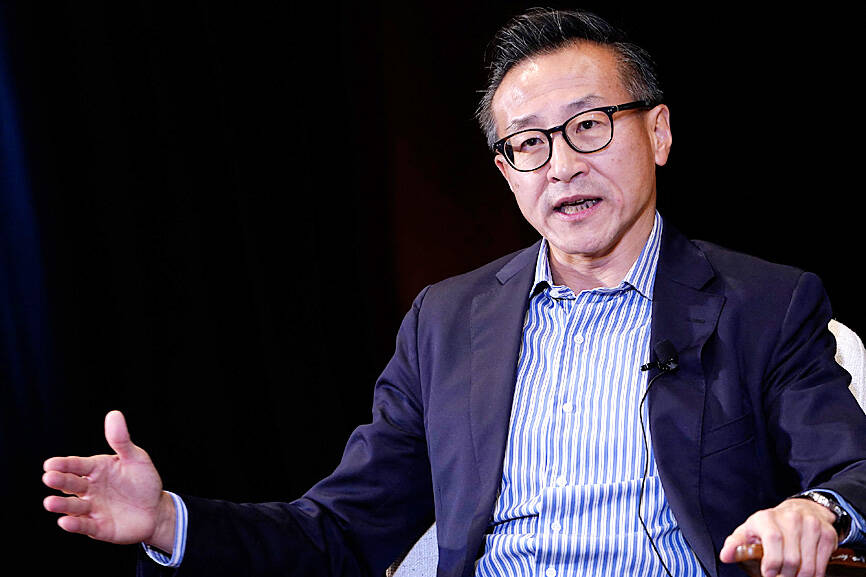

Alibaba Group Holding Ltd (阿里巴巴) chairman Joe Tsai (蔡崇信) yesterday warned of a potential bubble forming in data center construction, arguing that the pace of that buildout might outstrip initial demand for artificial intelligence (AI) services.

A rush by big tech firms, investment funds and other entities to erect server bases from the US to Asia is starting to look indiscriminate, Tsai told the HSBC Global Investment Summit in Hong Kong.

Many of those projects are built without clear customers in mind, Tsai said.

Photo: AFP

From Microsoft Corp to Softbank Group Corp, tech firms on both sides of the Pacific Ocean are spending billions of dollars buying the Nvidia Corp and SK Hynix Inc chips crucial to AI development.

Alibaba itself — which last month said that it was going all-in on AI — plans to invest more than 380 billion yuan (US$52 billion) over the next three years.

Server farms are springing up from India to Malaysia, while US President Donald Trump is touting a Stargate project that envisions an outlay of US$500 billion dollars.

Many on Wall Street have begun to question that spending, especially after Chinese firm DeepSeek (深度求索) released an open-source AI model that it claims rivals US technology, but was built at a fraction of the cost.

Critics have also pointed out the persistent dearth of practical, real-world applications for AI.

“I start to see the beginning of some kind of bubble,” Tsai told delegates.

Some of the envisioned projects commenced raising funds without having secured “uptake” agreements, he added.

“I start to get worried when people are building data centers on spec. There are a number of people coming up, funds coming out, to raise billions or millions of capital,” he said.

Tsai talked about how Alibaba was undergoing a “reboot” and rehiring after years of regulatory scrutiny that crimped growth.

The firm has initiated programs to acquire the AI talent it needs to further its stated ambition of exploring artificial general intelligence.

At the same time, Tsai had choice words for his US rivals, particularly with their spending.

Just this year, Amazon.com Inc, Alphabet Inc and Meta Platforms Inc pledged to spend US$100 billion, US$75 billion and up to US$65 billion respectively on AI infrastructure.

Microsoft has said it expects to spend US$80 billion this fiscal year on AI data centers, but that pace of spending growth should begin to slow in the year starting July.

“I’m still astounded by the type of numbers that’s being thrown around in the United States about investing into AI,” Tsai told the audience. “People are talking, literally talking about US$500 billion, several 100 billion dollars. I don’t think that’s entirely necessary. I think in a way, people are investing ahead of the demand that they’re seeing today, but they are projecting much bigger demand.”

HORMUZ ISSUE: The US president said he expected crude prices to drop at the end of the war, which he called a ‘minor excursion’ that could continue ‘for a little while’ The United Arab Emirates (UAE) and Kuwait started reducing oil production, as the near-closure of the crucial Strait of Hormuz ripples through energy markets and affects global supply. Abu Dhabi National Oil Co (ADNOC) is “managing offshore production levels to address storage requirements,” the company said in a statement, without giving details. Kuwait Petroleum Corp said it was lowering production at its oil fields and refineries after “Iranian threats against safe passage of ships through the Strait of Hormuz.” The war in the Middle East has all but closed Hormuz, the narrow waterway linking the Persian Gulf to the open seas,

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Taiwan has enough crude oil reserves for more than 100 days and sufficient natural gas reserves for more than 11 days, both above the regulatory safety requirement, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday, adding that the government would prioritize domestic price stability as conflicts in the Middle East continue. Overall, energy supply for this month is secure, and the government is continuing efforts to ensure sufficient supply for next month, Kung told reporters after meeting with representatives from business groups at the ministry in Taipei. The ministry has been holding daily cross-ministry meetings at the Executive Yuan to ensure

RATIONING: The proposal would give the Trump administration ample leverage to negotiate investments in the US as it decides how many chips to give each country US officials are debating a new regulatory framework for exporting artificial intelligence (AI) chips and are considering requiring foreign nations to invest in US AI data centers or security guarantees as a condition for granting exports of 200,000 chips or more, according to a document seen by Reuters. The rules are not yet final and could change. They would be the first attempt to regulate the flow of AI chips to US allies and partners since US President Donald Trump’s administration said it rescinded its predecessor’s so-called AI diffusion rules. Those rules sought to keep a significant amount of AI