Discount Chinese retail app Temu appears to be passing on nearly all of US President Donald Trump’s new import taxes to US consumers, more than doubling the cost of some products in a move that may add to concern about the inflationary impact of tariffs.

Previously exempted from any levies under the so-called ‘de minimis’ rule, parcels priced up to US$800 now face an ad-valorem tax — of 120 percent of a product’s value — or a per postal item fee of at least US$100 starting on Friday. PDD Holdings Inc (拼多多)-owned Temu is requiring customers to pay those levies on top of the original cost of the goods.

A look at 14 shipped-from-China items on Temu’s bestsellers list showed taxes exceeded the value of the product. A US$19.49 power strip, for instance, attracted US$27.56 in import charges as of yesterday, or 1.41 times the price of the product. However, there are no import surcharges on items that are already available in US warehouses, keeping the prices of such goods generally stable.

Photo: Kirill Kudryavtsev, AFP

Among the top 80 items on Temu’s recommended bestsellers, 66 items are marked to be shipped from local warehouses, according to data compiled by Bloomberg. Temu and rival Shein Group Ltd (希音) previously said they will start adjusting prices one week ahead of Friday's de minimis tariff exemption removal.

The higher costs illustrate the impact of Trump’s tariffs, and they risk changing how Americans shop and disrupting shipments from the likes of Temu and Shein. The increase is part of Trump’s wider strategy to force China to seek a trade deal that would narrow Washington’s trade deficit with Beijing.

Temu has been asking Chinese factories to ship their goods in bulk to American warehouses back in February in what it calls a “half-custody” framework where it only manages the online marketplace.

However, as inventory in the US depletes over time, prices could eventually go up when factories replenish stocks if tariffs on Chinese imports remain elevated at 145 percent.

Fast-fashion giant Shein also raised US prices of its products, with hikes of more than 300 percent for certain items.

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the

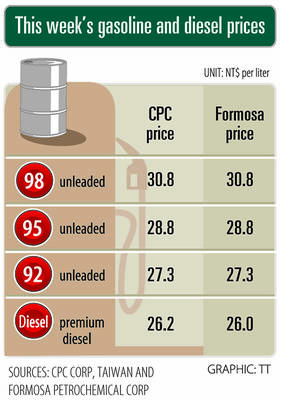

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

A German company is putting used electric vehicle batteries to new use by stacking them into fridge-size units that homes and businesses can use to store their excess solar and wind energy. This week, the company Voltfang — which means “catching volts” — opened its first industrial site in Aachen, Germany, near the Belgian and Dutch borders. With about 100 staff, Voltfang says it is the biggest facility of its kind in Europe in the budding sector of refurbishing lithium-ion batteries. Its CEO David Oudsandji hopes it would help Europe’s biggest economy ween itself off fossil fuels and increasingly rely on climate-friendly renewables. While

SinoPac Financial Holdings Co (永豐金控) is weighing whether to add a life insurance business to its portfolio, but would tread cautiously after completing three acquisitions in quick succession, president Stanley Chu (朱士廷) said yesterday. “We are carefully considering whether life insurance should play a role in SinoPac’s business map,” Chu told reporters ahead of an earnings conference. “Our priority is to ensure the success of the deals we have already made, even though we are tracking some possible targets.” Local media have reported that Mercuries Life Insurance Co (三商美邦人壽), which is seeking buyers amid financial strains, has invited three financial