Traders further boosted their expectations for the Federal Reserve to cut US interest rates this year as fallout from US President Donald Trump’s tariffs convulsed markets for another day.

Money markets are fully pricing four quarter-point reductions by the end of this year, with a 50 percent chance of a fifth — up from just three cuts before levies were announced.

The rally in US Treasuries accelerated after China said it would impose a 34 percent tariff on all imports from the US, spurring fears of a global trade war. That pushed US 10-year yields below 3.90 percent, the lowest since before election day.

Photo: Reuters

Trump's new tariffs are "larger than expected," and the economic fallout including higher inflation and slower growth likely will be as well, Fed Chair Jerome Powell said yesterday, while cautioning it was still too soon to know what the right response from the central bank ought to be.

"We face a highly uncertain outlook with elevated risks of both higher unemployment and higher inflation," undermining both of the Fed's mandates of 2 percent inflation and maximum employment, Powell told a business journalists' conference in Arlington, Virginia, in remarks that pointed to difficult decisions ahead for the US central bank and did nothing to staunch a global bloodletting in stock markets.

Powell spoke as equity markets from Tokyo to London to New York continued a swoon that has wiped some 10 percent off major US stock indexes since Trump announced a raft of new tariffs on trading partners around the world on Wednesday.

“The markets will find it hard not to price in more Fed cuts until risk sentiment stabilizes,” said Jordan Rochester, head of macro strategy for EMEA at Mizuho International PLC. “At this stage I suspect they will be cautious to give too much of a steer for markets given the inflationary issue tariffs may cause.”

The S&P 500 Index was down another nearly 6 percent, with the Dow Jones Industrial Average 5.5 percent lower and the NASDAQ off 5.82 percent yesterday, ending a two-day decline that is the worst since the onset of the COVID-19 pandemic in March 2020.

Trump on Thursday welcomed the fall in 10-year yields in comments. US Secretary of the Treasury Scott Bessent has repeatedly made clear that pushing down that yield — and keeping it down — is a priority for the administration.

European bonds have been swept up in the bond rally, reflecting concerns over the blow to growth from a 20 percent tariff. The yield on Germany’s 10-year note, the region’s safe asset, has plunged more than 20 basis points this week. That has erased the surge that greeted the nation’s spending plans last month.

Traders also expect the European Central Bank (ECB) to lower interest rates more sharply, with three quarter-point reductions fully priced in for this year and a chance of a fourth. The Bank of England is also seen easing 78 basis points.

For Mark Dowding, chief investment officer at RBC BlueBay Asset Management, the repricing has already gone far enough. He doubts that both the Fed and ECB would be able to respond to tariffs with monetary easing, citing inflationary concerns in the US and an emphasis on fiscal support in Europe, and is instead looking for entry points to bet against bonds once markets settle.

“The rally in bond yields appears overdone,” he wrote in a note. “We think the Fed will do nothing for the foreseeable future, as long as there is not a large rise in unemployment.”

Treasuries have already rallied 3.8 percent this year, according to a Bloomberg gauge of US debt.

Powell said yesterday that the Fed has time to wait for more data to decide how monetary policy should respond, but the US central bank's focus will be on ensuring that inflation expectations remain anchored, particularly if Trump's import taxes touch off a more persistent jump in price pressures.

"While tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent," Powell said.

"Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem," he said.

Powell's comments highlighted the tension the Fed is seeing emerge between "hard data" that remains solid — the economy added 228,000 jobs last month with a 4.2 percent unemployment rate — and "soft data" like surveys and interviews with business contacts that point to a coming slowdown.

"We are closely watching this tension between the hard and soft data. As the new policies and their likely economic effects become clearer, we will have a better sense of their implications for the economy and for monetary policy," Powell said.

"We are well positioned to wait for greater clarity before considering any adjustments to our policy stance. It is too soon to say what will be the appropriate path for monetary policy."

Additional reporting by Reuters

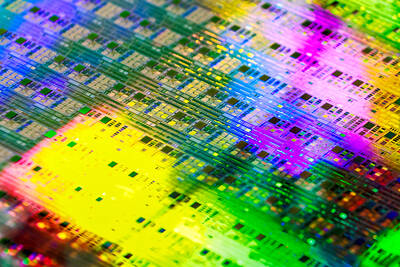

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs

The US on Friday penalized two Chinese firms that acquired US chipmaking equipment for China’s top chipmaker, Semiconductor Manufacturing International Corp (SMIC, 中芯國際), including them among 32 entities that were added to the US Department of Commerce’s restricted trade list, a US government posting showed. Twenty-three of the 32 are in China. GMC Semiconductor Technology (Wuxi) Co (吉姆西半導體科技) and Jicun Semiconductor Technology (Shanghai) Co (吉存半導體科技) were placed on the list, formally known as the Entity List, for acquiring equipment for SMIC Northern Integrated Circuit Manufacturing (Beijing) Corp (中芯北方積體電路) and Semiconductor Manufacturing International (Beijing) Corp (中芯北京), the US Federal Register posting said. The

India’s ban of online money-based games could drive addicts to unregulated apps and offshore platforms that pose new financial and social risks, fantasy-sports gaming experts say. Indian Prime Minister Narendra Modi’s government banned real-money online games late last month, citing financial losses and addiction, leading to a shutdown of many apps offering paid fantasy cricket, rummy and poker games. “Many will move to offshore platforms, because of the addictive nature — they will find alternate means to get that dopamine hit,” said Viren Hemrajani, a Mumbai-based fantasy cricket analyst. “It [also] leads to fraud and scams, because everything is now

MORTGAGE WORRIES: About 34% of respondents to a survey said they would approach multiple lenders to pay for a home, while 29.2% said they would ask family for help New housing projects in Taiwan’s six special municipalities, as well as Hsinchu city and county, are projected to total NT$710.65 billion (US$23.61 billion) in the upcoming fall sales season, a record 30 percent decrease from a year earlier, as tighter mortgage rules prompt developers to pull back, property listing platform 591.com (591新建案) said yesterday. The number of projects has also fallen to 312, a more than 20 percent decrease year-on-year, underscoring weakening sentiment and momentum amid lingering policy and financing headwinds. New Taipei City and Taoyuan bucked the downturn in project value, while Taipei, Hsinchu city and county, Taichung, Tainan and Kaohsiung