Global finance leaders came to Washington this past week seeking clarity on what it would take to get some relief from US President Donald Trump's multi-layered tariff assault and on just how much pain it will bring to the world economy.

Most headed home with more questions than answers.

Many participants in the IMF and World Bank Spring Meetings had a sense that Trump's administration was still conflicted in its demands from trading partners hit with his sweeping tariffs.

Photo: Reuters

During the whirlwind week, many finance and trade ministers sought to meet with US Secretary of the Treasury Scott Bessent and other key Trump administration officials, to no avail. Those that did were often told to be patient — even as the clock steadily ticks down on the 90-day pause Trump had granted on the steepest levies.

Indeed, not a single deal was finalized over the course of the week despite the Trump administration touting the receipt of 18 written proposals and a full slate of negotiations.

"We are not negotiating. We are just presenting, discussing the economy," said Polish Finance Minister Andrzej Domanski. He added that he stressed "how this uncertainty is bad for Europe, for the US. I mean, it's actually bad for everyone."

Warnings that the tariffs — 25 percent on all US imports of vehicles, steel and aluminum and currently 10 percent for most everything else — would cause painful damage to the US and other major economies went largely unheeded by US officials.

"We know that they think — that it won't be that bad," Domanski said. "They think it's a short-term pain, long-term gain. And I'm afraid that we'll have short-term pain, long-term pain."

The Trump administration's most substantial trade negotiations during the week were with Japan and South Korea, but the results were inconclusive as Bessent cited "productive" talks with both countries. Specific currency targets for the Japanese yen were not discussed, but both countries' currency policies are expected to be part of future talks as the US sees currency weakness against the US dollar as a nontariff barrier to American exports.

The IMF took a slightly more optimistic view of the economic fallout from the highest US tariffs in more than a century, slashing growth forecasts for most countries in its World Economic Outlook but stopping far short of predicting recessions — even for the US and export-dependent China, which now faces US tariffs of 145 percent on many goods.

IMF Managing Director Kristalina Georgieva acknowledged that member countries were anxious about the uncertainty shock to a global economy buffeted by pandemic, inflation and wars but held out hope that trade negotiations would ease the tariff strains.

"We recognize that there is work under way to resolve trade disputes and reduce uncertainty," Georgieva told reporters. "Uncertainty is really bad for business, so the sooner there is this cloud that is hanging over our heads is lifted, the better for profit, for growth, for the world economy." Several finance officials told Reuters that odds of recession were higher than the IMF's 37 percent chance, citing private sector forecasts.

Eric LeCompte, executive director of Jubilee USA Network, a faith-based nonprofit group advocating debt relief, said that the IMF's forecasts were clearly aimed at preventing market panic, even as officials in private meetings expressed concerns about new debt crises emerging. "It was a do-nothing kind of week," LeCompte said, adding that debt discussions were inconclusive and overshadowed by tariff talks.

US WITHDRAWAL

Policymakers did breathe a sigh of relief when Bessent expressed US support for the IMF and the World Bank, declaring that they have "enduring value" but criticizing their "mission creep" into climate, gender and equality issues.

Rather than withdrawing from the institutions as prescribed by the Project 2025 Republican policy manifesto, Bessent said he wanted to refocus them on their core missions of economic stability and development, with expanded World Bank energy financing options and an end to China loans.

Participants at the meetings, along with financial markets, were encouraged by Bessent's comments early last week that triple-digit US tariffs on Chinese goods and vice versa were unsustainable, suggesting that a deal to ease them could be reached soon. But China denied Trump's assertions that tariff negotiations were under way with Beijing, adding to the week's confusion over his tariffs and offering little reassurance to country delegations.

"I think most people left here bracing for things to get worse from an economic perspective," said Josh Lipsky, a former IMF adviser who is now senior director of the Atlantic Council's GeoEconomics Center. "The broad picture, when you step back, is very concerning."

But a big challenge for developed countries at the moment was the recent selloff in US Treasury debt and other US dollar-based assets, which indicated an erosion of trust in US economic policies, Lipsky said.

Trust in US economic leadership was the fundamental reason that the US dollar had achieved reserve currency status, he said.

While the US economy is too big to ignore the US dollar for now, trading partners will try to seek alternatives unless that trust is repaired, he added.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the

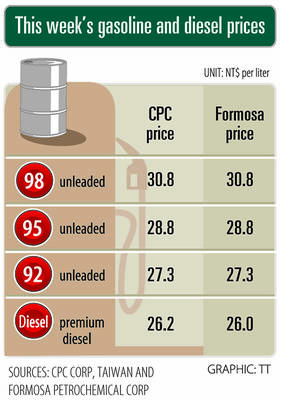

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices