration, said in an interview on Tuesday. "I think it's still a work in progress."

He said government-to-government agreements were one alternative. Such a structure would likely tie in to Trump's broader trade strategy of making deals with individual countries, one of the sources said. That would make it easier for the US to use access to American-designed chips as leverage in other negotiations.

US Secretary of Commerce Howard Lutnick said at a conference in March that he wanted to include export controls in trade talks.

Other possible changes include a lower threshold for an exception to licensing. Under the current rule, orders under the equivalent of about 1,700 of Nvidia Corp's powerful H100 chips do not count toward country caps and only require the government be notified about the order. No license is necessary.

The Trump administration is considering making the cutoff orders under the equivalent of 500 H100 chips, one source said.

A spokesperson for the commerce department declined comment. A spokesperson for the White House did not immediately respond to a request for comment.

For months, Trump administration officials have suggested they want to make the rule "stronger but simpler," but at least some experts believe removing the tiers will make the rule more complicated.

Oracle Corp executive vice president Ken Glueck, a critic of the current rule, said that the tiers did not make sense, noting that Israel and Yemen were both in the second tier.

"Wouldn't surprise me they're going to take a new look at this," said Glueck, who said he did not know the Trump administration's plan but expects the rule to be modified in a significant way.

Oracle and Nvidia were both outspoken in their criticism of the new rule when it was issued in January. Industry has argued that by limiting access to the chips, countries will buy the technology from China. Some US lawmakers have agreed. Seven Republican senators sent a letter to Lutnick last month asking for the rule to be withdrawn.

The restrictions would incentivize buyers, especially in Tier 2 countries, to turn to China's "unregulated cheap substitutes," the letter said.

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,

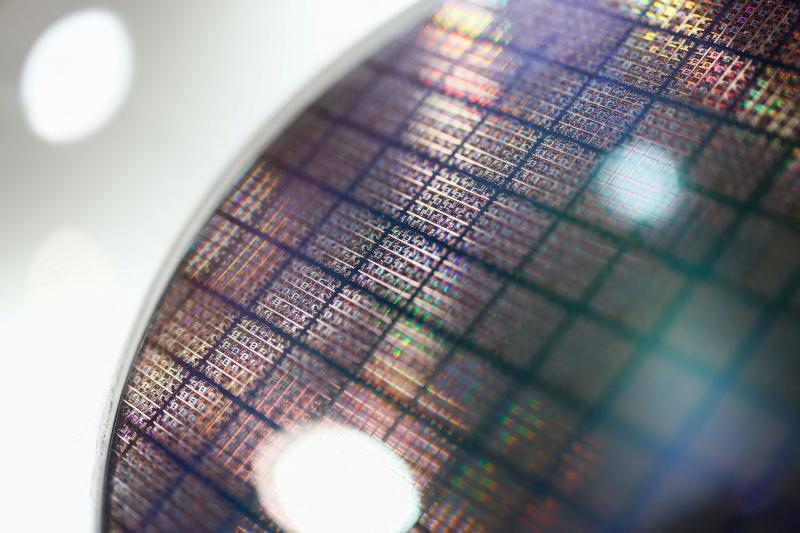

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,

‘BASICALLY A BAN’: Sources said the wording governing H200 imports from officials was severe, but added that the regulations might change if the situation evolves Chinese customs authorities told customs agents this week that Nvidia Corp’s H200 artificial intelligence (AI) chips are not permitted to enter China, three people briefed on the matter said. Chinese government officials also summoned domestic technology companies to meetings on Tuesday, at which they were explicitly instructed not to purchase the chips unless necessary, two of the people and a third source said. “The wording from the officials is so severe that it is basically a ban for now, though this might change in the future should things evolve,” one of the people said. The H200, Nvidia’s second-most powerful AI chip, is one

A proposed billionaires’ tax in California has ignited a political uproar in Silicon Valley, with tech titans threatening to leave the state while California Governor Gavin Newsom of the Democratic Party maneuvers to defeat a levy that he fears would lead to an exodus of wealth. A technology mecca, California has more billionaires than any other US state — a few hundred, by some estimates. About half its personal income tax revenue, a financial backbone in the nearly US$350 billion budget, comes from the top 1 percent of earners. A large healthcare union is attempting to place a proposal before