Manz Taiwan Ltd (亞智科技), a supplier of equipment for advanced chip packaging, yesterday said it is scouting sites for a US sales office, following in the footsteps of its key customers.

The move would be Manz’s latest global expansion, following the establishment of service offices in Malaysia, India and Japan. The Taoyuan-based company currently operates manufacturing facilities in Taiwan and Suzhou, China.

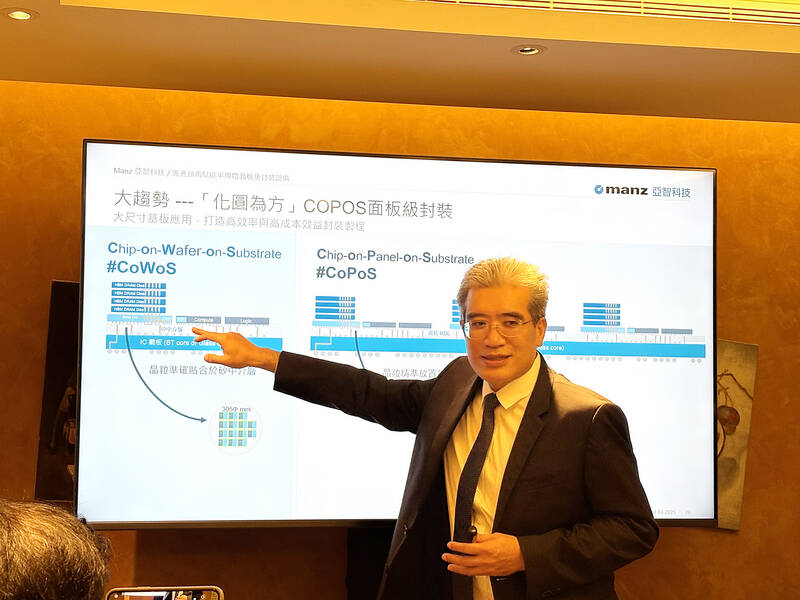

“If our customers build factories there [the US], we certainly have to set up service offices there as well. It is almost a rule for equipment suppliers, and we have to provide after-sales services such as maintenance and upgrades,” Manz Taiwan president Robert Lin (林峻生) said at a media gathering in Taipei.

Photo: Lisa Wang, Taipei Times

The company has no plans to build a manufacturing facility in the US due to high operating costs, as it would be at least 50 percent more expensive to run a factory there, the company said.

Last month, the company opened a new semiconductor research and development (R&D) center in Taoyuan as part of a strategic shift toward developing equipment for advanced chip packaging technology known as chip-on-panel-on-substrate (CoPoS), which is regarded as a more cost-efficient than chip-on-wafer-on-substrate technology.

The new R&D center is also expected to enhance real-time support for five customers working on CoPoS development and help meet their supply chain localization goals, Lin said.

To date, the company has delivered 8,000 units of semiconductor and display equipment to leading global chip packaging firms, IC substrate manufacturers and flat-panel display makers. Its key customers include Lam Research Corp, ASE Technology Holding Co (日月光), Powertech Technology Inc (力成) and Innolux Corp (群創).

Manz Taiwan generates about half of its revenue from semiconductor equipment — primarily for advanced chip packaging — while the other half comes from display equipment sales.

The company has signed an agreement with its German parent company, Manz AG, to become an independent entity through a management buyout, with the transaction expected to close this quarter, it said, without disclosing financial details.

The company also plans to launch an initial public offering within the next three years, likely on the Taipei Exchange, with an initial capital of NT$200 million (US$6.15 million), it added.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) secured a record 70.2 percent share of the global foundry business in the second quarter, up from 67.6 percent the previous quarter, and continued widening its lead over second-placed Samsung Electronics Co, TrendForce Corp (集邦科技) said on Monday. TSMC posted US$30.24 billion in sales in the April-to-June period, up 18.5 percent from the previous quarter, driven by major smartphone customers entering their ramp-up cycle and robust demand for artificial intelligence chips, laptops and PCs, which boosted wafer shipments and average selling prices, TrendForce said in a report. Samsung’s sales also grew in the second quarter, up

On Tuesday, US President Donald Trump weighed in on a pressing national issue: The rebranding of a restaurant chain. Last week, Cracker Barrel, a Tennessee company whose nationwide locations lean heavily on a cozy, old-timey aesthetic — “rocking chairs on the porch, a warm fire in the hearth, peg games on the table” — announced it was updating its logo. Uncle Herschel, the man who once appeared next to the letters with a barrel, was gone. It sparked ire on the right, with Donald Trump Jr leading a charge against the rebranding: “WTF is wrong with Cracker Barrel?!” Later, Trump Sr weighed

HEADWINDS: Upfront investment is unavoidable in the merger, but cost savings would materialize over time, TS Financial Holding Co president Welch Lin said TS Financial Holding Co (台新新光金控) said it would take about two years before the benefits of its merger with Shin Kong Financial Holding Co (新光金控) become evident, as the group prioritizes the consolidation of its major subsidiaries. “The group’s priority is to complete the consolidation of different subsidiaries,” Welch Lin (林維俊), president of the nation’s fourth-largest financial conglomerate by assets, told reporters during its first earnings briefing since the merger took effect on July 24. The asset management units are scheduled to merge in November, followed by life insurance in January next year and securities operations in April, Lin said. Banking integration,

LOOPHOLES: The move is to end a break that was aiding foreign producers without any similar benefit for US manufacturers, the US Department of Commerce said US President Donald Trump’s administration would make it harder for Samsung Electronics Co and SK Hynix Inc to ship critical equipment to their chipmaking operations in China, dealing a potential blow to the companies’ production in the world’s largest semiconductor market. The US Department of Commerce in a notice published on Friday said that it was revoking waivers for Samsung and SK Hynix to use US technologies in their Chinese operations. The companies had been operating in China under regulations that allow them to import chipmaking equipment without applying for a new license each time. The move would revise what is known