Prices of gasoline products at domestic gas stations are to fall NT$0.3 per liter this week, even though international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday.

International crude oil prices moved up last week, as the geopolitical situation in the Middle East became more tense, CPC said in a statement.

Based on the company’s floating oil price formula, the cost of crude oil rose 1.6 percent last week from a week earlier, CPC said.

China’s latest plans to stimulate domestic consumption and the US’ announcement of a new round of sanctions on Iran also weighed on market sentiment and sent crude oil prices higher, Formosa said in a separate statement.

Front-month Brent crude oil futures — the international benchmark — rose 2.24 percent last week to US$72.16 per barrel at London’s ICE Stock Exchange, while West Texas Intermediate crude oil futures — the US benchmark — advanced 2.05 percent to US$68.28 per barrel at the New York Mercantile Exchange.

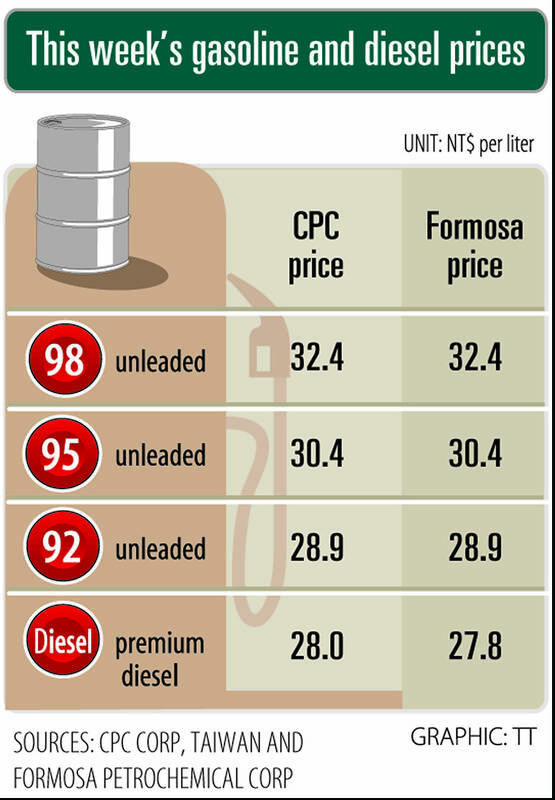

Effective today, gasoline prices at CPC and Formosa stations are to fall to NT$28.9, NT$30.4 and NT$32.4 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel are to rise NT$0.1 per liter to NT$28 per liter at CPC stations and NT$27.8 at Formosa pumps, the companies said.

BYPASSING CHINA TARIFFS: In the first five months of this year, Foxconn sent US$4.4bn of iPhones to the US from India, compared with US$3.7bn in the whole of last year Nearly all the iPhones exported by Foxconn Technology Group (富士康科技集團) from India went to the US between March and last month, customs data showed, far above last year’s average of 50 percent and a clear sign of Apple Inc’s efforts to bypass high US tariffs imposed on China. The numbers, being reported by Reuters for the first time, show that Apple has realigned its India exports to almost exclusively serve the US market, when previously the devices were more widely distributed to nations including the Netherlands and the Czech Republic. During March to last month, Foxconn, known as Hon Hai Precision Industry

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and the University of Tokyo (UTokyo) yesterday announced the launch of the TSMC-UTokyo Lab to promote advanced semiconductor research, education and talent development. The lab is TSMC’s first laboratory collaboration with a university outside Taiwan, the company said in a statement. The lab would leverage “the extensive knowledge, experience, and creativity” of both institutions, the company said. It is located in the Asano Section of UTokyo’s Hongo, Tokyo, campus and would be managed by UTokyo faculty, guided by directors from UTokyo and TSMC, the company said. TSMC began working with UTokyo in 2019, resulting in 21 research projects,

Ashton Hall’s morning routine involves dunking his head in iced Saratoga Spring Water. For the company that sells the bottled water — Hall’s brand of choice for drinking, brushing his teeth and submerging himself — that is fantastic news. “We’re so thankful to this incredible fitness influencer called Ashton Hall,” Saratoga owner Primo Brands Corp’s CEO Robbert Rietbroek said on an earnings call after Hall’s morning routine video went viral. “He really helped put our brand on the map.” Primo Brands, which was not affiliated with Hall when he made his video, is among the increasing number of companies benefiting from influencer

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) yesterday expressed a downbeat view about the prospects of humanoid robots, given high manufacturing costs and a lack of target customers. Despite rising demand and high expectations for humanoid robots, high research-and-development costs and uncertain profitability remain major concerns, Lam told reporters following the company’s annual shareholders’ meeting in Taoyuan. “Since it seems a bit unworthy to use such high-cost robots to do household chores, I believe robots designed for specific purposes would be more valuable and present a better business opportunity,” Lam said Instead of investing in humanoid robots, Quanta has opted to invest